Sustainable Development Remains a GBA Business Priority

Joint research by UOB Hong Kong and Hong Kong Trade Development Council

While global climate issues have become ever more pressing, countries around the world have accelerated their formulation of remedial environmental policies. In the case of China, it has set out to fulfil the commitments it made as part of the Paris Agreement by setting “dual carbon” goals relating to carbon peaking and carbon neutrality. In line with central government policies, the GBA cities are prioritising their development of a green, low‑carbon and circular economic system. Against this backdrop, all GBA enterprises will have to comply with the relevant environmental laws and regulations in order to mitigate any legal or financial risks. Many are actively responding to the environmental concerns of consumers by implementing green and environmentally friendly initiatives. At the same time, they are also striving to optimise their ESG adoption process.

HKTDC Research and UOB Hong Kong worked together again in the third quarter of 2024 to track the green and sustainable development process of Greater Bay Area (GBA) enterprises, as well as their investment intentions. They also examined how GBA enterprises, against a backdrop of establishing diversified supply chains domestically and overseas, are adjusting their business strategies, as well as their trading and investment interactions with ASEAN countries. For the current study, a questionnaire survey of 600 enterprises in Hong Kong and five mainland GBA cities (Guangzhou, Shenzhen, Foshan, Dongguan and Zhongshan) was conducted. For the current study, a questionnaire survey of 600 enterprises in Hong Kong and five mainland GBA cities (Guangzhou, Shenzhen, Foshan, Dongguan and Zhongshan) was conducted.

This concluding section reviews the progress made by GBA‑based businesses as they look to adopt a more green and sustainable operational model, while also considering Hong Kong’s ever‑evolving role as the leading regional business platform. Contents below forms part of a joint study conducted by HKTDC Research and UOB: “GBA Supply Chain Diversity: Enhancing Connectivity Among ASEAN, Hong Kong and Mainland China”.

GBA Enterprises Increasingly Proactive on Sustainable Practices Front

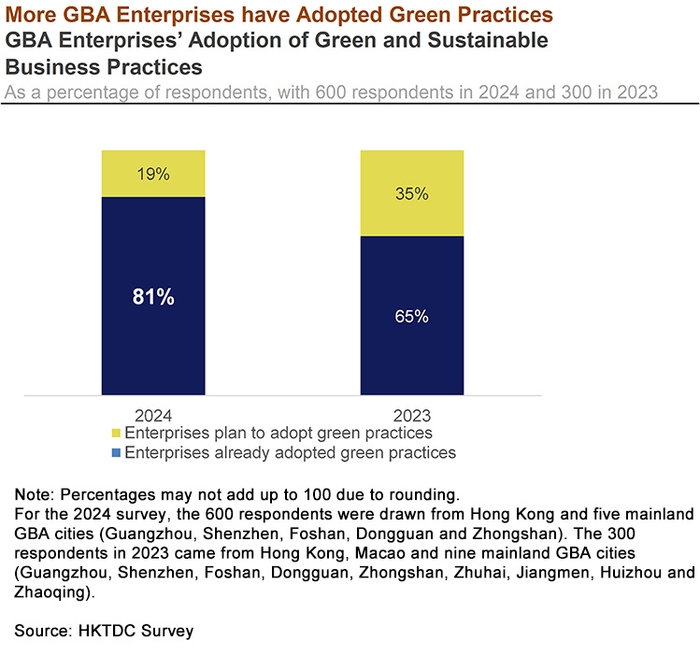

The survey results show that enterprises have become more proactive in terms of implementing green practices, with 81% of participating enterprises saying they have already adopted such protocols. This is an increase of 16 percentage points from the 65% reported in the 2023 survey. In addition, a further 19% of enterprises intend to introduce such practices.

