Middle East Opportunities: Kuwait Overview

Kuwait has the fourth largest economy in GCC

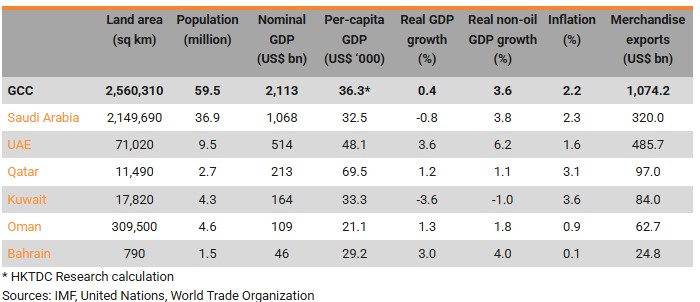

The nation of Kuwait, situated in the Arabian Gulf, is a pivotal global energy supplier. In 2023, it had a nominal GDP of US$164 bn (HK$1.278 tn), the fourth biggest among the states of the Gulf Cooperation Council (GCC).

In that year, it had a population of 4.3 million and a per capita income of US$33,300 – the third highest in the GCC.

Major economic indicators of GCC countries 2023

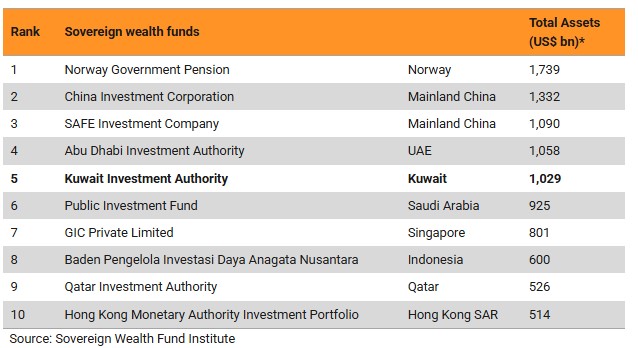

Kuwait maintains the GCC’s second largest sovereign wealth fund

Kuwait has one of the largest sovereign wealth funds in the world. The Kuwait Investment Authority has assets under management (AUM) of US$1,029 bn, the fifth biggest total globally and the second largest in the GCC region. Kuwait’s sovereign wealth fund generally focuses on diversifying its investment portfolio by investing in fields that align with the country’s economic diversification strategies.

Kuwait’s economic diversification

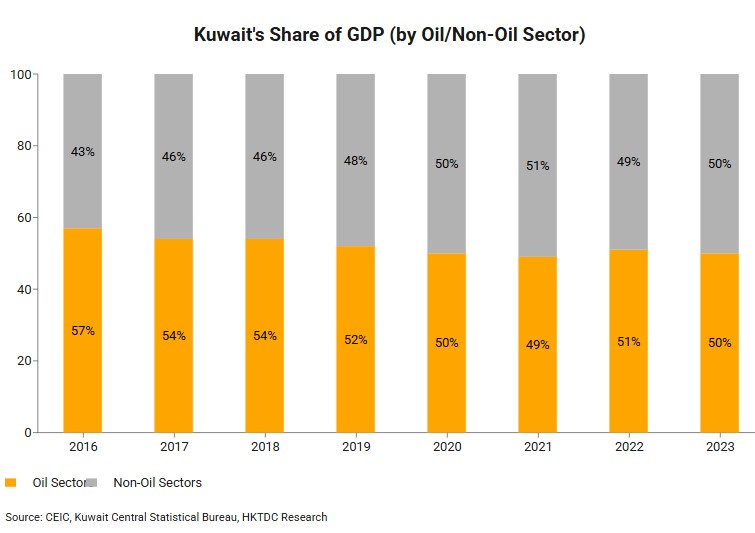

The oil sector is the cornerstone of the country’s economic structure. In 2023, it accounted for approximately 50% of Kuwait’s total GDP, and made up over 90% of government revenue during the 2023/24 fiscal year. Kuwait boasts the world’s sixth largest oil reserves, representing roughly 7% of the planet’s proven reserves, and ranks eighth in terms of natural gas reserves.

