Chinese Mainland E-Commerce Retail Market: Market Positioning of Hong Kong Medicines and Health Products

(Consumer Survey Results)

Key Findings:

- The Chinese mainland has a huge e-commerce retail market, and the central government has adopted all sorts of measures to facilitate cross-border e-commerce imports. Traders in medicines and health products can enjoy import tax incentives and customs clearance facilitation through cross-border e-commerce channels.

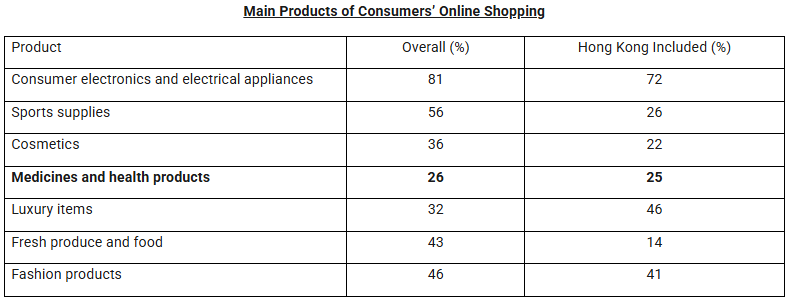

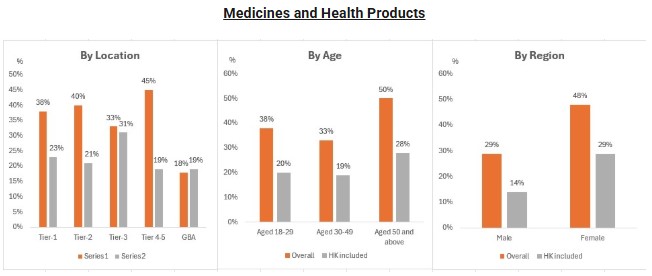

- 26% of survey respondents said they have bought medicines and health products online, while 25% of respondents have bought Hong Kong medicines and health products online. Respondents aged 30-49 buy medicines and health products online most frequently. The propensity to buy is the same for men and women.