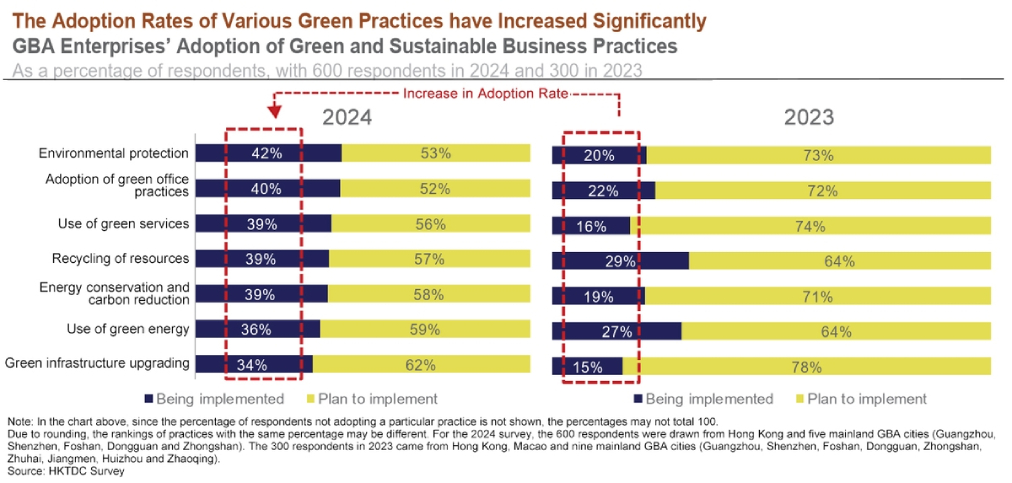

The overall adoption ratios in 2024 were significantly higher than in 2023, with the full range of available actions in the survey adopted by more than 30% of enterprises in 2024, while no single action was adopted by more than 30% of enterprises in 2023. These results show that more and more GBA enterprises are adopting green and sustainable business practices, a trend that is consistent with China’s acceleration of its economic and social development in line with its comprehensive green transformation objectives.

The 2024 survey showed that the three actions with the highest adoption rates were notably different from those in the previous survey:

- Environmental protection (42%), including the use of eco-friendly equipment/raw materials to reduce air/water/soil pollution.

- Adoption of green office practices (40%), including the use of efficient energy-saving office equipment and the adoption of paperless office/online systems.

- Use of green services (39%), including green certification/monitoring and testing/assessment reviews, the adoption of green financing products, etc.

In the 2023 survey, the actions with the highest adoption rates were: recycling of resources (29%), use of green energy (27%) and green office practices (22%).

Though many enterprises have accelerated their adoption of green practices, there is still room for improvement overall. This can be seen from the results that show that, in the case of all green practices, more than half of the surveyed enterprises were still at the planning stage. Specifically, the pace of green energy adoption and the implementation of green infrastructure upgrading had slowed and tended to be still at the planning stage. The proportion planning to adopt these two practices was 59% and 62%, respectively.

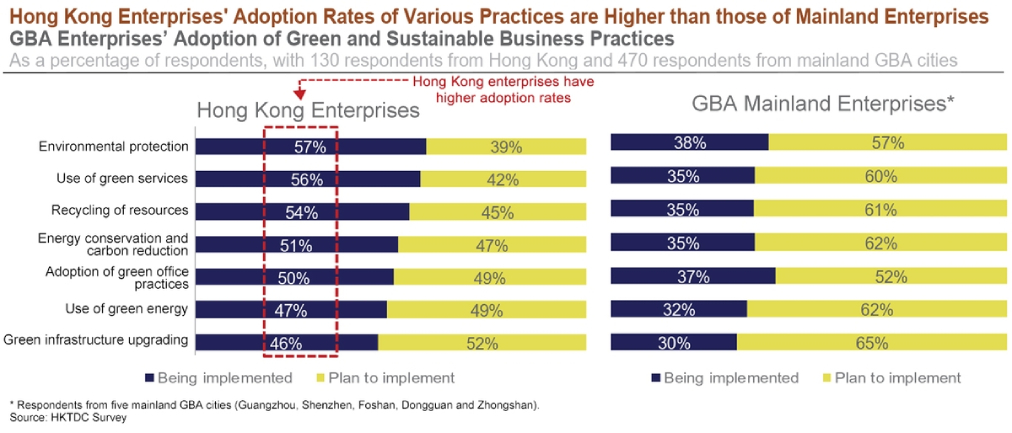

Similar to the 2023 survey, the pace of adopting green practices by Hong Kong enterprises was typically quicker than that of enterprises in any of the five surveyed mainland GBA cities. Similarly, more Hong Kong enterprises were implementing plans relating to the full range of practices in the survey, with adoption rates ranging from 46% to 57%. For mainland enterprises, the adoption rates were in the 30% to 38% range. Compared with Hong Kong‑based businesses, for example, the adoption of green office practices is a higher priority for mainland GBA enterprises.

