Chinese Mainland E-Commerce Retail Market: Market Positioning of Hong Kong Luxury Items

(Consumer Survey Results)

Key findings

- The Chinese mainland has a huge e-commerce retail market and the government has adopted numerous measures to facilitate cross-border e-commerce imports. Many luxury items enjoy import tax incentives and customs clearance facilitation through cross-border e-commerce channels. This provides many kinds of market development opportunities for e-commerce businesses.

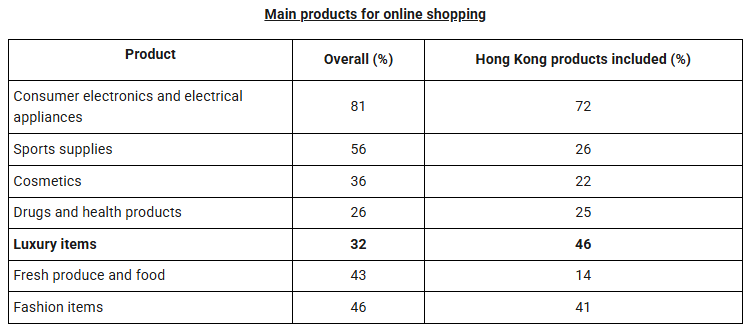

- Luxury items are the sixth most popular category of products in online shopping, with 32% of respondents reporting buying such items online, of which 46% had bought Hong Kong luxury items. Consumers aged 18-29 are the most frequent online shoppers of these products. Females shop online for luxury items more frequently than males.

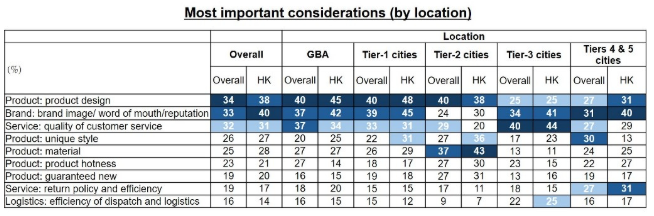

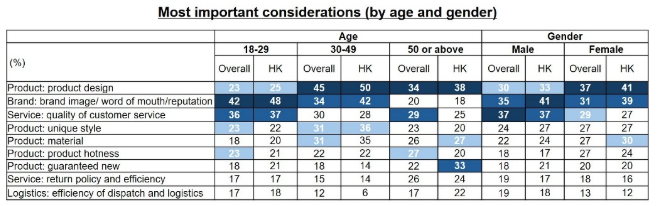

- Consumers’ first consideration is product design when buying luxury items online (34%). For those who have bought Hong Kong luxury items online, the first consideration is brand image and word of mouth (40%). The considerations of consumers of different age groups vary. Males put customer service quality first, while females set greater store by product design. Factors of consideration in different locations are quite similar.

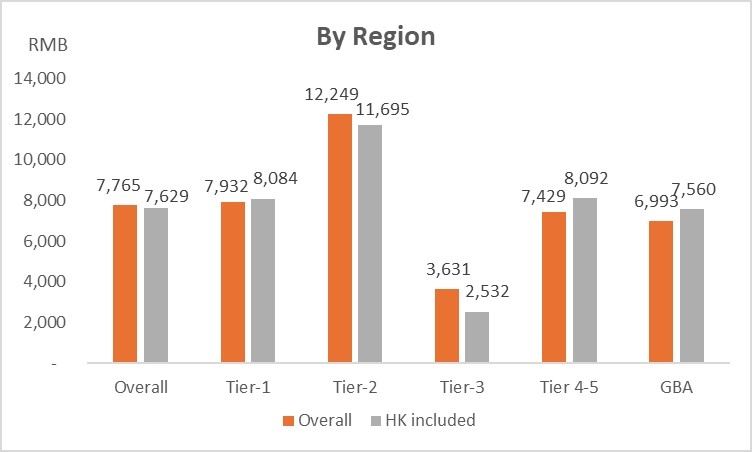

- In online shopping for luxury items, the highest average order value is reported in tier-two cities (RMB12,249), followed by tier-one cities (RMB7,932). In buying Hong Kong luxury items, respondents reported even higher average spending in tier-one (RMB8,084), tiers four and five cities (RMB8,092), and mainland GBA cities (RMB7,560).