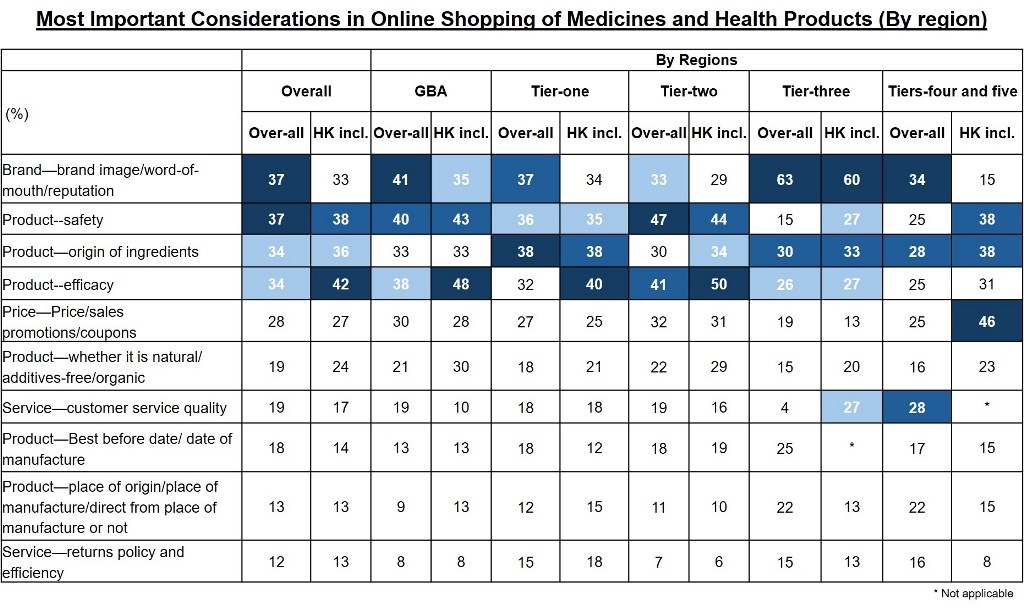

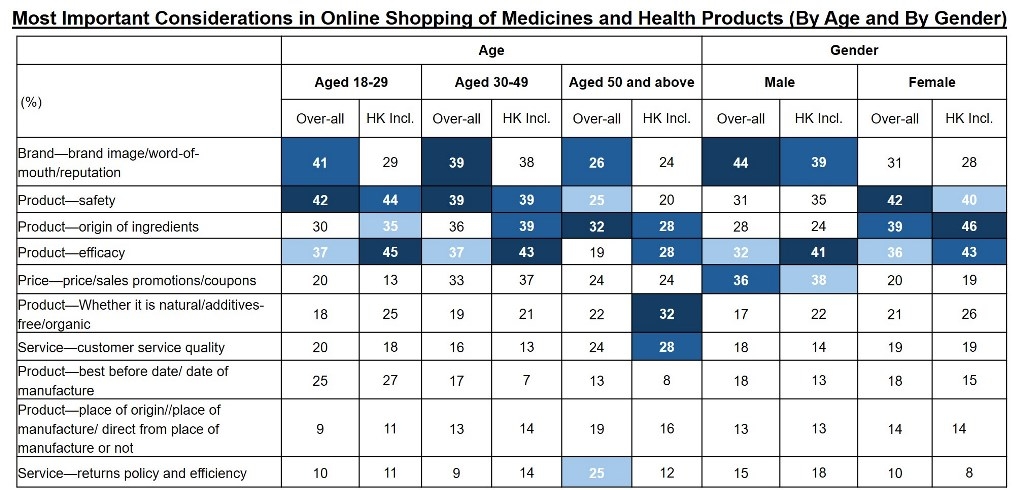

- Consumers view brand image/word-of-mouth (37%) and safety (37%) as the most important considerations when buying medicines and health products online. Those who have bought Hong Kong medicines and health products attach greater importance to the efficacy of products (42%). The preferences of consumers aged below 50 are largely similar, but those aged 50 and above consider the origin of ingredients as the most important concern (32%). Men tend to consider brand image and word-of-mouth first while women consider safety more important. Factors of consideration differ in different regions.

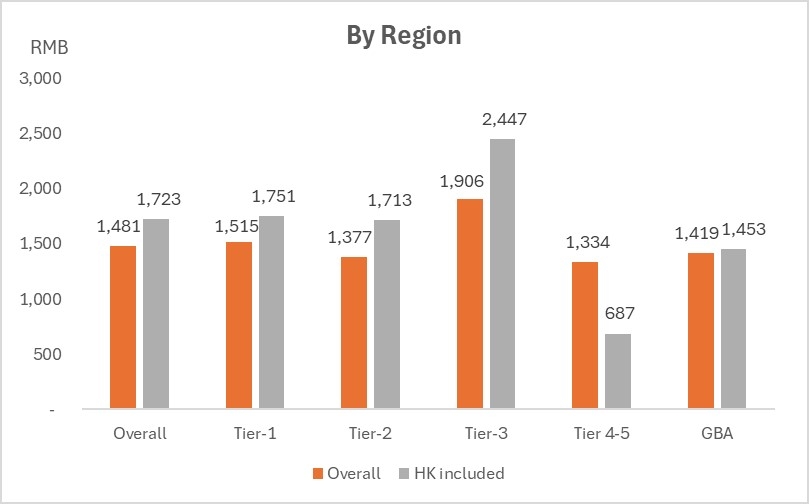

- In online shopping for medicines and health products, the highest average order value is reported in tier-three cities (RMB1,906), followed by tier-one cities (RMB1,515). In online shopping for Hong Kong medicines and health products, the average spending of consumers is generally higher, with the highest spending being reported in tier-three cities (RMB2,447), followed by tier-one cities (RMB1,751), tier-two cities (RMB1,713) and the GBA cities (RMB1,453).

