The Addis Ababa-Djibouti Railway is the latest beneficiary of China's African investment programme, with the BRI set to ensure that the number of such projects is set to increase, but are China and Africa's agendas truly compatible?

Djibouti is among the tiniest of all of the African nations, while Ethiopia has long been considered the economic powerhouse of the Horn region of East Africa. Both, however, are clear beneficiaries of the Belt and Road Initiative (BRI), China's massive international infrastructure and trade development programme.

While Djibouti may be diminutive, its port packs a punch, occupying, as it does, a strategic position straddling the entrance to the Red Sea. The country also has a substantial military presence, including the largest American military base in Africa. By contrast, Ethiopia, a nation with the second-largest population on the continent, is a true regional economic bright spot.

These two countries, although markedly different, have now been linked by the Addis Ababa-Djibouti Railway, a project largely realised through Chinese engineering and investment. Officially opened in October 2016, Africa's first cross-border electric railway was built by the China Railway Group and the China Civil Engineering Construction Corporation, while most of the US$4 billion financing came from the Exim Bank of China.

The new 750km railway provides a much improved import-export corridor for landlocked Ethiopia. Most significantly, it slashes the seven-day road-freight journey from Addis Ababa to the port of Djibouti to just 10 hours. The outcome of a strategic partnership between China and Africa, the rail link is viewed as an integral part of the BRI.

More recently, in June this year, another China-funded/managed project, the Mombasa-Nairobi Line, went into operation. The 485km line is actually phase I of a much bigger project – a $14 billion standard-gauge railway network that will eventually extend from Kenya on to Uganda then to Rwanda.

Once completed, it is hoped that this network will open up many of the landlocked East African markets to Chinese manufactured goods via the port of Mombasa. It is also anticipated that it will improve the supply chain for African mineral commodity exports, resources that China increasingly relies upon.

The two rail projects are just the latest in a long line of engineering initiatives that have seen China establish a substantial presence in Africa. Back in the 1970s, China built the Tazara Railway, which connected landlocked Zambia and its copperbelt with the Tanzanian port of Dar es Salaam. At the time, this was China's largest aid project in Africa.

More recently, China's commitment to major infrastructure projects across Africa has formed a key element of its BRI agenda. It is also clear that China is keen to play a major role in Africa's economic development, a policy that will only enhance its commercial presence on the continent.

Acknowledging this, during the 2015 Forum on China-Africa Cooperation Xi Jinping, China's President, committed to a generous US$60 billion package of development assistance for Africa. Much of this was earmarked for investment in several major infrastructure projects, including the new Ethiopia-Djibouti Railway and a series of port upgrades along the East African coast.

Assessing China's game plan, David Monyae, a political analyst at Johannesburg University's Confucius Institute, said: "China has enhanced its role on the continent with a no-strings-attached approach to investment and commercial engagement. This has created the impression that Beijing is ready and willing to support Africa's development efforts."

Other analysts, however, have been more cynical, asserting that the BRI is a means for China to create not only a global trading bloc, but also to establish a "zone of influence". One such commentator, Peter Fabricius, a consultant for South Africa's Institute for Security Studies, said: "Xi may be taking advantage of a fortuitous opportunity to extend China's economic and political influence as a world leader. This could see it capitalising on a moment of American global capitulation under Donald Trump, the notoriously isolationist US President."

Fabricius is not alone in seeing a clear indication that a new international economic order may be emerging. As a sign of this, China recently established a military base in Djibouti, alongside those already leased to several other countries, including the US and France.

Others, however, refute that the BRI projects underway across the continent form part of a clandestine power grab. Instead, they maintain that China's investments in East Africa are purely part of a wider trade network, one intended to improve access to Africa's one-billion strong consumer market. As such, it is thought, they should be seen as a development drive that is looking to nurture joint progress through enhanced trading pathways.

Whether the two – geopolitical assertiveness and an increased global trading network – can be genuinely separated out is something of contentious issue. Either way, as one writer – Peter Bruce, one of South Africa's leading business journalists – said: "Chinese influence in Africa is immense, visible and spreading fast."

For many, the key question is whether what works for China will also work for Africa. The African Union, a body that represents all 55 countries across the continent, is optimistic that it will. It has long made it clear that it is keen for China to partner with many of Africa's infrastructure and technology programmes.