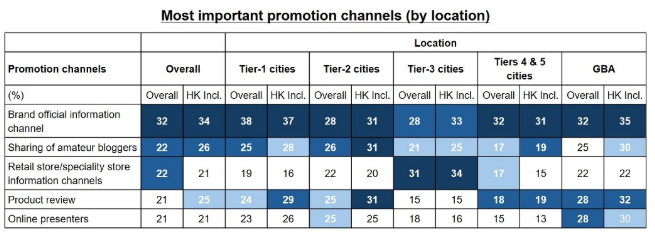

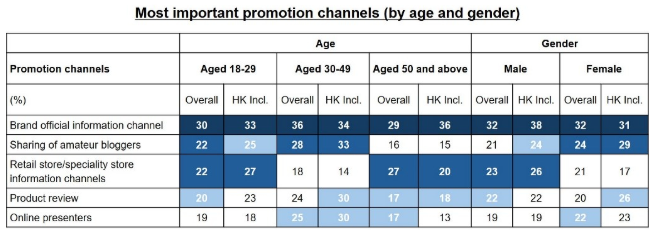

- When buying luxury items online, consumers mainly obtain product information through official brand information channels, amateur bloggers and retail store information channels. Consumers in many locations value official brand information most, but tier-three city consumers value retail store information channels. All young consumers consider official brand information channels most important. Both female and male consumers consider official brand information most important.

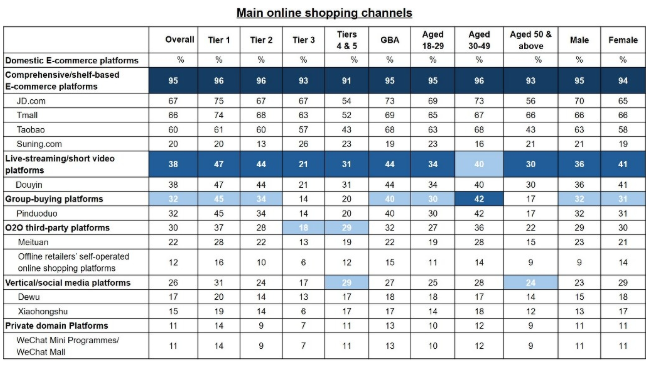

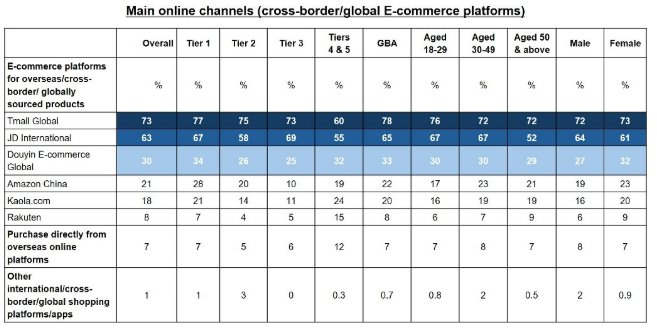

- Mainland consumers use comprehensive/digital shelf e-commerce platforms as their main shopping channel, with over 90% of respondents (accounting for 95% of the total) using them. They generally prefer shopping from Tmall Global or JD Worldwide when shopping for cross-border or imported products online, with 73% and 63% of respondents using them.

In 2024, HKTDC Research commissioned a market survey agency to conduct a questionnaire survey of 2,200 middle-income class or above consumers from different mainland cities. The aim was to understand their online consumption habits and their preferences regarding Hong Kong products. For details, please refer to Hong Kong Businesses Navigating Chinese Mainland E-commerce Retail Market—Consumer Survey Results. |