The heavy reliance on the oil industry exposes Kuwait’s economy to volatility from global oil price fluctuations. This prompted the launch in 2017 of the Kuwait Vision 2035 initiative, which was aimed at diversifying the economy, reducing oil dependency and stimulating private sector growth. The result has been a gradual rise in the importance of the non‑oil sector in the Kuwaiti economy. Between 2016 and 2023, the sector – which encompasses, among other activities, finance, construction and logistics – has grown from 43% to 50% of the country’s GDP.

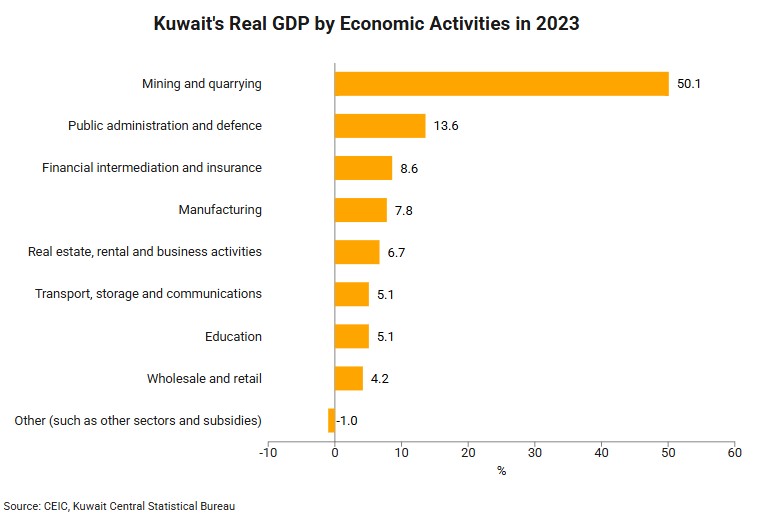

In terms of economic activity by sector, mining and quarrying (which is the oil economy) accounts for 50.1% of total economic activity. Public administration and defence is the next biggest at 13.6%, reflecting significant government involvement in the non‑oil economy. The financial sector, the country’s most thriving industry, makes up 8.6% of the economy and is the largest private sector component within the non‑oil economy.