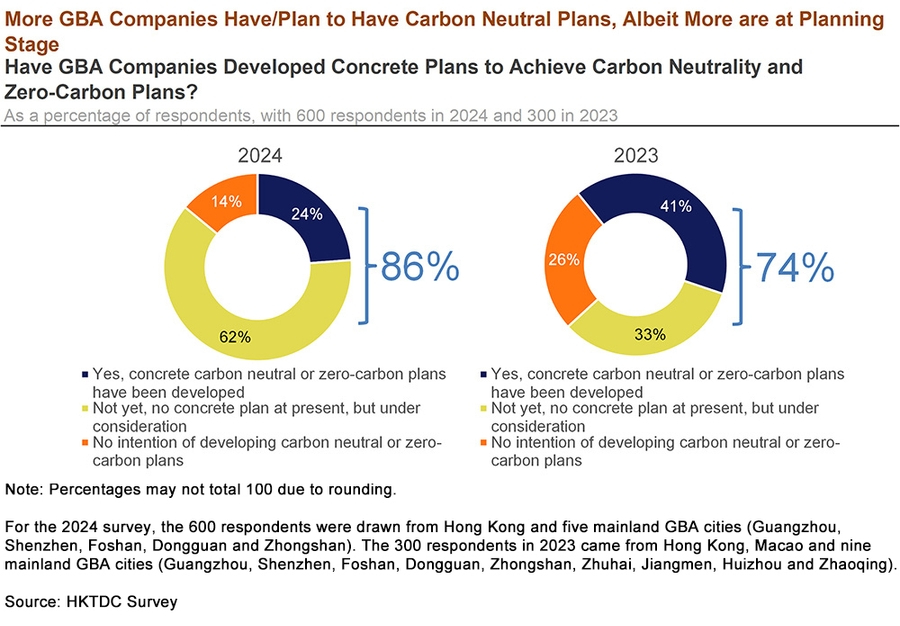

GBA Enterprises Committed to Achieving Carbon Neutrality/Zero-Carbon Goals

This survey also focused on concrete zero‑carbon plans at a company level. Of the GBA‑based enterprises, 86% said they had developed (or planned to develop) carbon neutrality plans, a significant increase on the 74% reported in the 2023 survey. Nevertheless, more enterprises said they were still at the stage of considering or attempting to develop related plans.

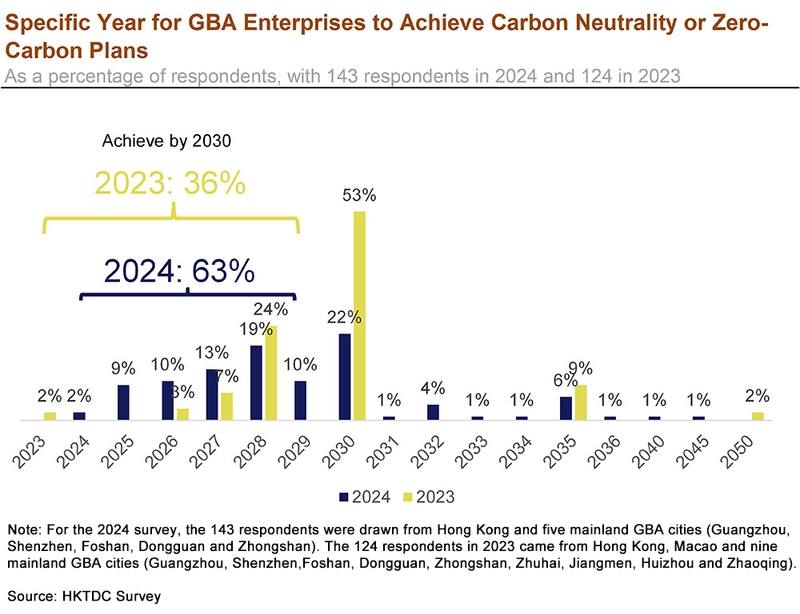

In both surveys, of those enterprises indicating they had developed plans, a similar proportion aimed to have achieved carbon neutrality (or zero‑carbon) by 2030. Some 85% aimed to achieve carbon neutrality in 2030 or earlier, 4 percentage points lower than the figure of 89% recorded for the 2023 survey. By contrast, in the most recent survey, 63% said their aims were achievable before 2030, a far higher figure than the 36% recorded for 2023, a clear indication that GBA enterprises are accelerating their progress with regard to their sustainable development goals.