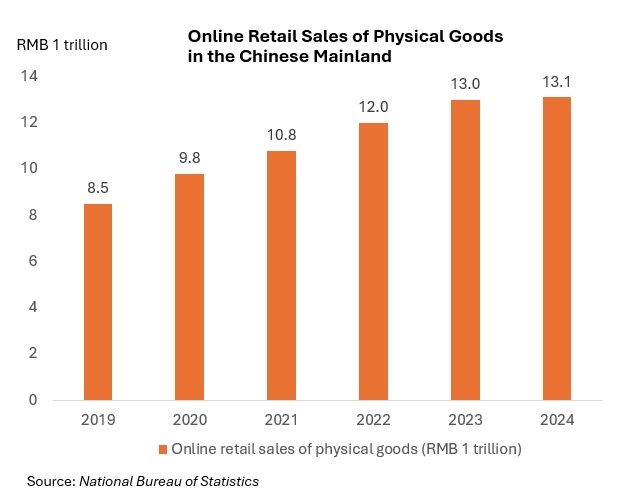

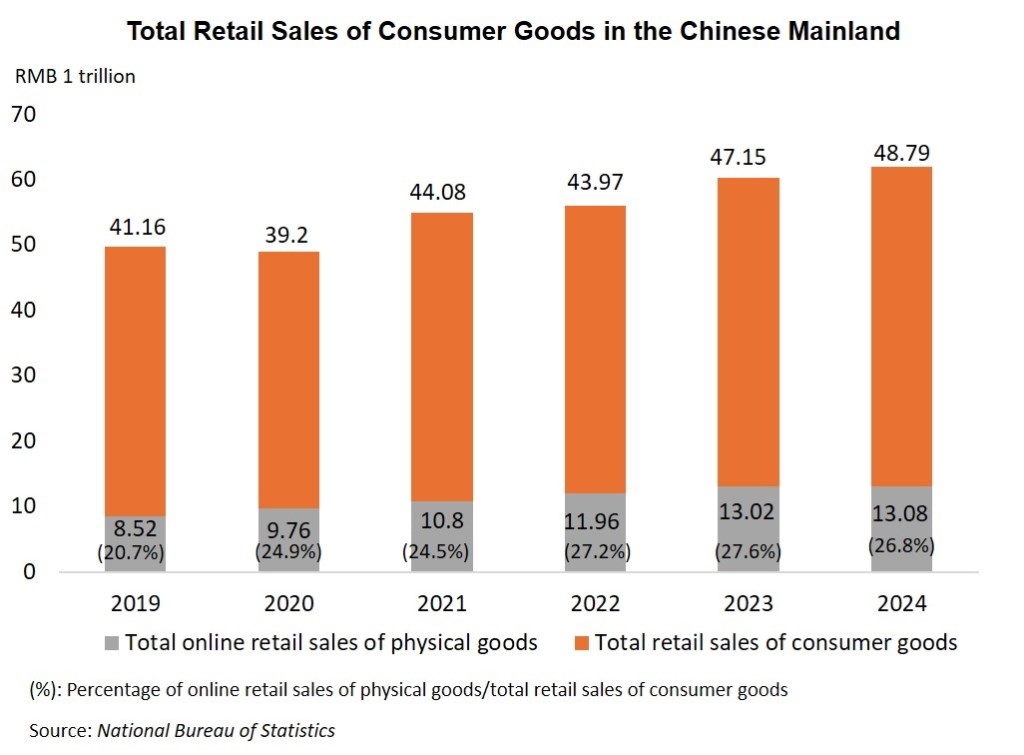

Mainland leads global market

The Chinese mainland leads the world with its vast e‑commerce retail market. Figures from the National Bureau of Statistics show China’s online retail sales of physical goods growing by approximately 54.1% from RMB8.5 trillion in 2019 to RMB13.1 trillion in 2024. This represents 26.8% of total retail sales of consumer goods and is an important factor for sustained growth in the local consumer market. In a joint report by the HKTDC and the Hong Kong Export Credit Insurance Corporation at the end of last year [1], Hong Kong traders believed the Chinese mainland’s e‑commerce market will have the greatest growth potential in the coming two years.