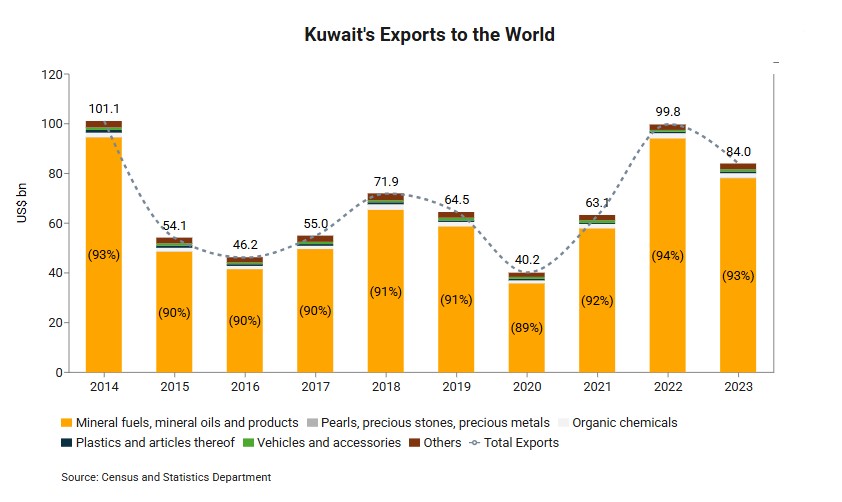

Oil products accounts for 90% of Kuwait’s total exports

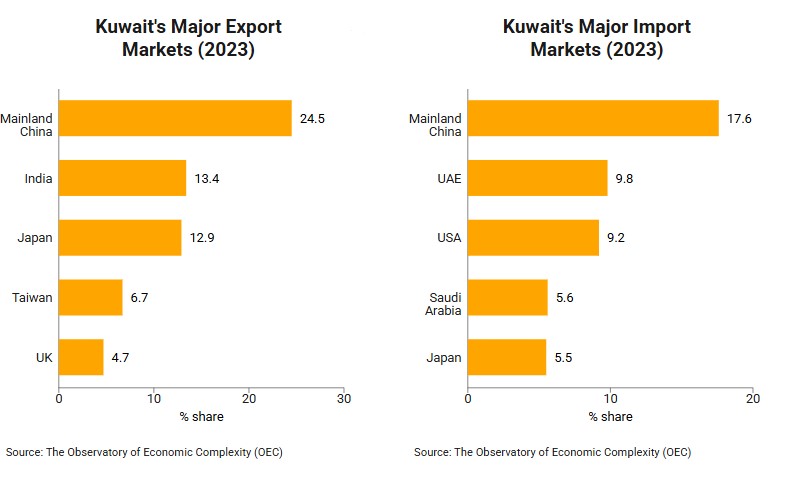

Despite the growth of the non‑oil sector, crude oil and refined oil products continue to dominate Kuwait’s exports, making up about 90% of them. Mainland China was Kuwait’s largest trading partner in 2023, accounting for about 20% of the country’s total trade.