Perhaps going some way to explain the Union's enthusiasm, Greg Mills, a South African economist, said: "Chinese contractors and businesses are willing to go to places and work in conditions that few in the West would contemplate."

Made in ChinAfrica

It's not just infrastructure deals, however, that are attracting Chinese investors to Africa. According to the World Bank, an estimated 86 million low-skilled manufacturing jobs are set to be outsourced from China, a consequence of the rising cost pressures caused by higher wage expectations. Ultimately, it is expected that Africa will be the primary beneficiary of this shift in labour demand.

Assessing this likely change, Mills said: "Low-tech, high-labour manufacturing cannot be done virtually and, as China moves up the development scale, Africa can realistically hope to meet this demand."

One sector where such a process is underway is the textile industry, with China having relocated some production facilities to Africa. In particular, China has invested heavily in several large manufacturing projects in Ethiopia, with the East African country set to become the continent's garment manufacturing hub.

Ethiopia is already one of Africa's fastest-growing economies, with the country having pursued a policy of deliberately keeping labour costs low in order to create a competitive advantage. One industrial park, near Addis Ababa, the nation's capital, now houses some 80 Chinese textile firms, all attracted by low or zero tariffs and cheaper labour – comparative industry wages are 15 times lower in Ethiopia than in China. The Huajian Group, a Zhejiang-based footwear manufacturer, has also invested heavily in a large plant in the park, which currently has more than 3,000 employees.

Overall, improved transport infrastructure – much of it funded by China – has led to manufacturing efficiency improving across Africa. Once landlocked Ethiopia, for example, now has direct access to a port following the opening of the Addis-Djibouti Line.

It should be no surprise then that several other African countries, notably Morocco, South Africa, Cameroon and Togo, are now said to be angling for Beijing's attention. Given that Chinese companies have already created some 600,000 jobs across Africa, it is pretty much inevitable that every country on the continent would look to capitalise on the possible spoils of the BRI.

For its part, China clearly believes that outsourcing some of its manufacturing requirements will help make certain African countries more self-sufficient. The naysayers argue, however, that China is taking advantage of cheap labour, demonstrating that it's indifferent to the repressive regimes and poor governance that characterise many of its partner countries across Africa.

Despite these concerns, it's indisputable that Africa needs to create a larger manufacturing sector if its economies are to achieve sustainable growth in a global environment where falling commodity revenues seem a long-term reality. It is also clear that China is looking to capitalise on this need.

Ultimately, as with all other investors, China wants to ensure it is getting a good return on its capital, a policy that is more than apparent in its approach to its African infrastructure projects. Highlighting this, Bruce said: "China does almost no work in Africa from which it does not derive some form of benefit, either political or economic."

As was the case with China several years ago, Africa is now keen to participate more fully in the globalised economy. For many, if the BRI can help boost development across Africa and drive economic activity, then that can only be a positive for the continent.

Mark Ronan, Special Correspondent, Cape Town

Editor's picks

Trending articles

Fung Business Intelligence

With a joint communique signed by the attending government heads and an extensive list of 270 deliverables, the first Belt and Road Forum (BRF) concluded fruitfully in Beijing on 15 May. Featuring the theme ‘Cooperation for Common Prosperity’, the two-day forum drew around 1,500 delegates from more than 130 countries and 70 international organizations, including 29 foreign heads of state and government.

The BRF is touted as China’s highest-profile diplomatic event of the year, and a first-of-its-kind international conference promoting the Belt and Road Initiative, which was proposed by Chinese President Xi Jinping in 2013 and has involved over 100 countries and international organizations so far. The second BRF will be held in China in 2019, Xi announced at the close of the forum.

Inspired by the ancient silk routes and previously known as ‘One Belt, One Road’, the Belt and Road Initiative is an ambitious plan spearheaded by the Chinese government to promote trade and economic integration across Asia, Europe, Africa and possibly beyond. The Initiative, which includes the Silk Road Economic Belt and the 21st Century Maritime Silk Road, aims at creating an open platform among the participating countries and international organizations to improve policy coordination, infrastructure connectivity, trade and finance collaboration, and people-to-people bonds.

