Latin Lessons: Brazil as a Gateway to Latin American Markets

Economic transformation and tax simplification give Brazil an extra edge

To help Hong Kong SMEs better understand the current business landscape of this enormous BRICS market, HKTDC Research recently hosted a webinar titled Unlocking Brazil’s Business Potential. Experts were invited to expound on Brazil’s economic and trade developments and offer practical advice to Hong Kong companies interested in expanding into the country.

Alice Tsang, Principal Economist (Global Research) at HKTDC Research, pointed out that many Hong Kong companies are looking to develop new markets given so many uncertainties in the global economy. Brazil is the largest economy in Latin America, accounting for one‑third of the region’s GDP as well as foreign direct investment (FDI) stock. Being Hong Kong’s main trading partner in Latin America, it represents a market that Hong Kong companies cannot afford to overlook. Yet, because of the unfamiliar business environment and regulations, it is crucial for them to prepare thoroughly in advance to achieve good results.

Understanding Brazil’s Business Landscape

In November 2024, Nicholas Fu, Senior Economist (Global Research), HKTDC Research, visited economic hubs and key cities of Brazil including São Paulo, Rio de Janeiro, Belo Horizonte and Foz do Iguaçu to identify new business opportunities for Hong Kong SMEs.

With a maturing start‑up ecosystem, Brazil boasts the largest start‑up scene in Latin America and the 27th‑largest in the world.

In his briefing on Brazil’s economic and market development, Fu highlighted that the country has diversified industries and the best start‑up ecosystem in the region while its huge markets are a key attraction for venture investment. Currently, Brazil boasts more than 12,000 start‑ups and 24 unicorn enterprises from various sectors. It therefore represents the largest start‑up market in Latin America and the 27th‑largest in the world.

By citing various success cases, Fu demonstrated that Brazil’s start‑ups have already established a presence in the international market.

- 99, a ride-hailing app platform in Brazil, was founded in 2012 and later became the country’s first unicorn enterprise. Its acquisition by Mainland China’s DiDi in 2018 marked the first cross-border M&A transaction in China’s ride-sharing sector.

- Since 2023, Inter&Co, a Brazilian fintech company, has been participating in cross-border tokenisation experiments jointly conducted by the Banco Central do Brasil and the Hong Kong Monetary Authority, extending financial collaboration between Hong Kong and Brazil.

- Yosen Nanotechnology, a Brazilian healthcare firm, was the second runner-up in the 2022 Innovation and Entrepreneurship Competition (Macao) for Technology Enterprises from Brazil and Portugal. In May 2024, it formally established a business in Macao, indicating that Brazilian start-ups are eying the huge market opportunities in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

Strengthened Logistics

The Brazilian government is endeavouring to achieve its industrial decarbonisation goal. Brazil now generates 80% of its power from renewable energy, while it is further driving the development of biofuels and hydrogen energy. In 2024, a hydrogen research centre was set up in Brazil’s Itaipu Technology Park to develop the use of hydrogen as a sustainable aviation fuel (SAF). Investment in a pilot SAF plant was also initiated.

At Port Santos, the largest port in Latin America, the Brazilian government is implementing a new zoning plan to increase the container handling capacity.

In the freight and logistics sector, Brazil’s Port Santos, the largest port in Latin America, handles almost one‑third of the country’s trade. Currently, over half of the handled cargo consists of dry bulk and one‑third comprises container cargo. The Port intends to boost its container capacity to help handle the ever‑increasing freight volume and also foster Brazil’s logistics development. Under a new zoning plan, Port Santos’ container capacity will increase from 6 million TEUs to 9 million TEUs.

Fu pointed out that Hong Kong is the gateway for Latin American companies to enter Mainland China and Asia. Economic and trade exchanges between the two regions are frequent, and Mexico, Brazil, Chile, Colombia and Peru are Hong Kong’s main export markets in Latin America. On the other hand, Brazil is Hong Kong’s largest source of imports from Latin America, 66% of which are various types of meat and meat products.

Brazil is a major agricultural country that plays a vital role in the global food market. In addition to supplying Hong Kong with an array of agricultural and food products, it also takes advantage of Hong Kong’s role as a food trading hub to help it enter the Asian market. For example, Frimesa, a renowned meat product exporter from Brazil, has been exporting pork and dairy products to Hong Kong for years. Currently, Frimesa’s export business covers 31 markets worldwide and some 70% of its products are exported to Asia. In view of Hong Kong’s well‑developed shipping and logistics industry, the company is planning to set up a new production plant to deal with the market demand from Hong Kong, Vietnam and South Africa.