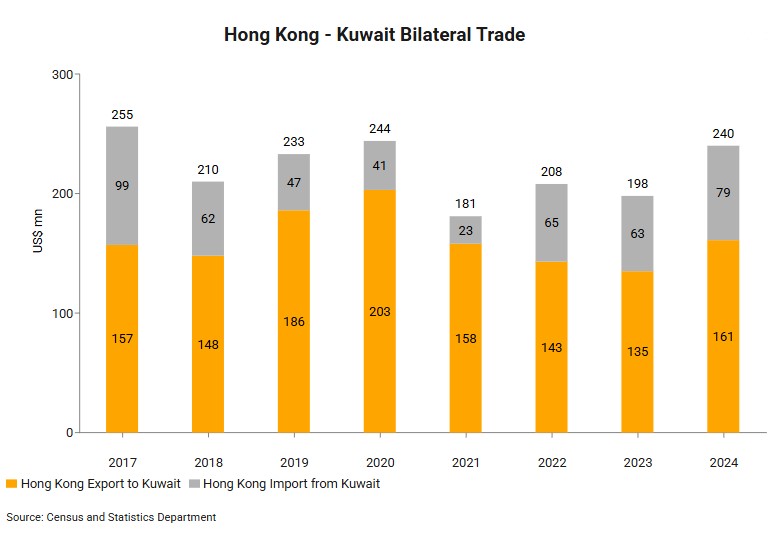

Hong Kong-Kuwait trade rebounded impressively in 2024

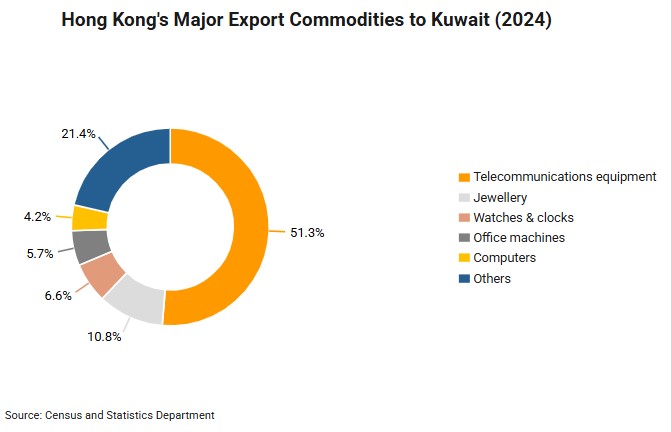

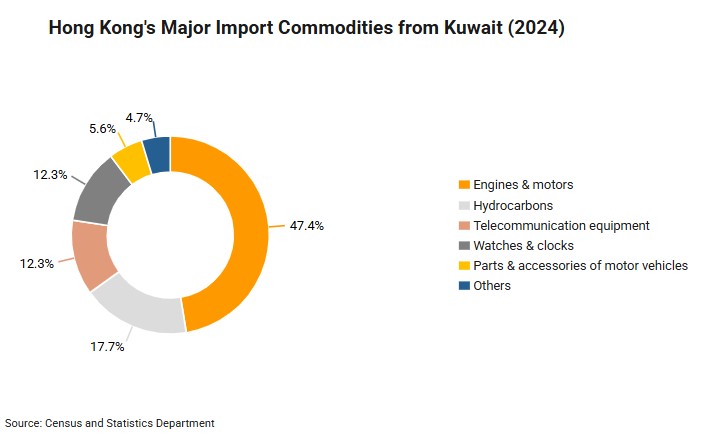

In terms of Hong Kong’s trading relationships, Kuwait ranked fifth among GCC states in 2024. Bilateral trade between Hong Kong and Kuwait has rebounded from the Covid-19 pandemic. In 2024, bilateral trade between Hong Kong and Kuwait was worth US$240 m, up 21.2% from the year before. Telecommunication equipment makes up 51.3% of exports from Hong Kong to Kuwait, accounting for US$83 m. The next biggest sector is jewellery (10.8%, US$17 m), followed by watches & clocks (6.6%, US$11 m). Engines and motors are Hong Kong’s major source of imports from Kuwait, amounting to US$37 m , or 47.4% of the total. followed by hydrocarbons (17.7%, US$14 m) and telecommunication equipment (12.3%, US$10 m).

Latest regulatory changes favour private sector development

Kuwait has been actively pursuing measures designed to facilitate development and attract foreign investment, particularly as part of Kuwait Vision 2035. Recent regulatory changes have been aimed at accelerating the country’s private sector development.

Kuwait government budget and key development projects

In its 2025/26 budget, the Kuwaiti government allocated some US$6 bn (about 7% of the total budget) for the development of the country’s infrastructure and services. It will fund over 90 projects, including railways, roads, water, electricity and Mubarak Port.

Key projects currently under development include: the Madinat Al-Hareer (Silk City), a large‑scale, mixed‑use urban development in the Subiya region which is set to become the country’s northern economic zone; the Kuwait section of the Gulf Railway Project, currently in the design and planning phase; and the Al Dibdibah and Al Shagaya Renewable Energy Project – Phase III, a large scale public‑private partnership (PPP) solar photovoltaic project expected to generate 1,600 MW in total, for which developers will be selected during 2025 and 2026.

New Housing Law

The New Housing Law, promulgated on 20 August 2023, is designed to support housing development by encouraging foreign investors to undertake real estate and related infrastructure projects in Kuwait. The law allows the Kuwaiti state to set up firms focused on developing housing, cities and residential districts in collaboration with the private sector, both locally and internationally.

According to Arabian Gulf Business Insight, the value of Kuwait’s real estate transactions increased by 34% between 2023 and 2024. There were 4,950 transactions – up from 4,442 the year before – worth a total of US$12.1 bn (KD3.73 bn), an increase of US$3 bn year on year.

However, the persistent shortage of housing in Kuwait appears to be growing. The backlog of government housing applications had reached 97,671 cases by October 2024, with 6,134 new applications submitted that year alone. This underscores the urgent need for expanded public housing projects to meet demand. It’s estimated that PPP housing projects worth more than US$811 m are needed, which offers a great deal of potential for Hong Kong’s architecture designers and project consultants.

Article 24 of the Commercial Law

In January 2024, Kuwait revised regulations concerning foreign companies and investors. Until then, international investors had the option of either forming a company with a majority Kuwaiti shareholder or appointing a local agent. Now they can also set up a wholly owned branch in Kuwait. The rule changes also allow foreign entities to directly engage in government tenders without the need for a Kuwaiti agent or partner, once they are registered as service providers and contractors.

“New Kuwait” 2035

The aim of Kuwait Vision 2035 is to diversify Kuwait’s economy and promote long‑term growth by transforming the country into a regional and international financial and trade hub and making it an attractive destination for investors. Its primary goals include:

- Restoring Kuwait’s regional leadership role as a financial and commercial hub, and reviving the pivotal role of the Kuwaiti private sector in leading development.

- Reconstructing the bodies and institutions of the country, and enabling increased work empowerment and productivity.

- Providing new infrastructure and legislation to help create a business environment conducive to development, while also providing the controls and climate needed to ensure a balanced development of human resources.

- Consolidating the values of Kuwaiti society, preserving its identity as well as achieving greater justice, freedom and political participation.

Source: King Faisal Center for Research and Islamic Studies, HKTDC Research

Infrastructure

One of the most significant aspects of Kuwait Vision 2035 is the focus on developing infrastructure. This includes the construction of new cities like Silk City and the enhancement of ports such as Mubarak Port, which is being constructed on Boubyan Island. The aim of these projects is to enhance Kuwait’s logistical capabilities and streamline regional and global trade routes. Kuwait Vision 2035 also prioritises the modernisation of transportation networks by integrating seaports with upgraded road and rail systems, creating a more efficient movement of goods both domestically and internationally.