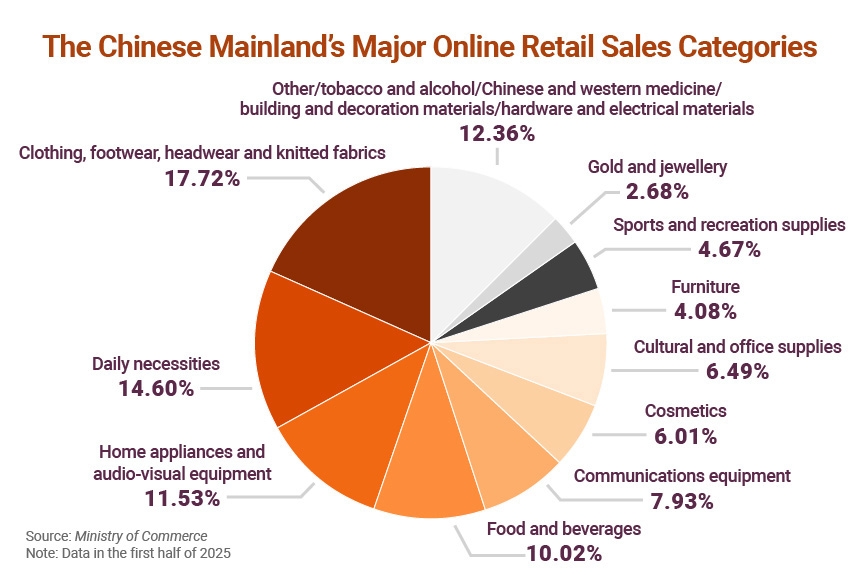

The mainland online market boom is not only in the steady growth of total value but also in the diversity of product categories. According to the Ministry of Commerce, consumers had been getting used to buying all sorts of consumer goods through online channels by the first half of 2025. In the online retail value of physical goods, gold and jewelry (2.68%) account for a considerable market share.

Attention to laws and regulations

The mainland government has introduced many laws and regulations for the e‑commerce industry to ensure its healthy development. In particular, the E-Commerce Law of the People’s Republic of China was enacted on 1 January 2019 to regulate e‑commerce activities and protect market order. Enterprises must comply with these laws and regulations, including:

- Refunds and returns: Consumers enjoy “seven-day no-reason return” for goods purchased online under the Law of the PRC on the Protection of Consumer Rights and Interests.

- Handling of personal information: The Measures for the Supervision of Online Transactions [2] stipulate that an online business that collects or uses the personal information of consumers must adhere to the principles of lawfulness, legitimacy and necessity. The law also explicitly states the permitted purposes, methods and scope of collection or use of information, and the need to obtain the consent of consumers.

- Marketing do’s and don’ts: The Code of Conduct for Online Presenters [3] clearly states that online presenters shall guide users to interact civilly, express themselves rationally and spend reasonably. They must also refrain from hyping hot social topics and sensitive issues, or intentionally creating “hot issues” in public opinion.

- Anti-unfair competition: The revised Anti-Unfair Competition Law of the PRC [4] stipulates that platform operators shall not force or covertly force retailers on a platform to sell goods at prices below cost in accordance with their pricing rules, thereby disrupting market competition.

(For further details, please read An Analysis of the Chinese Mainland’s E‑Commerce Retail Market[Research Report])

Cross-border e-commerce imports

If Hong Kong companies choose to import products through cross‑border e‑commerce, they need to comply with a series of legal requirements. The mainland government also offers preferential measures to the cross‑border e‑commerce imports concerned. These measures include:

- Taxation: Tax incentives for cross-border e-commerce imports include a zero tariff allowance for goods on the list of retail imports, and import VAT and consumption tax are levied at 70% of the statutory payable amount.

- Product specifications: Cross-border e-commerce imports enjoy simplified customs clearance treatment compared with general trade. That is, the goods shall be supervised as entering China for personal use and not be governed by the requirements for initial import licensing, registration or record-filing of goods. However, goods imported via cross-border e-commerce retail channels can only be sold to consumers directly and cannot be resold.

- Product scope: The Chinese mainland has a cross-border e-commerce retail import list and only goods whose tariff codes are on the list can be imported into the mainland through cross-border e-commerce. Goods not on the list have to be imported through general trade. Hong Kong companies must ensure that their products meet the latest adjustments to product varieties to continue importing their goods for marketing through cross-border e-commerce channels.

- Purchase limit: A consumer can import goods valued at up to RMB5,000 per single transaction and a total of RMB26,000 annually.

(For further details, please read An Analysis of the Chinese Mainland’s E‑Commerce Retail Market [Research Report])

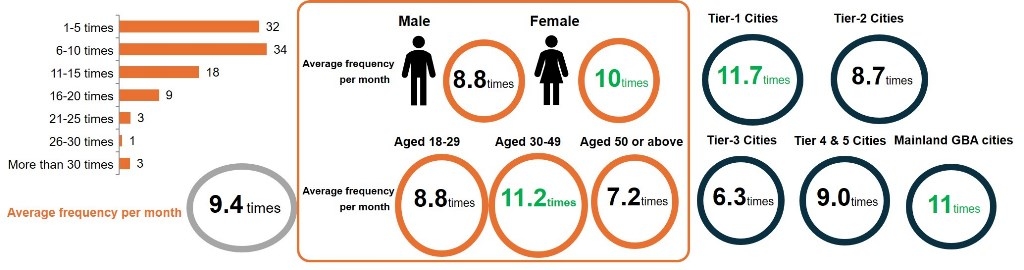

Mainland consumers shop frequently

HKTDC Research commissioned a market survey agency to conduct a questionnaire survey of mainland online consumers in the second and third quarters of 2024. The findings show mainland consumers shopping online frequently. Respondents shopped online 9.4 times a month on average.