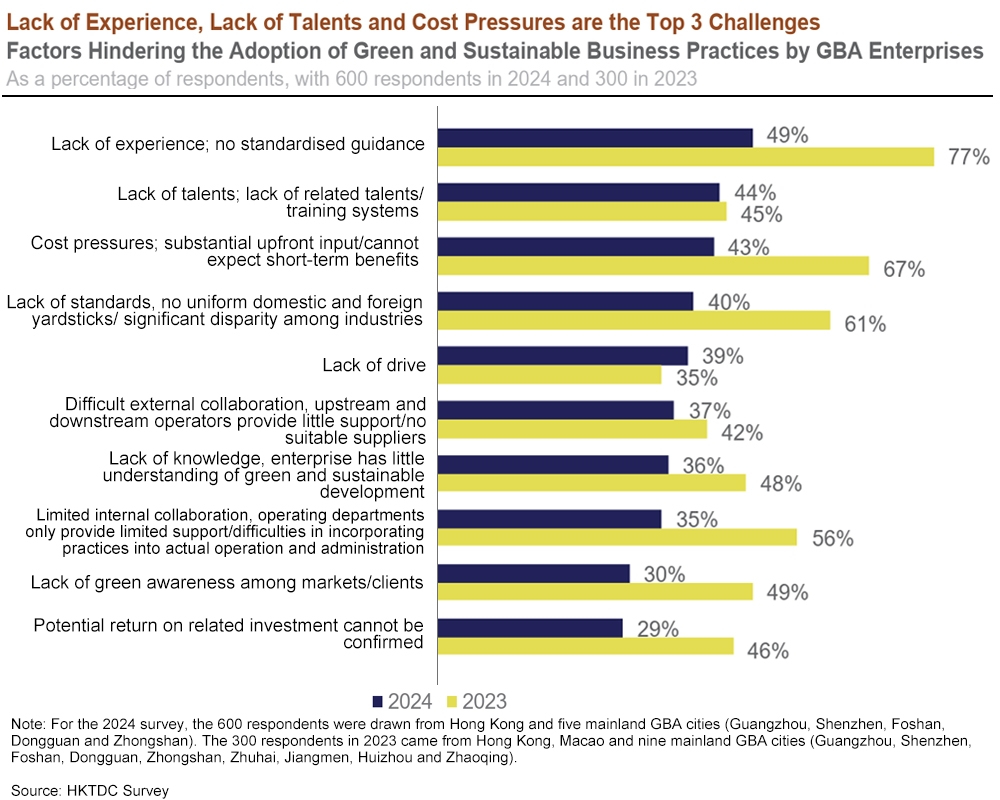

Challenges Easing for Enterprises Implementing Green and Sustainable Practices

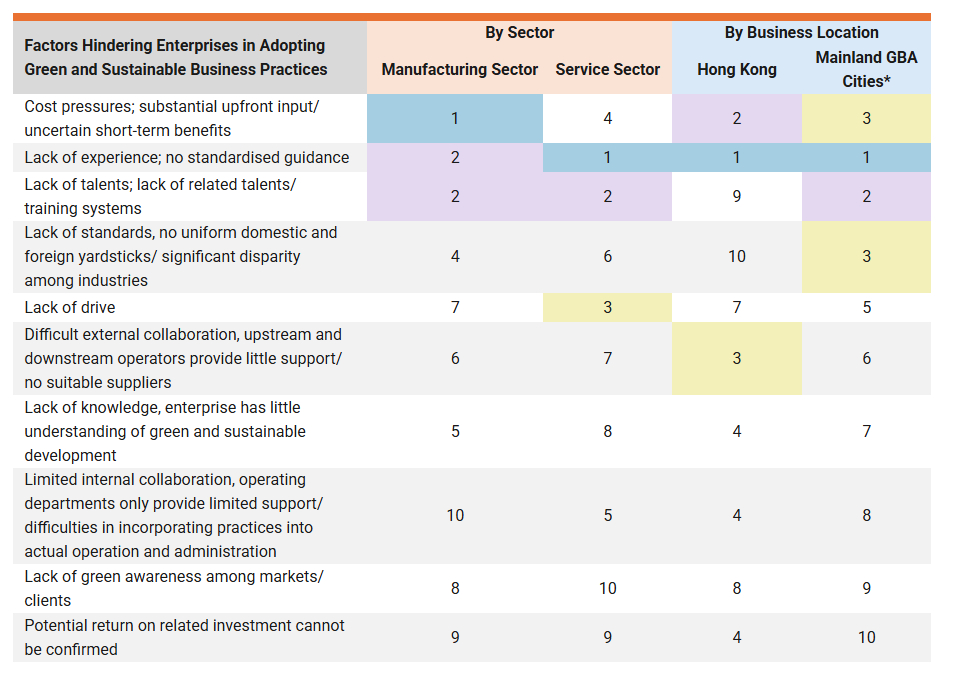

The survey results also show that there have been changes to the main challenges facing enterprises as they look to adopt green and sustainable practices. The top three obstacles this year were lack of experience (49%), lack of talents (44%) and cost pressures (43%). Compared with the 2023 survey, however, the current situation has generally improved. In the most recent survey, the selection rates for most options were lower than in 2023, possibly because GBA cities are now more committed to driving green development. As a sign of this, in February 2024, the Guangdong provincial government issued its plan for cultivating and developing green and low‑carbon industrial clusters. Thanks to such government initiatives, it can be seen that enterprises are getting more support to overcome the obstacles they encounter.

Across various industries, the challenges facing manufacturing and service enterprises appeared to be more or less the same. In the case of location, however, the differences among surveyed enterprises were more appreciable. The five mainland GBA cities, for instance, appeared to have greater difficulty when it came to finding talents and dealing with multiple standards. On the other hand – possibly because the city is an international business hub – Hong Kong‑based businesses tend to have a strong global perspective, rich resources for related training and capacity‑building capabilities, while many green technology enterprises and talents are located there and a wide variety of industry‑specific guides to green and sustainable practices are also available.