Sustainability

Sustainability is a cornerstone of Kuwait Vision 2035. It aligns with the United Nations Sustainable Development Goals (SDGs), emphasising environmental stewardship and promoting green technologies and renewable energy to balance economic growth with ecological preservation. By embedding these global objectives into its strategy, Kuwait seeks to establish itself as a regional leader in sustainable development while securing a prosperous, resilient future.

The Vision’s target is to position Kuwait within the top 20% of nations across key global indicators by 2035, reflecting Kuwait’s ambition to become a benchmark for progress in the Gulf region.

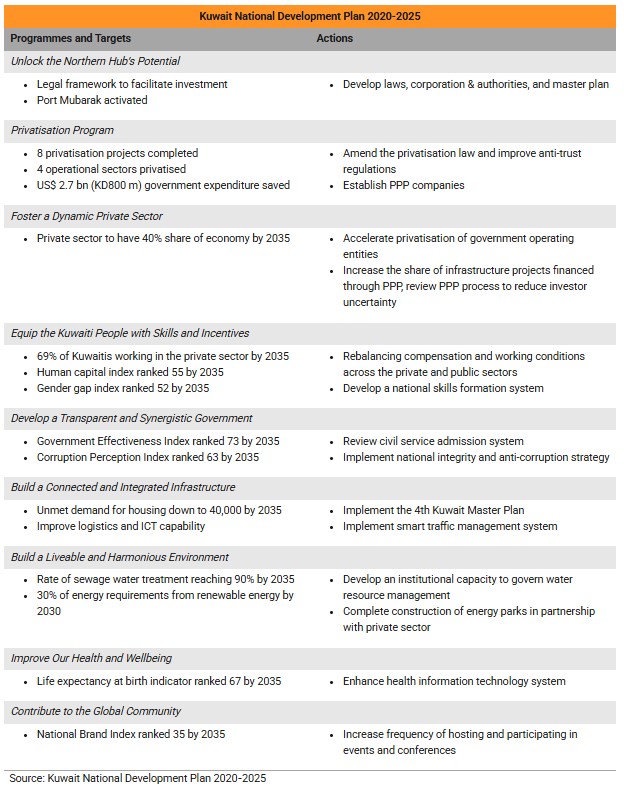

Kuwait National Development Plan 2020-2025

The Kuwait National Development Plan (KNDP) sets out the programmes and policies designed to push the nation towards its 2035 vision. It focuses on increasing the involvement of the private sector in all sectors of the economy.

Because of the push to increase private sector engagement, one of the plan’s major components is its privatisation programme. The government has set a target of eight privatisation projects to be implemented by 2025, and is also looking to privatise four operational sectors in the government. By doing this, it expects to cut government spending by US$2.7 bn (around 3% of total government expenditure).

Private Public Partnership (PPP) business model will be used to carry out the privatisations of government projects and sectors. PPP companies will be formed in targeted sectors and shares in them distributed to Kuwaiti citizens at subsidised prices.

Kuwait’s priority sectors and opportunities for Hong Kong

The Kuwait Direct Investment Promotion Authority (KDIPA) was established in 2013. It is the primary agency responsible for promoting and regulating FDI in Kuwait. KDIPA operates as a one‑stop shop for foreign investors, providing guidance on legal requirements, licensing and incentives. It also negotiates investment agreements and ensures alignment with Kuwait’s strategic sectors.

A core function of KDIPA is its regulatory oversight. The authority reviews, approves and grants investment licences while awarding incentives based on transparent criteria outlined in its founding law, in collaboration with the relevant government bodies. KDIPA also provides ongoing support, facilitation and aftercare services for licensed projects, alongside continuous monitoring throughout a project’s lifecycle to ensure compliance and success.

Kuwait offers tax holidays of up to ten years, exempting foreign investors from income tax and other taxes. Additionally, customs duties on imports of machinery, equipment and raw materials may also be waived, reducing operational costs. However, these incentives are not automatic and all require approval from KDIPA.