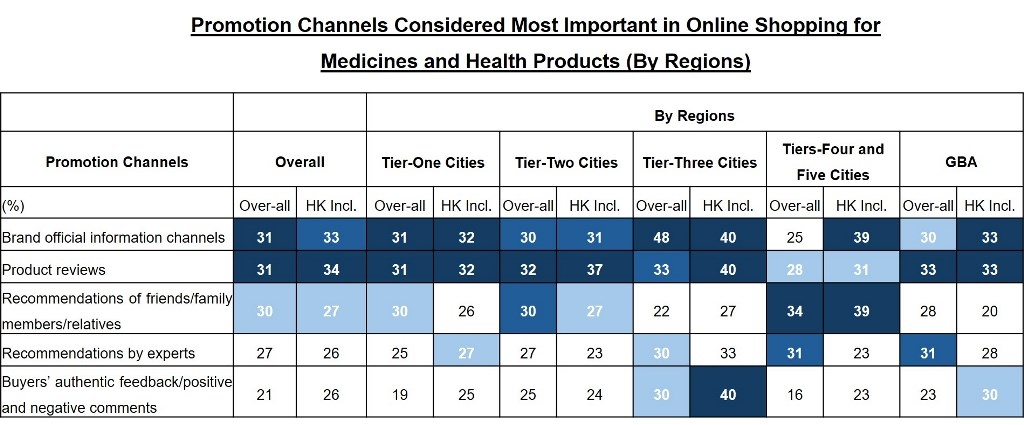

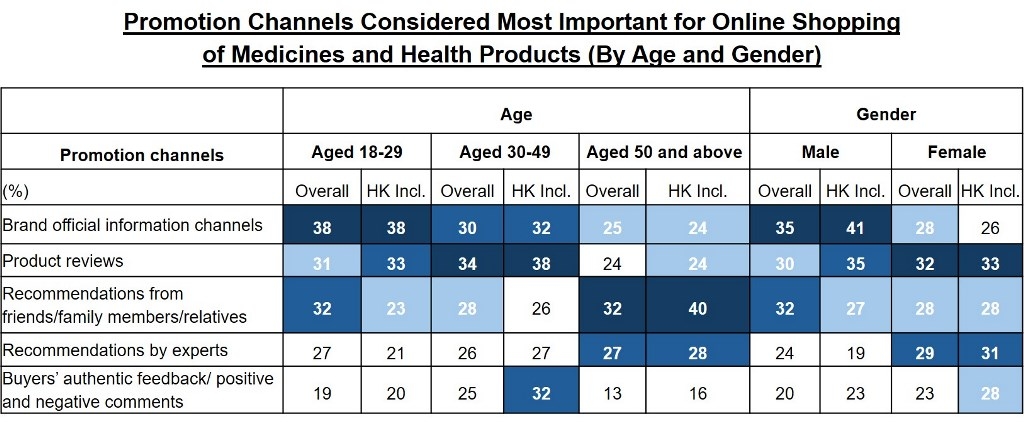

- When consumers buy medicines and health products through online shopping platforms, they mainly obtain product information through brand official information channels and product reviews and follow the recommendations of friends/family members/relatives. Consumers in many places regard product reviews as the most important source of information. Consumers in tier-three cities consider brand official information channels as the most important source, while consumers in tiers four and five cities value recommendations from friends/family members/relatives. Younger consumers consider brand official information channels as the most important source. Female consumers consider product reviews as most important, while male consumers put brand official information first.

In 2024, HKTDC Research commissioned a market survey agency to conduct a questionnaire survey of 2,200 middle-income class or above consumers from different mainland cities. The aim was to understand their online consumption habits and their preferences regarding Hong Kong products. For details, please refer to Hong Kong Businesses Navigating Chinese Mainland E-commerce Retail Market—Consumer Survey Results. |