99.8% of GBA Enterprises Planning to Incorporate ESG into Business Operations

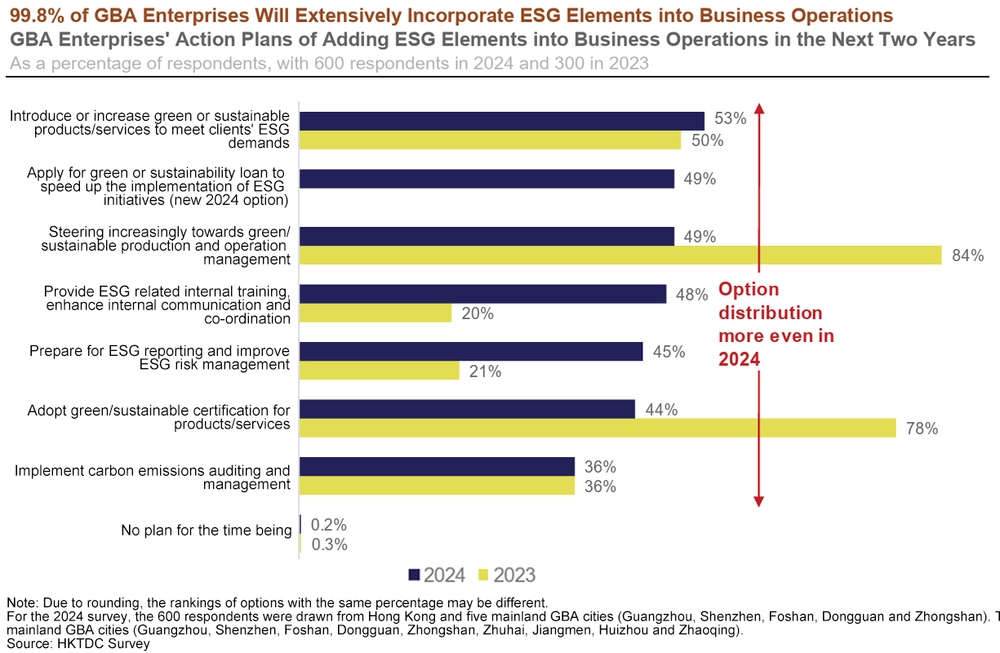

With ESG widely established as a key corporate development strategy, some 99.8% of the surveyed GBA enterprises indicated an intent to incorporate such elements into their operations over the next two years, a similar figure to the 99.7% recorded for 2023. In something of a change, however, many enterprises are now considering incorporating ESG elements into a wider range of operations instead of focusing solely on production/operation processes and product/service certifications.

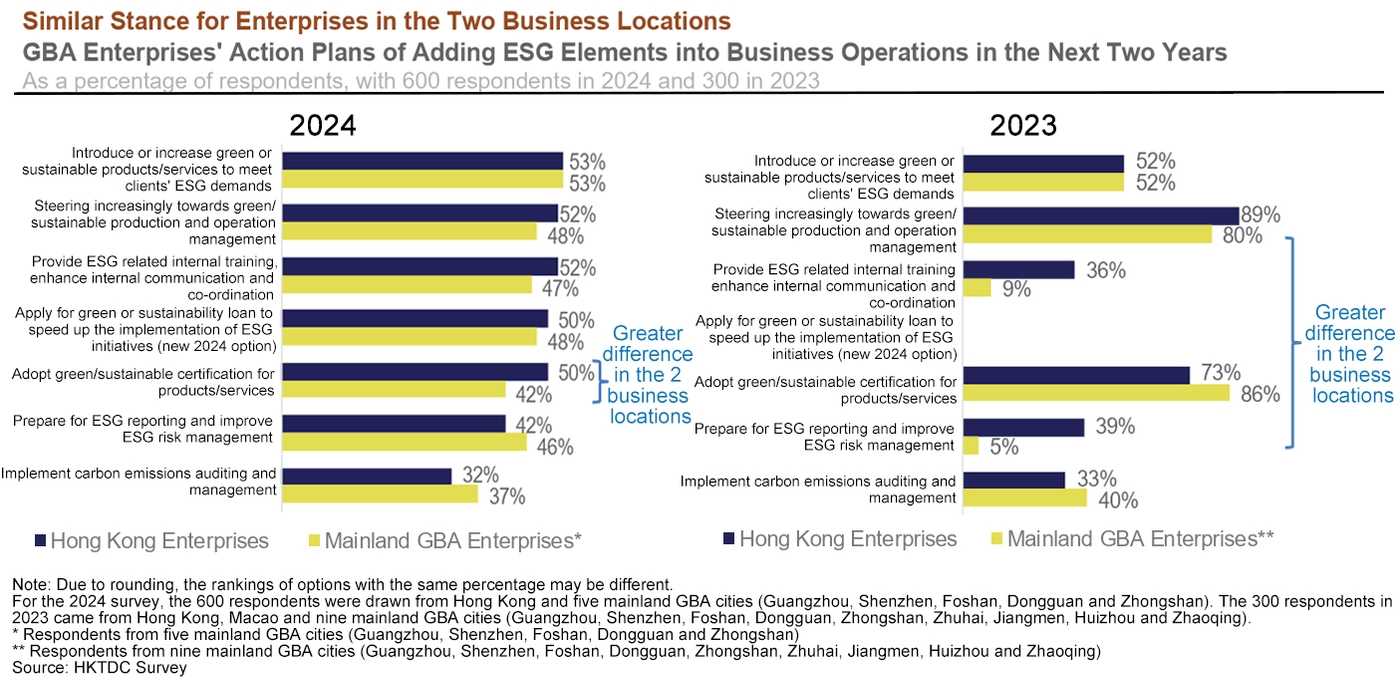

In the 2024 survey, most enterprises said they would introduce or increase green or sustainable products/services to meet clients’ ESG demands (53%). Joint second to this was the new option of applying for green or sustainability loans to speed up the implementation of ESG initiatives (49%) and steering increasingly towards green/sustainable production and operation management (49%).