KDIPA has identified 12 key sectors to attract foreign investment and diversify Kuwait's economy beyond oil. These are:

The following sectors present potential opportunities for Hong Kong investors:

IT, software development and technology

Kuwait Vision 2035 prioritises the development of the IT sector, focusing on enhancing digital infrastructure and integrating advanced technologies across key industries. The country’s ICT market, which was valued at US$22.48 bn in 2023, is projected to grow to US$39.83 bn by 2028, driven by public and private investment in technology areas such as AI, cloud computing and 5G networks applications. Potential areas for growth include hardware development, software solutions and IT services, within sectors such as oil and gas, healthcare, finance, and telecommunications.

Construction

Kuwait’s construction sector is fuelled by mega‑projects such as Silk City, Mubarak Port, and large‑scale housing and infrastructure developments. According to KPMG, Kuwait has nearly 300 projects ongoing in 2025, including those in the bid and execution phrase. While Hong Kong companies may face challenges in securing contractor roles for these projects, the sector’s complexity and scale require diverse expertise, creating significant opportunities for Hong Kong‑based consultancy firms that specialise in project planning, management, green building solutions and technical oversight. Additionally, companies could explore investment opportunities through PPP projects listed on the Kuwait Stock Exchange.

Renewable Energy

Kuwait is heavily reliant on fossil fuels and urgently needs to diversify its energy mix and embrace renewable sources. In 2023, 99% of the country’s electricity was generated from fossil fuels, with just 1% sourced from solar panels, according to the International Renewable Energy Agency (IRENA). Kuwait aims to address this imbalance by generating 30% of its electricity from renewables by 2030, which will create significant opportunities for solar and wind power solution providers. There is a high demand for solutions tailored to extreme desert conditions, such as high temperatures, sandstorms, and arid climates.

Warehousing and logistics

The storage and logistics sector encompassing warehousing, freight logistics, and express delivery services is undergoing transformation, driven by port expansions, airport upgrades and growing consumer demand. Warehousing plays a pivotal role in facilitating trade activities, yet businesses in Kuwait face a persistent shortage of suitable storage spaces, creating opportunities for investors to provide advanced warehousing solutions. Major projects like the Kuwait Air Cargo City and Mubarak Port are reshaping the logistics landscape, offering avenues for businesses to capitalise on Kuwait’s strategic geographic position. These initiatives aim to enhance regional connectivity and efficiency, positioning Kuwait as a logistics hub in the Gulf. Investors can use these developments to address gaps in supply chain infrastructure like port management expertise, especially because Kuwait is ambitious to develop its marine trade and become a regional trade hub.

Food & Agriculture

Since the Covid-19 pandemic and the Russian invasion of Ukraine, Kuwait has become more aware of the importance of reducing its reliance on food imports. Nearly 90% of food in Kuwait is imported, so the country is planning to diversify its food sources to confront food security challenges. The government has already taken steps to secure the country’s food supply, such as allocating more land for farming. Four vertical farms have opened since 2021. Products designed to improve crop yields in Kuwait’s nutrient‑poor soil and harsh climate are in high demand. Companies that provide agritech solutions may find opportunities in this market.

Professional Services

There is increasing interest in Kuwait from mainland China, and vice versa. Hong Kong’s bilingual talent pool and status as a Belt and Road Initiative hub mean that its professional services companies are uniquely positioned to collaborate with their Kuwaiti counterparts, leveraging their expertise in international finance, arbitration, cross‑border regulatory compliance and so on. There is plenty of potential for Hong Kong professional services firms to work with Kuwait’s local and regional counterparts to facilitate two‑way flows of investment between mainland China and Kuwait.

Healthcare Services

Kuwait's healthcare system struggles with low‑quality public facilities and a lack of specialised medical services. In 2023, the country’s health spending per capita was US$2,292, the third highest in the region behind Qatar and the UAE. In a report into the Kuwaiti healthcare system, industry analysts BMI found that while the government has invested in integrating digital healthcare solutions such as electronic healthcare records (EHR) systems, mobile applications and telemedicine, such efforts are still at an early stage and lack a cohesive and interconnected ecosystem. BMI also said the country is likely to keep driving the uptake of digital health solutions as high quality healthcare is one of the key pillar of Kuwait Vision 2035. This means there is potential for digital healthcare solution providers to tap into the market.

Original article published in https://hkmb.hktdc.com