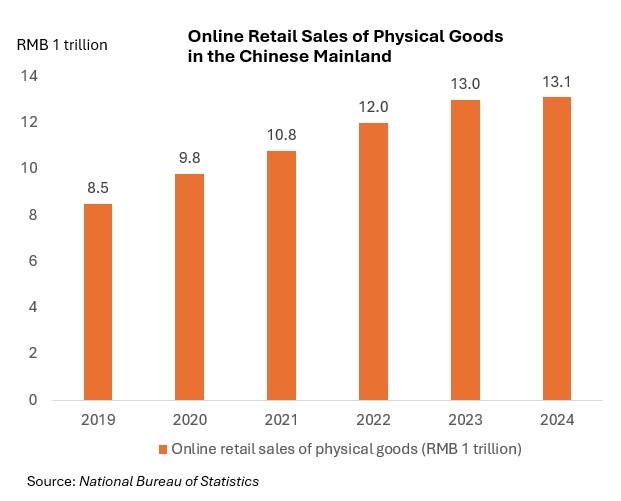

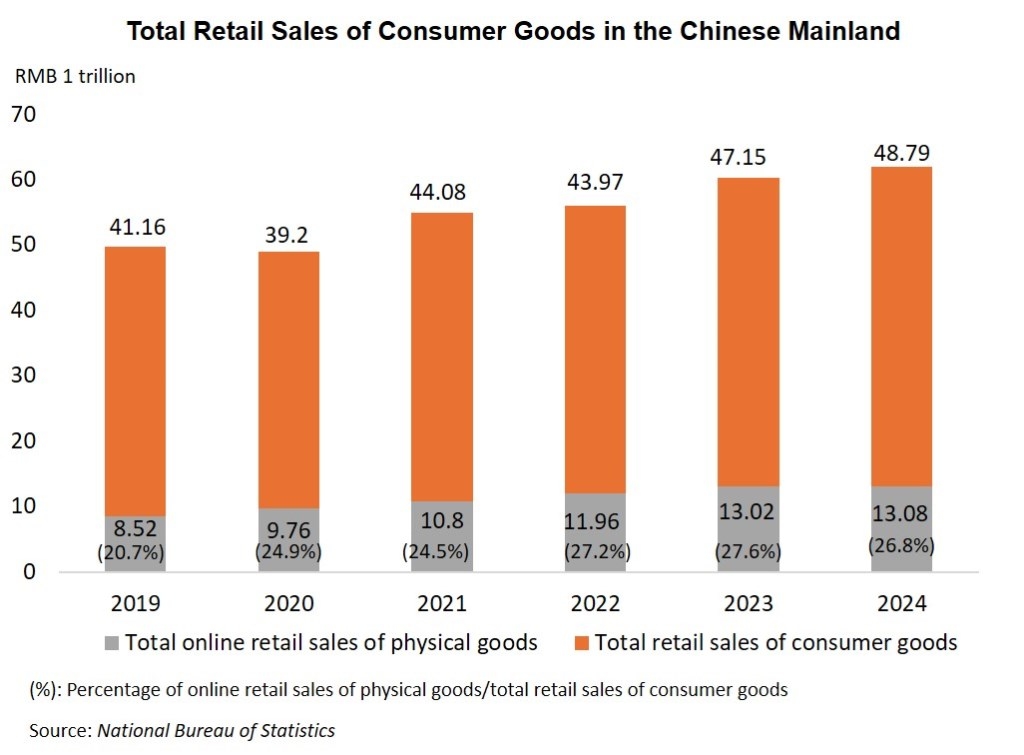

Chinese mainland leads global e-commerce retail market

The Chinese mainland leads the world with its vast e‑commerce retail market. Figures released by the State Statistical Bureau show online retail sales of physical goods in China growing by approximately 54.1% between 2019 and 2024, from RMB8.5 trillion to RMB13.1 trillion, which represented 26.8% of total retail sales of consumer goods and represents an important factor in the local consumer market’s sustained growth. A report published by the HKTDC and the Hong Kong Export Credit Insurance Corporation at the end of last year [1] also showed Hong Kong traders interviewed generally sharing the view that the Chinese mainland’s e‑commerce market will have the greatest growth potential in the coming two years.

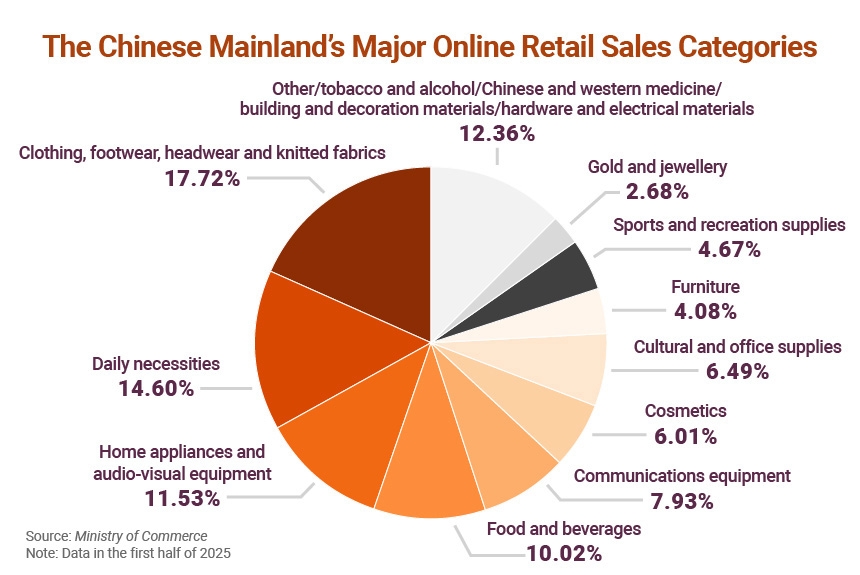

The boom in the Chinese mainland’s online retail market not only finds expression in the steady growth of total value but also in the diversity of product categories. According to figures published by the Ministry of Commerce, consumers were already accustomed to buying all sorts of consumer goods through online channels in the first half of 2025. Regarding the online retail value of physical goods, other goods (including Chinese and western medicine) (12.36%) enjoy considerable market share.

Compliance a vital requirement

The mainland government has introduced many laws and regulations for the e‑commerce industry to ensure its healthy development. In particular, the E-Commerce Law of the People’s Republic of China was enacted on 1 January 2019 to regulate e‑commerce activities and protect market order. Electronic and electrical appliance enterprises must pay attention to and comply with the requirements of relevant laws and regulations. These cover:

- Refunds and returns: Consumers enjoy “seven-day no-reason return” for goods purchased online under the Law of the PRC on the Protection of Consumer Rights and Interests.

- Handling of personal information: Measures for the Supervision of Online Transactions [2] stipulate that an online transaction business that collects or uses the personal information of consumers must adhere to the principles of lawfulness, legitimacy and necessity. The law also explicitly outlines the purposes, methods and scope of collection or use of information, and the need to obtain the consent of consumers.

- Marketing “Do’s and Don’ts”: The Code of Conduct for Online Presenters [3] clearly states that online presenters must guide users to interact civilly, express themselves rationally, and spend reasonably. They must also refrain from hyping hot social topics and sensitive issues, or intentionally creating “hot issues” in public opinion.

- Anti-Unfair Competition: The revised Anti-Unfair Competition Law of the PRC [4] stipulates that platform operators must not force or covertly force operators on a platform to sell goods at prices below cost in accordance with their pricing rules, thereby disrupting order in market competition.