Across many of the options, Hong Kong enterprises did not differ hugely in their responses from enterprises in the five mainland GBA cities. One exception, though, was green certification, where the proportion of Hong Kong enterprises responding positively was notably higher than that of their mainland counterparts. In the 2023 survey, significantly more Hong Kong enterprises than mainland ones said they would introduce such elements as green production, ESG reporting and ESG training, while more mainland enterprises intended to adopt green certification.

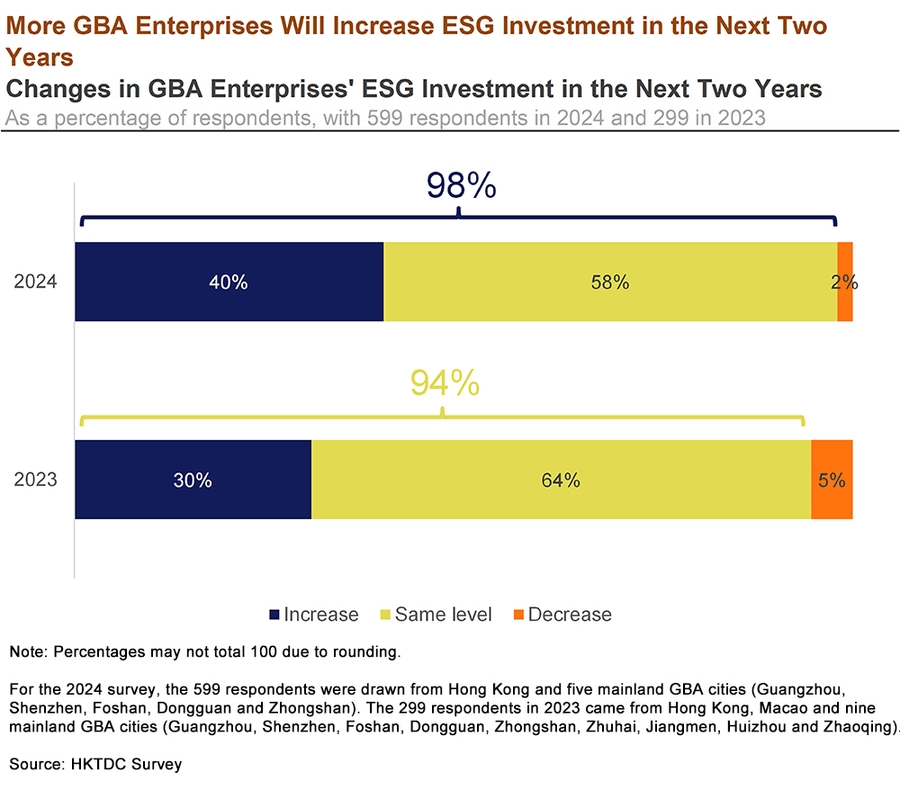

More Enterprises Increasing ESG Investment

Overall, 98% of the surveyed GBA‑based planned to increase or maintain their level of ESG investment in the next two years, a 4 percentage point increase from 2023 (94%). Of these, 40% said they planned to increase funding for ESG elements, a higher figure than the 30% recorded for the 2023 survey.