By location, consumers’ online frequency is significantly higher in tier‑one cities and mainland GBA cities, with their higher level of economic development and more complete logistics infrastructure. Their monthly online shopping frequency is 11.7 times and 11 times respectively.

Efficient logistics services

Mainland online consumers generally receive their products soon after placing orders. The survey shows that, on average, respondents receive their products within 3.2 days after order. Consumers in tier‑two and tier‑three cities receive their products soonest, waiting only 3.1 days on average. Male consumers receive their products faster than female consumers, averaging 3 days. Consumers aged 18‑29 and 30‑49 receive their products 3.1 days after placing their order, longer than consumers aged 50 and above.

Luxury items popular

Mainland consumers purchase all kinds of products from online platforms, with luxury items ranking sixth in popularity among product categories. For online shoppers of Hong Kong products, luxury items rank second in popularity. The survey shows that as many as 32% of respondents have bought luxury items online in the past year, with 46% of those saying they have bought Hong Kong luxury items online.

Characteristics of luxury items

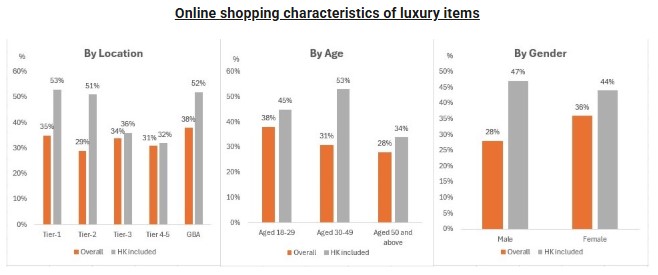

- The GBA has the highest percentage of online shopping of luxury items

By location, the GBA has the highest percentage of online consumers of luxury items (38%), followed by tier‑one cities (35%). The percentage of tier‑three cities is on a par with tier‑one cities (34%), while the percentage of tier‑two cities is only 29%.

The trend of mainland consumers buying Hong Kong luxury items also varies according to location. The percentage of consumers shopping for Hong Kong luxury items online is highest in tier‑one cities (53%), with the percentage similar in GBA cities (52%), followed closely by tier‑two cities (51%). The percentage in tiers four and five cities is only 32%.

- Consumers aged 18-29 are the most frequent online shoppers of luxury items

By age, consumers aged 18‑29 buy luxury items online most frequently (38%), followed by those aged 30‑49 (31%). The percentage is only 28% for those aged 50 and above.

Hong Kong luxury items are most popular among those aged 30‑49 (53%), followed by those aged 18‑29 (45%), and those aged 50 and above (34%), which is still higher than the overall percentage of 28%.

- Females buy luxury items more frequently than males

By gender, female consumers (36%) buy luxury items online more frequently than male consumers (28%). But for Hong Kong luxury items, the percentage for males (47%) is slightly higher than that for females (44%).

Factors of consideration

- Primary factors: product design, brand image and customer service

When buying luxury items online, the main considerations of mainland consumers are product design (34%), brand image and word of mouth (33%), and customer service (32%).

When buying Hong Kong luxury items online, mainland consumers pay top attention to brand image and word of mouth (40%), followed by product design (38%) and customer service quality (31%).

- Considerations vary by location

In terms of location, the most important factors for consumers in the GBA are product design (40%), followed by brand image and word of mouth (37%), and customer service (37%). For consumers in tier‑one cities, the most important consideration is also product design (40%), followed by brand image and word of mouth (39%), and then customer service (33%). Consumers in tier‑two cities also consider product design most important (40%), followed by material (37%) and then customer service (29%). Although most regions attach much importance to brand image and word of mouth, the percentage in tier‑two cities is lower (24%).