(For further details of these laws and regulations, please read An Analysis of the Chinese Mainland’s E-Commerce Retail Market [Research Report])

Laws and regulations governing cross-border e-commerce retail imports

If Hong Kong companies choose to engage in importing products to the mainland market through cross‑border e‑commerce, they need to comply with a series of legal requirements. The central government also offers preferential measures for such imports. These measures include:

- Taxation: Tax incentives for cross-border e-commerce imports include a zero tariff allowance for goods on the list of retail imports, while import VAT and consumption tax are levied at 70% of the statutory payable amount.

- Product Specifications: Cross-border e-commerce imports enjoy simplified customs clearance treatment compared to general trade, meaning the goods are supervised as objects entering China for personal use and not governed by the requirements for initial import licensing, or the registration or record-filing of goods. However, goods imported via cross-border e-commerce retail channels can only be sold to consumers directly and cannot be resold.

- Product Scope: The Chinese mainland has a cross-border e-commerce retail import list and only goods whose tax ID is on the list can be imported into the mainland through cross-border e-commerce. Goods not on the list have to be imported through general trade. Hong Kong companies must ensure that their products meet the latest adjustments to product varieties to continue importing their goods for marketing through cross-border e-commerce channels.

- Purchase Limit: Under China's cross-border e-commerce retail import policy, a consumer can import goods valued at up to RMB5,000 per single transaction and a total of RMB26,000 annually.

(For further details of these laws and regulations, please read An Analysis of the Chinese Mainland’s E-Commerce Retail Market [Research Report])

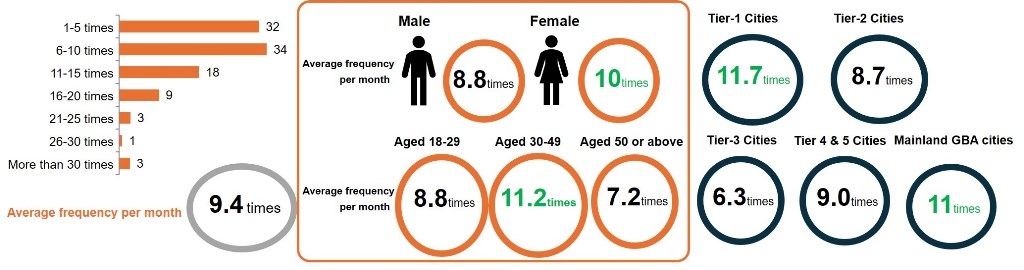

Mainland consumers are frequent online shoppers

HKTDC Research commissioned a market survey agency to conduct a questionnaire survey on mainland online shopping consumers in the second and third quarters of 2024. The survey findings show mainland consumers engaging in online shopping frequently. Overall, the respondents shopped online 9.4 times a month on average.

Classified by region, consumers’ online shopping frequency is significantly higher in tier‑one cities and mainland GBA cities with a higher level of economic development and a more complete logistics infrastructure. The monthly online shopping frequency in such cities is 11.7 times and 11 times respectively.

Efficient Logistics Services: Products delivered 3.2 days later on average

Currently, mainland online shopping consumers generally receive delivery of their products soon after placing orders. The survey shows that, on average, respondents receive their products within 3.2 days. Consumers in tier‑two and tier‑three cities receive their products soonest, waiting only 3.1 days on average, while male consumers receive their products faster than female consumers, averaging 3.0 days. Consumers aged 18‑29 and 30‑49 receive their products 3.1 days after placing their orders, longer than for consumers aged 50 and above.

Consumers frequently choose to buy Hong Kong medicines and health products online

Mainland consumers buy all kinds of products, including medicines and health products, through online platforms. The survey shows 26% of respondents choosing to buy pharmaceutical consumer goods online, and the percentage of consumers choosing to buy Hong Kong medicines and health products online is similar to the overall trend, with 25% of consumers having bought such products online.

Online shopping characteristics: medicines and health products

- Tier-one cities have the highest percentage of online shopping for medicines and health products

Classified by region, tier‑one cities have the highest percentage of consumers shopping online for medicines and health products (38%), followed by tier‑two cities (32%) and GBA cities (28%). The percentage is a mere 9% in tier‑three cities.

The trend of mainland consumers buying Hong Kong medicines and health products online is more or less the same in different regions. The percentage is highest in tier‑two cities (31%) and similar in tier‑one cities (30%), with GBA cities trailing closely behind (26%). It is worth pointing out that tier‑three and tiers four and five cities have a higher than overall percentage of consumers shopping online for Hong Kong medicines and health products specifically, at 18% and 15% respectively.

- Consumers aged 30-49 are frequent online shoppers for medicines and health products

Classified by age, consumers aged 30‑49 buy medicines and health products online most frequently (36%), followed by those aged 18‑29 (22%). The percentage is only 14% for those aged 50 and above.