Bruno Eduardo Di Giulio, Legal Director of the Brazilian Chamber of Commerce in Hong Kong.

Brazil's Tax System

Bruno Eduardo Di Giulio, Legal Director of the Brazilian Chamber of Commerce in Hong Kong, provided insights into Brazil’s business environment from the legal and political prospectives. He pointed out that Brazil adopts a continental law system and, due to its multi‑party political structure, its trade policies can shift with changes in the ruling party.

Bruno noted the strong business ties between Hong Kong and Brazil. While Brazil’s fruits, beverages, fashion apparel and health products have much potential to tap into the Hong Kong market, its high‑quality beef and coffee are well‑positioned to carve out larger market shares in the city.

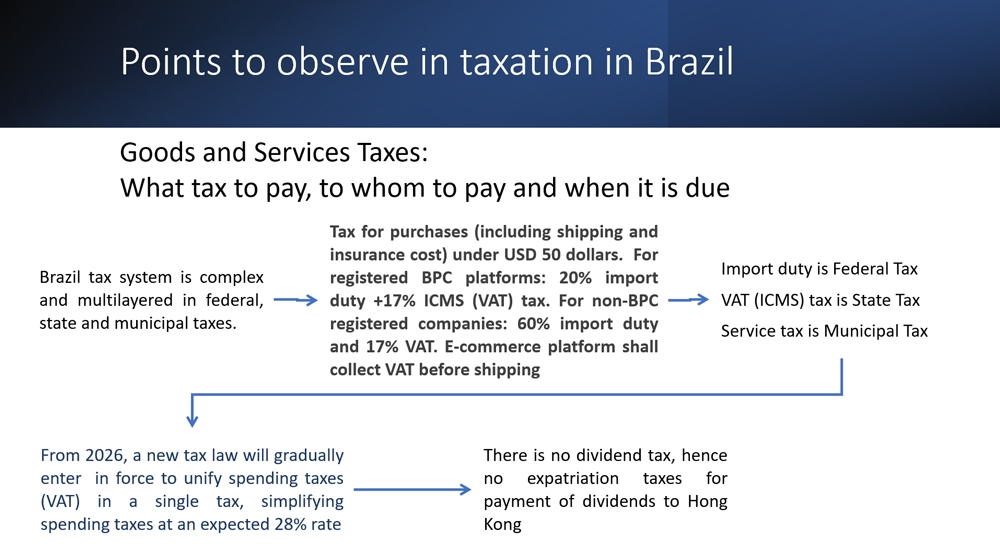

Hong Kong companies should note that the Brazilian government is striving to simplify its tax system. A key reform measure is to establish a new value‑added tax (VAT) system by consolidating five long‑existing taxes (industrial product tax, income tax, social integration tax, tax on circulation of goods and services, and service tax) into a VAT with a uniform rate of 28%. The new tax regime, expected to gradually take effect in 2026, will help attract investment and raise Brazil’s economic competitiveness. Brazil’s current tax system is complex, with multiple layers of taxes administered at the federal, provincial and municipal levels, such as a consumption tax for purchases of not more than US$50 (inclusive of shipping and insurance), a 20% import tariff and an over 17% tax on circulation of goods and services (ICMS).

Brazil’s high‑quality beef and coffee are well‑positioned to carve out larger market shares in the Hong Kong market.

Respect Cultures

Bruno reminded Hong Kong companies intending to venture into the Brazilian market of the importance of understanding local business practice and respecting cultural differences. While the Brazilian economy is vibrant and innovative with a huge consumer market, local businesses tend to focus on domestic sales. Additionally, the volatility of exchange rates can impact business planning.

Bruno suggested that Hong Kong companies entering the Brazilian market as an e‑commerce entity should first enrol in the government’s E‑Commerce Compliance Programme to enjoy tax breaks and quicker customs clearance. Companies so enrolled can enjoy a drastic reduction in import duty from 60% to 20%. Furthermore, Brazil has already signed logistics and customs agreements with various countries and regions. For example, Hong Kong companies can utilise the related logistics services offered by Hong Kong Post to mitigate the risks associated with mailing merchandise.

He also stressed that Hong Kong companies intending to hire personnel in Brazil should pay close attention to local labour laws. For example, the country has a designated department for handling labour disputes and only allows limited unmonitored negotiation between employees and employers. Companies can proactively reach collective agreements with labour unions on employment policies and benefits to ensure compliance with local labour laws, thereby avoiding potential issues that may affect business development.

Brazil’s high‑quality beef and coffee are well‑positioned to carve out larger market shares in the Hong Kong market.

Original article published in https://hkmb.hktdc.com