Tier‑three city consumers consider customer service most important (40%), followed by brand image and word of mouth (34%), and then product design (25%). For consumers in tiers four and five cities, the most important consideration is brand image and word of mouth (31%), followed by unique style (30%), and then product design (27%), customer service (27%) and return policy and efficiency (27%).

When buying Hong Kong luxury items, the most important considerations in the GBA are product design (45%), followed by brand image and word of mouth (42%), and customer service quality (34%). Tier‑one city consumers also consider product design as most important (48%), followed by brand image and word of mouth (45%), and then customer service (31%) and unique style (31%).

When buying Hong Kong luxury items online, consumers in tier‑two cities give top consideration to material (43%), followed by product design (38%) and unique style (36%). Tier‑three city consumers give top consideration to customer service (44%), followed by brand image and word of mouth (41%), product design (25%), and logistic (25%). Consumers in tiers four and five cities consider brand image and word of mouth most important (40%), followed by product design (31%) and return policy and efficiency (31%).

- Considerations of younger consumers are similar

In terms of age, when buying luxury items online, whether these are products of Hong Kong, the Chinese mainland or elsewhere, the most important consideration of consumers aged 18‑29 is brand image and word of mouth (42%), followed by customer service (36%) and then product design (23%), unique design (23%) and product “hotness” (23%).

When consumers aged 30‑49 buy these products online, their most important consideration is product design (45%), followed by brand image and word of mouth (34%), and then unique style (31%) and material (31%). Their considerations are roughly the same in their online shopping of Hong Kong luxury items, with product design (50%) as most important, followed by brand image (42%) and then unique style (36%).

There are obvious differences in the considerations of consumers aged 50 and above. When buying luxury items online, they consider product design (34%) most important, followed by customer service (29%) and product hotness (27%). They pay less attention to brand image and word of mouth (20%). When buying Hong Kong luxury items, they also consider product design (38%) most important, followed by guaranteed new products (33%) and material (27%).

- Male consumers first consider customer service but female consumers prioritise product design

By gender, male consumers will first consider customer service when buying luxury items online while female consumers care more about product design. For male consumers, the most important consideration is customer service quality (37%), followed by brand image and word of mouth (35%) and then product design (30%). Their considerations are more or less the same when buying Hong Kong luxury items online, but their top consideration is brand image and word of mouth (41%), followed by customer service (37%) and then product design (33%).

Female consumers consider product design as most important (37%), followed by brand image and word of mouth (31%), and then customer service (29%). When buying Hong Kong luxury items, they also consider product design (41%) most important, followed by product image (39%). But they care more about material (30%) than customer service (27%).

Spending on Hong Kong luxury Items

- Average order exceeds RMB7,700

Respondents spend an average of RMB7,765 per order when buying luxury items online. When Hong Kong products are included in these purchases, the average order amount is similar at RMB7,629.

- Average spending is highest in tier-two cities

By location, average spending is highest among respondents in tier‑two cities (RMB12,294), followed by tier‑one cities (RMB7,932) and tiers four and five cities (RMB7,429).

- Spending higher for Hong Kong luxury items

When Hong Kong products are included in the online shopping of luxury items, the average spending of respondents is higher in tier‑one cities (RMB8,084), tiers four and five cities (RMB8,092) and the GBA (RMB7,560).

Channels for promotion

- Official brand information is most important

Overall, consumers mainly obtain product information from official brand information channels for online shopping of luxury items (32%). They may also refer to amateur bloggers (22%) and retail store information channels (22%).

When Hong Kong products are included, the channels are basically the same. Consumers mainly use official brand information channels (34%) and refer to amateur bloggers (26%). Hong Kong consumers pay more attention to product review (25%) than to retail store information channels (21%).

- Consumers in many locations consider official brand information as most important while consumers in tier-three cities value retail store and speciality store information channels

Classified by location, consumers in tier‑one cities consider official brand information channels (38%) as most important, followed by amateur bloggers (25%) and then product review (24%). When Hong Kong products are included, consumers in tier‑one cities consider official brand information channels as most important (37%), putting this before product review (29%) and amateur bloggers (28%).

Consumers in tier‑two cities also consider official brand information channels as most important (28%), followed by amateur bloggers (26%), then product review (25%) and online presenters (25%). When Hong Kong products are included, consumers in tier‑two cities consider several channels as most important, including official brand information channels (31%), amateur bloggers (31%) and product review (31%). Consumers in tiers four and five cities have similar considerations as consumers in tier‑one and tier‑two cities. To them, the most important consideration is official brand information channels (32%), followed by product review (18%) and then amateur bloggers (17%) and retail store information channels (17%). When Hong Kong products are included, consumers in tiers four and five cities put official brand information channels first (31%), followed by amateur bloggers (19%) and product review (19%).