Classified by age, Hong Kong medicines and health products are also most popular among consumers aged 30‑49 (31%), followed by those aged 18‑29 (23%) and consumers aged 50 and above (17%). The percentage of consumers aged 18‑29 and aged 50 and above buying Hong Kong products is higher than the overall percentage.

- Male consumers buy Hong Kong medicines and health products more frequently than female consumers

By gender, the frequency of online shopping for medicines and health products is the same for male consumers (26%) and female consumers (26%). For Hong Kong products, the trend is similar, with male consumers buying these more frequently (26%) than female consumers (24%).

Factors of consideration in online shopping for medicines and health products

- Primary Factors: Brand image, product safety, origin of product ingredients

When buying medicines and health products online, the main considerations for mainland consumers are brand image (37%) and safety (37%), followed by origin of product ingredients (34%) and product efficacy (34%).

When buying Hong Kong medicines and health products online, mainland consumers put product efficacy first (42%), followed by product safety (38%) and origin of product ingredients (36%).

- Considerations are not quite the same in different regions

The most important considerations for consumers in the GBA are brand image (41%) and price and sales promotions (40%), but they also care more about product efficacy (38%) than origin of ingredients (33%). For consumers in tier‑two cities, meanwhile, the most important consideration is product safety (47%), a percentage far higher than in other regions, followed by product efficacy (41%); however, these consumers care more about brand image (33%) than the origin of product ingredients (30%). The primary considerations of consumers in tiers four and five cities in online shopping for medicines and health products are brand image (34%), followed by origin of product ingredients (28%) and quality of customer service (28%).

Consumers in tier‑one cities care most about the origin of product ingredients (38%), followed by brand image (37%) and product safety (36%). Consumers in tier‑three cities care most about brand image (63%), followed by the origin of product ingredients (30%) and product efficacy (26%). Product safety (15%) is not among their top three important considerations.

When buying Hong Kong medicines and health products online, consumers in the GBA care most about product efficacy (48%) and product safety (43%), but they also put brand image (35%) before origin of product ingredients (33%). The preferences of consumers in tier‑two cities are roughly the same as the overall trend. They also care most about product efficacy (50%), followed by product safety (44%) and product ingredients origin (34%). Consumers in tiers four and five cities put price and sales promotions first (46%), followed by product safety (38%) and the origin of product ingredients (38%).

In shopping online for Hong Kong medicines and health products, consumers in tier‑one cities care most about product efficacy (40%), followed by the origin of product ingredients (38%) and product safety (35%). For consumers in tier‑three cities, brand image is the most important factor (60%), followed by the origin of product ingredients (33%), product safety (27%), product efficacy (27%) and quality of customer service (27%).

- Younger consumers value products safety and brand image

In terms of age, when buying medicines and health products online, the most important consideration for consumers aged 18‑29 is product safety (42%), followed by brand image (41%) and product efficacy (37%). When buying Hong Kong medicines and health products online, the most important considerations are product efficacy (45%), product safety (44%) and origin of ingredients (35%).

When consumers aged 30‑49 buy these products online, their most important considerations are brand image (39%) and product safety (39%), followed by product efficacy (37%). Their considerations are not quite the same for purchases of Hong Kong medicines and cosmetics: for these, they put product efficacy first (43%), followed by product safety (39%) and the origin of ingredients (39%).

The considerations of consumers aged 50 and above are obviously different. When buying medicines and health products online, they care most about the origin of product ingredients (32%), followed by brand image (26%) and product safety (25%). When buying Hong Kong medicines and health products, they care less about brand image and product safety but consider whether the products are natural/additives‑free/organic (32%) as most important. Next in importance are the origin of product ingredients (28%), product efficacy (28%) and customer service quality (28%).

- Male consumers put brand image first, while female consumers think more about safety

Classified by gender, male consumers put brand image first when buying medicines and health products online, while female consumers care more about product safety. For male consumers, the most important consideration is brand image (44%), followed by price and sales promotions (36%) and product efficacy (32%). When buying Hong Kong medicines and health products online, male consumers put product efficacy first (41%), followed by brand image (39%) and price and sales promotions (38%).

Female consumers consider product safety as most important (42%), followed by the origin of product ingredients (39%) and product efficacy (36%). When buying Hong Kong medicines and health products online, their considerations are slightly different. Their first consideration is the origin of ingredients (46%), but they care more about product efficacy (43%) than product safety (40%).

Order values higher for Hong Kong medicines and health products

- Order amount exceeds RMB1,400 on average

Respondents spend as much as RMB1,481 per order on average when shopping online for medicines and health products. For Hong Kong medicines and health products, the average order amount is RMB1,723, higher than the overall figure.