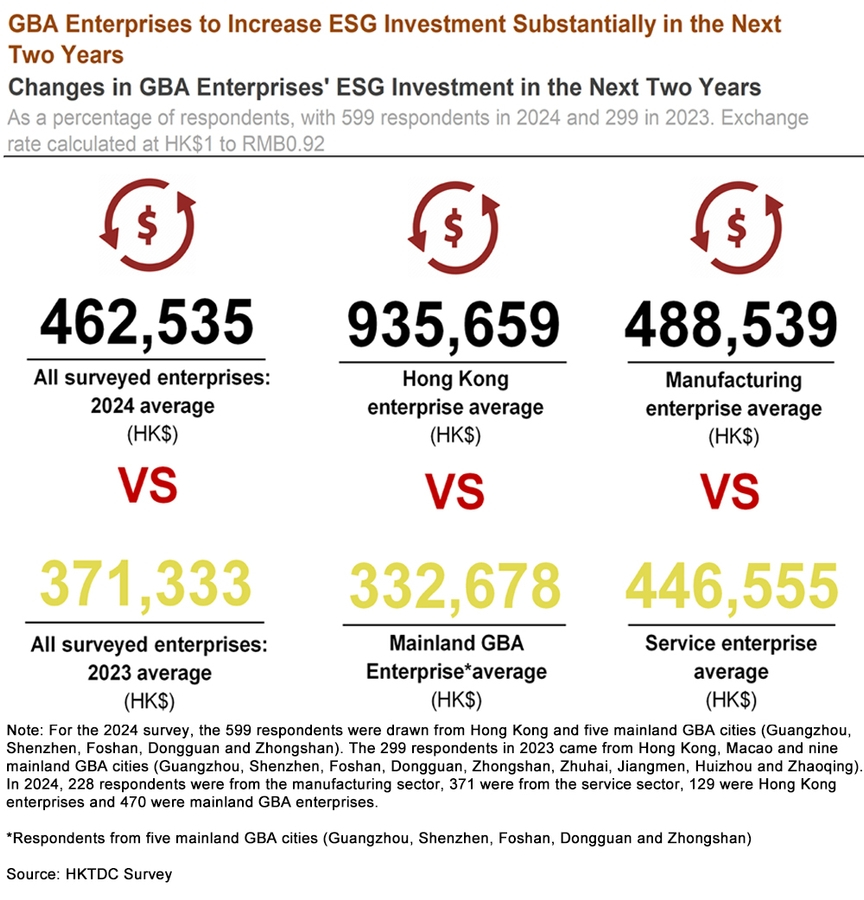

In terms of budgeting, the average amount of investment in ESG by GBA enterprises in the next two years is expected to be about HK$462,535, a rise of almost 25% on the figure of HK$371,333 recorded in 2023. Comparing enterprises from the two places, Hong Kong enterprises are willing to invest an average of HK$935,659, much higher than enterprises in the five mainland GBA cities. Mainland enterprises are willing to invest an average of HK$332,678, similar to the amount recorded for the 2023 survey. It was also notable that manufacturing industries are investing more than service industries, averaging out at HK$488,539 and HK$446,555, respectively.

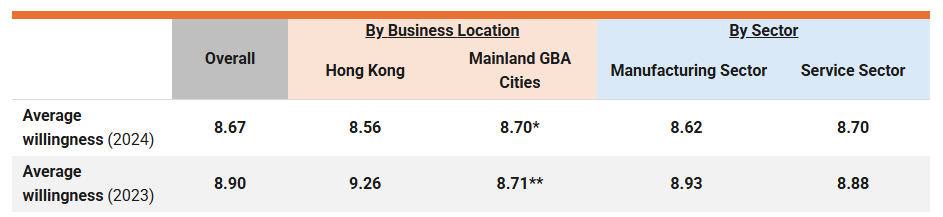

GBA Enterprises Set High Value on Hong Kong’s Green Services

As part of the survey, enterprises were asked to rate their willingness to learn more about and use the green and sustainability services of Hong Kong on a 10‑point scale. The overall average score in 2024 remained high at 8.67, a similar value to that recorded for 2023, indicating that GBA enterprises remain willing to learn more about and utilise Hong Kong’s sustainability services. Overall, geographically, the willingness of enterprises from the five mainland GBA enterprises was higher, while, by sector, the willingness of the manufacturing and service sectors, with scores of 8.62 and 8.70, respectively, showed little variance. At a time when the GBA is committed to establishing a green, low‑carbon and circular economic system, Hong Kong continues to serve as the preeminent green platform for the region, providing enterprises with essential services and assisting them with their green transformation programmes.

Note: For the 2024 survey, the 600 respondents were drawn from Hong Kong and five mainland GBA cities (Guangzhou, Shenzhen, Foshan, Dongguan and Zhongshan). The 300 respondents in 2023 came from Hong Kong, Macao and nine mainland GBA cities (Guangzhou, Shenzhen, Foshan, Dongguan, Zhongshan, Zhuhai, Jiangmen, Huizhou and Zhaoqing). In 2024, 228 respondents were from the manufacturing sector, 372 were from the service sector, 130 were Hong Kong enterprises and 470 were mainland GBA enterprises.

2024: *Respondents from five mainland GBA cities (Guangzhou, Shenzhen, Foshan, Dongguan and Zhongshan).

2023: **Respondents from nine mainland GBA cities (Guangzhou, Shenzhen, Foshan, Dongguan, Zhongshan, Zhuhai, Jiangmen, Huizhou and Zhaoqing)