Consumers in GBA cities also consider official brand information channels most important (32%), followed by product review (28%) and online presenters (28%). When Hong Kong products are included, consumers in GBA cities have similar considerations. They also consider official brand information channels as most important (35%), followed by product review (32%) and then amateur bloggers (30%) and online presenters (30%).

The considerations of consumers in tier‑three cities are different from other locations. They consider retail store information channels as most important (31%), followed by official brand information channels (28%) and then amateur bloggers (21%). When Hong Kong products are included, consumers in tier‑three cities also consider retail store information channels as most important (34%), followed by official brand information (33%) and then amateur bloggers (25%).

- Younger consumers prioritise official brand information channels

Classified by age, consumers aged 18‑29 consider official brand information channels as most important (30%), followed by amateur bloggers (22%) and retail store information channels (22%), and then product review (20%). When Hong Kong products are included, the channels through which consumers aged 18‑29 obtain information are basically consistent with the overall considerations, with official brand information channels (33%) as the primary consideration, followed by retail store information channels (27%) rather than amateur bloggers (25%).

Consumers aged 30‑49 also consider official brand information channels as most important (36%), followed by amateur bloggers (28%) and then online presenters (25%). When Hong Kong products are included, consumers aged 30‑49 mainly obtain information from official brand channels (34%), followed by amateur bloggers (33%) and then product review (30%) and online presenters (30%).

Consumers aged 50 and above also consider official brand information channels as most important (29%), followed by retail store information channels (27%) and then product review (17%) and online presenters (17%). When Hong Kong products are included, the main considerations of consumers aged 50 and above are basically the same. Their main consideration is official brand information (36%), followed by retail store information channels (20%) and then product review (18%).

- Both female and male consumers prioritise official brand information

In terms of gender, male consumers’ main consideration is official brand information (32%), followed by retail store information channels (23%) and then product review (22%). When Hong Kong products are included, the considerations of male consumers are roughly the same, with official brand information the most important (38%), followed by retail store information channels (26%). But they value amateur bloggers (24%) more than product review (22%).

Female consumers also consider official brand information channels as most important (32%), followed by amateur bloggers (24%) and then online presenters (22%). When Hong Kong products are included, female consumers also consider official brand information channels as most important (31%), followed by amateur bloggers (29%) and then product review (26%).

General E-commerce platforms are main channel

Mainland consumers mainly conduct online shopping on traditional comprehensive platforms. Over 90% of respondents (accounting for 95% of the total number) have used comprehensive/digital shelf e‑commerce platforms for online shopping, a percentage far higher than other platforms, such as live‑streaming/short video platforms (38%) and group buying platforms (32%).

This pattern is consistent across locations. Similarly, consumers of different age groups use digital shelf platforms as their main online shopping platforms (averaging over 90%). Classified by gender, the main online shopping platforms used by male and female consumers are the same, with comprehensive/digital shelf platforms, live‑streaming/short video platforms and group buying platforms respectively as their favourite choices.

On the other hand, when shopping cross‑border or for import products online, consumers generally prefer using Tmall Global or JD Worldwide, with 73% and 63% of respondents saying they use these two platforms for online shopping of overseas/cross‑border/global products. Classified by location, the preference of mainland consumers for different platforms is also quite consistent, with consumers mainly choosing Tmall Global. In terms of age and gender, the preferences of consumers of all ages and both sexes all coincide. They mainly choose the Tmall Global platform.

For sample details, please refer to Hong Kong Businesses Navigating Chinese Mainland E-commerce Retail Market - Consumer Survey Results

Related articles:

[1] Please refer to Unleashing the Lucrative Potential of Cross-border E-Commerce for Hong Kong Traders (Company Survey and Expert Opinion)

[2] For details, please refer to Measures for Supervision of Online Transactions Take Effect in May

[3] For details, please refer to China Announces Code of Conduct for Online Presenters

[4] For details, please refer to Revised Anti-Unfair Competition Law to Take Effect on 15 October

Original article published in https://hkmb.hktdc.com