- Average spending is highest among respondents in tier-three cities

In online shopping for medicines and health products, by region average spending is highest among respondents in tier‑three cities (RMB1,906), followed by consumers in tier‑one cities (RMB1,515) and GBA cities (RMB1,419).

- Average spending on Hong Kong medicines and health products is higher among respondents in many regions

Respondents generally spend more on average when shopping online for Hong Kong medicines and health products. Spending in tier‑three cities (RMB2,447) is highest, followed by tier‑one cities (RMB1,751) and tier‑two cities (RMB1,713).

Official brand channels and reviews are important

- When making online shopping decisions, brand official information channels and product reviews are the most important channels for consumers to obtain product information

Overall, consumers mainly obtain product information from brand official information channels (31%) and product reviews (31%) and from recommendations from friends/family members/relatives (30%) when buying medicines and health products online.

In online shopping for Hong Kong medicines and health products, the channels through which consumers obtain information are partially the same as for other medicines and health products, that is to say, consumers mainly obtain product information from product reviews (34%), brand official information channels (33%) and recommendations from friends/family members/relatives (27%).

- Consumers in many regions consider brand official information channels and product reviews as most important, while consumers in tiers four and five cities value recommendations from friends/family members/relatives

Classified by region, consumers in tier‑one cities consider brand official information channels (31%) and product reviews (31%) as most important, followed by recommendations from friends/family members/relatives (30%). In online shopping for Hong Kong medicines and health products, the considerations of consumers in tier‑one cities are consistent with the overall trend – that is, they put brand official information channels (32%) and product reviews (32%) first, but listen more to recommendations by experts (27%) than to what their friends/family members/relatives recommend.

Consumers in tier‑three cities also consider brand official information channels as most important (48%), followed by product reviews (33%), experts’ recommendations (30%) and buyers’ feedback/positive and negative appraisals (30%). When buying Hong Kong medicines and health products online, consumers in tier‑three cities attach equal importance to several different channels, including brand official information channels (40%), product reviews (40%), and buyers’ feedback/positive and negative appraisals (40%).

Consumers in tier‑two cities consider product reviews as most important (32%), followed by brand official information channels (30%) and recommendations from friends/family members/relatives (30%). When buying Hong Kong medicines and health products online, the preferences of consumers in tier‑two cities are roughly the same as the overall inclinations: they put product reviews first (37%), followed by brand official information channels (31%), and recommendations from friends/family members/relatives (27%).

In shopping online for medicines and health products, consumers in GBA cities also put product reviews first (33%), followed by experts’ recommendations (31%) and brand official information channels (30%). When buying Hong Kong medicines and health products online, consumers in GBA cities consider brand official information channels (33%) and product reviews (33%) as most important, followed by buyers’ feedback/positive and negative appraisals (30%).

Consumers in tiers four and five cities value recommendations from friends/family members/relatives most (34%), followed by experts’ recommendations (31%) and product reviews (28%). When buying Hong Kong medicines and health products online, consumers in tiers four and five cities consider brand official information channels (39%) and recommendations of friends/family members/relatives (39%) as most important, followed by product reviews (31%).

- Younger consumers consider product reviews as most important

Classified by age, consumers aged 18‑29 consider brand official information channels as most important (38%), followed by recommendations from friends/family members/relatives (32%) and product reviews (31%). In online shopping for Hong Kong medicines and health products, the channels through which consumers aged 18‑29 obtain information are basically consistent with the overall trend, with brand official information channels considered as most important (38%), more than product reviews (33%).

Consumers aged 30‑49 consider product reviews as most important (34%), followed by brand official information channels (30%) and recommendations from relatives and friends (28%). When buying Hong Kong medicines and health products online, consumers aged 30‑49 mainly obtain information from product reviews (38%), followed by brand official information channels (32%) and buyers’ authentic feedback/positive and negative comments (32%).

Consumers aged 50 and above consider recommendations from friends and family members as most important (32%), followed by recommendations by experts (27%) and brand official information channels (25%). When buying Hong Kong medicines and health products online, the considerations of consumers aged 50 and above are basically the same. They consider recommendations from friends and family members as most important (40%), followed by recommendations by experts (28%) and brand official information channels (24%) and product reviews (24%).

- Female consumers consider product reviews as most important, while male consumers attach greater importance to brand official information channels

Classified by gender, male consumers consider brand official information channels as most important (35%), followed by recommendations from friends/family members/relatives (32%) and product reviews (30%). When buying Hong Kong medicines and health products online, the considerations of male consumers are more or less the same. They consider brand official information channels as most important (41%) but put product reviews (35%) before recommendations from relatives and friends (27%).

Female consumers consider product reviews as most important (32%), followed by recommendations by experts (29%), brand official information channels (28%) and recommendations from relatives and friends (28%). When buying Hong Kong medicines and health products online, female consumers also consider product reviews as most important (33%), followed by recommendations by experts (31%), recommendations from relatives and friends (28%) and buyers’ authentic feedback/positive and negative comments (28%).