Source: HKTDC Survey

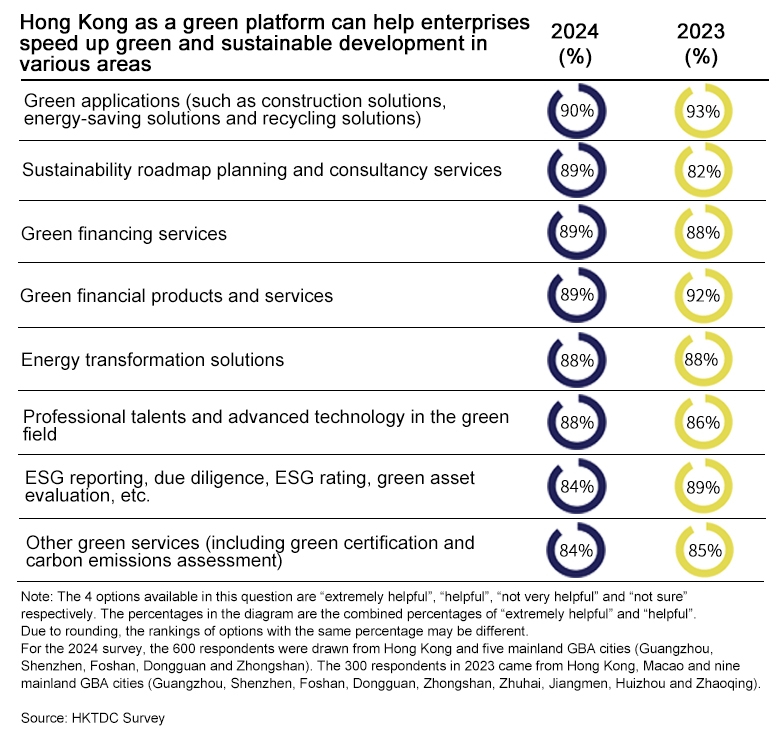

About 90% of GBA Enterprises See Hong Kong as a Catalyst for Accelerating Sustainability

As a key sustainability platform, Hong Kong offers a wide range of diversified green services, a resource that about 90% of surveyed GBA enterprises believe can help accelerate their related developments, a similar proportion to that recorded for the previous survey. In particular, such Hong Kong‑sourced services as green applications (90%), sustainability roadmap planning and consultancy services (89%), green financing services (89%), green financial products and services (89%), energy transformation solutions (88%) and professional talents and advanced technology in the green field (88%) continued to be highly appreciated by GBA enterprises.

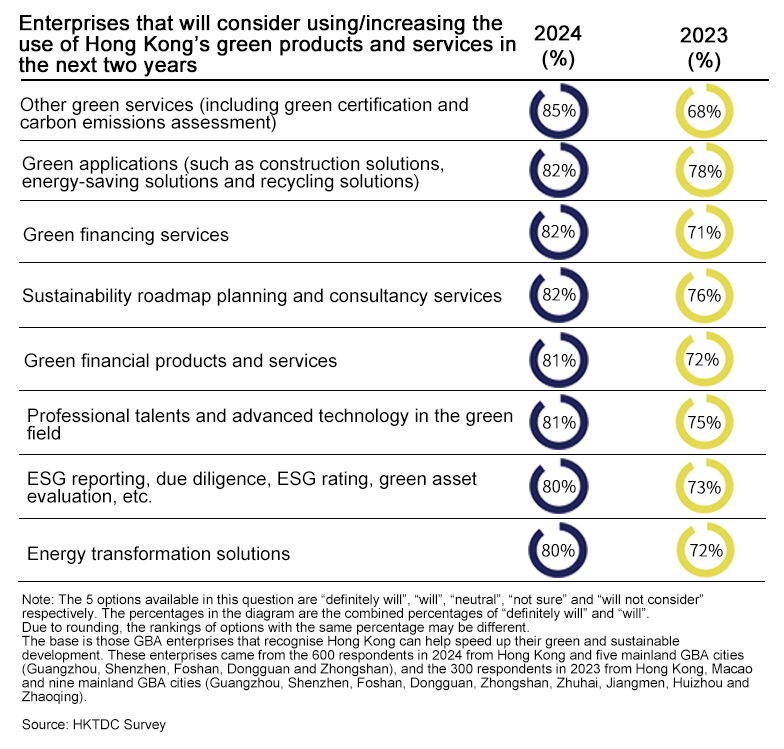

More than 80% of GBA Enterprises Expect to Increase Use of Hong Kong’s Green Resources

Of the surveyed enterprises in 2024 that believe Hong Kong can effectively speed up GBA enterprises’ green and sustainable development, more than 80% said they would consider using or increasing their use of Hong Kong’s green products and services, a significantly higher figure than about 70% recorded for the 2023 survey. Of the various services on offer, the increase in demand for other green services (including green certification and carbon emissions assessment) was especially notable, with 85% of enterprises indicating they would consider using or increasing their use of these services in the next two years. As part of the survey, many enterprises also indicated that they intend to achieve carbon neutrality by 2030, which possibly explains why more enterprises are using such green services as carbon emissions assessment. Overall, the proportion of enterprises saying they “definitely will” or “will” use a variety of services reached (or exceeded) 80%. From the above two findings, it is evident that Hong Kong’s green products and services, as well as Hong Kong’s role as a green platform, are receiving a high level of recognition from GBA enterprises.

The survey findings inside this article were compared with the results of two studies conducted in 2023: “Navigating Connectivity – Exploring ASEAN Opportunities for the Greater Bay Area” and “Sustainability in the GBA: Unlocking Opportunities and Empowering Growth”.

Original article published in https://hkmb.hktdc.com