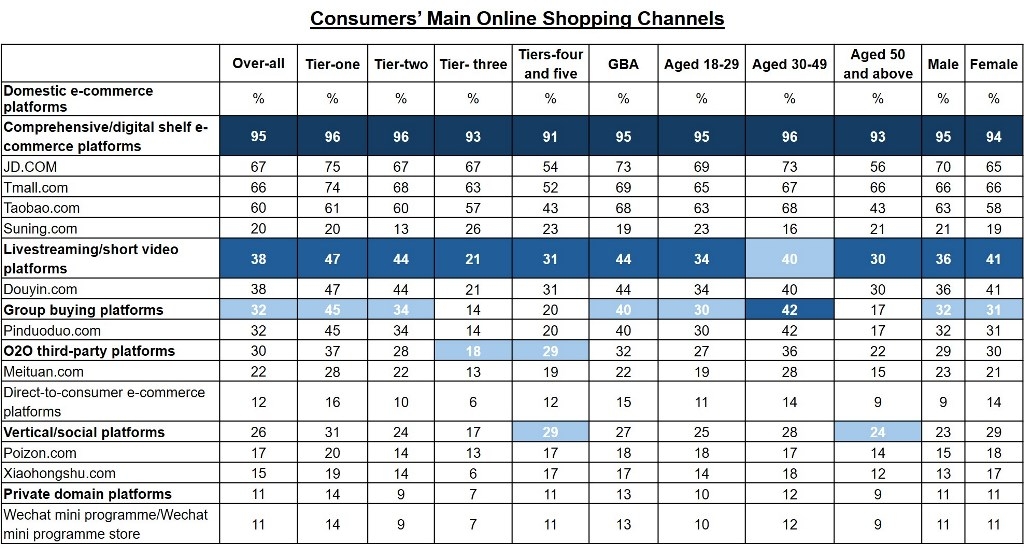

Comprehensive e-Commerce platforms are the main shopping channels

Mainland consumers mainly do their online shopping on traditional comprehensive platforms. Over 90% of respondents (accounting for 95% of the total number) have used comprehensive/digital shelf e‑commerce platforms for online shopping, a percentage far higher than other platforms, such as live‑streaming/short video platforms (38%) and group buying platforms (32%).

Classified by region, over 90% of consumers in different regions mainly do online shopping through comprehensive/digital shelf e‑commerce platforms, with live‑streaming/short video platforms as a distant second choice. Similarly, consumers of different age groups use digital shelf platforms as their main online shopping platforms (averaging over 90%). Classified by gender, the main online shopping platforms for male and female consumers are the same, with comprehensive/digital shelf platforms, livestreaming/short video platforms and group buying platforms being the favoured options.

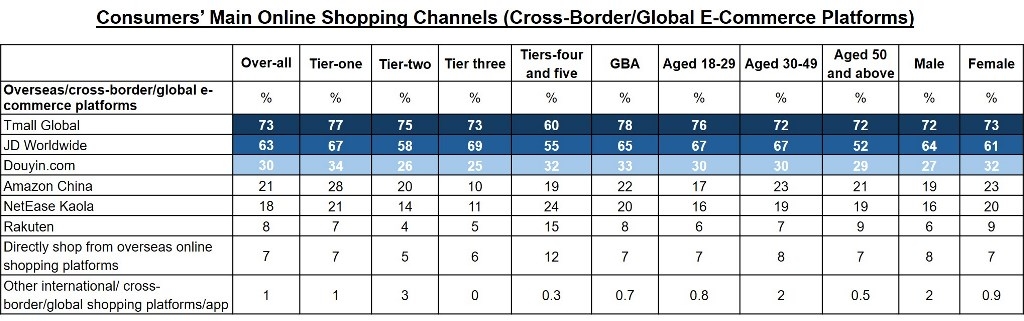

That said, consumers generally prefer using Tmall Global or JD Worldwide when shopping online for cross‑border or imported products, with 73% and 63% of respondents saying they use these two platforms when shopping for overseas/cross‑border/global products. Classified by region, the preferences of mainland consumers for different platforms are also quite consistent, with consumers in all regions mainly choosing Tmall Global for online shopping. Moreover the preferences of consumers of all ages and both sexes also coincide: they mainly choose the Tmall Global platform.

Related articles:

[1] For more details, please see Unleashing the Lucrative Potential of Cross-Border E-Commerce for Hong Kong Traders (Company Survey and Expert Opinion).

[2] For more details, please see Measures for Supervision of Online Transactions Take Effect in May.

[3] For more details, please see China Announces Code of Conduct for Online Presenters.

[4] For more details, please see Revised Anti-Unfair Competition Law to Take Effect on 15 October.

Original article published in https://hkmb.hktdc.com