I. Highlights of President Xi’s Keynote Speech

In his keynote speech delivered at the opening ceremony, President Xi repeated his call for an open world economy and reiterated China’s objective of pursuing the Initiative is to create ‘a new model of win-win cooperation’ but not ‘geopolitical maneuvering’. Besides, he pledged more financial support from China to the Initiative through loans and assistance.

Below are key highlights of President Xi’s keynote speech [1]:

- Renewing the Silk Road spirit

- President Xi called for renewing the ancient Silk Road spirit of ‘peace and cooperation, openness and inclusiveness, mutual learning and mutual benefit’.

- Reviewing progress made during the past four years

- Fruitful results have been achieved in the areas of policy coordination, infrastructure, trade, finance and people-to-people exchange.

- For example, China has signed cooperation agreements with over 40 countries and international organizations; total trade between China and other Belt and Road countries in 2014-2016 has exceeded US$3 trillion, and China’s investment in these countries has surpassed US$50 billion; the Asian Infrastructure Investment Bank has provided US$1.7 billion of loans for 9 projects in Belt and Road countries.

- Reiterating China’s objectives

- ‘We are ready to share practices of development with other countries, but we have no intention to interfere in other countries’ internal affairs, export our own social system and model of development, or impose our own will on others.’

- ‘We will not resort to outdated geopolitical maneuvering. What we hope to achieve is a new model of win-win cooperation. We have no intention to form a small group detrimental to stability, what we hope to create is a big family of harmonious co-existence.’

- Reaffirming the aim and focus of the Initiative

- ‘The pursuit of the Initiative is not meant to reinvent the wheel’, but ‘to complement the development strategies of countries involved by leveraging their comparative strengths’.

- The Initiative should ‘focus on the fundamental issue of development, release the growth potential of various countries and achieve economic integration and interconnected development and deliver benefits to all’.

- ‘We should build an open platform of cooperation and uphold and grow an open world economy.’

- Pledging more funds for the Initiative

- China’s Silk Road Fund will increase funding by 100 billion yuan; Chinese financial institutions will set up overseas RMB fund business with an estimated scale of around 300 billion yuan; the China Development Bank and the Export-Import Bank of China will make special loans worth 250 billion yuan and 130 billion yuan, respectively, to support cooperation in infrastructure, industrial capacity and financing.

- China also promised assistance worth 60 billion yuan to developing countries and international organizations over the next three years. Some other financial assistance will be provided to improve the well-being of people in the Belt and Road countries.

- Enhancing trade and cooperation

- China will host the China International Import Expo starting from 2018.

II. Major deliverables of the Belt and Road Forum

President Xi and 29 other heads of state and government signed a joint communique [2] at the close of the Leaders Roundtable held on the second day of the forum, reaffirming their commitment to building an open economy, ensuring free and inclusive trade, and promoting a universal, rules-based, open, non-discriminatory and equitable multilateral trading system with WTO at its core.

The two-day forum yielded fruitful results with 270 deliverables in five key areas, namely policy coordination, infrastructure, trade, finance as well as people-to-people exchange, according to a list of deliverables released by the Xinhua News Agency. During the forum, China signed cooperation agreements with 68 national governments and international organizations. Below are some of the major outcomes/deals achieved during the BRF [3]:

- Policy coordination

- The Chinese government signed bilateral cooperation agreements with 16 other national governments/relevant ministries and several international organizations.

- The Guiding Principles on Financing the Development of the Belt and Road was endorsed by the ministries of finance of relevant countries.

- An advisory council, a liaison office, and the Facilitating Centre for Building the Belt and Road will be set up. The official Belt and Road web portal and the Marine Silk Road Trade Index have been launched.

- Infrastructure connectivity

- Bilateral cooperation agreements in various fields such as energy, water, ports, railways and information technology, were reached between relevant government departments.

- Agreement for Further Cooperation on China-Europe Container Block Trains among Railways of China, Belarus, Germany, Kazakhstan, Mongolia, Poland and Russia was endorsed by railway companies of relevant countries.

- The China Development Bank and the Export-Import Bank of China signed financing agreements on various infrastructure projects with parties of relevant countries participating in the Initiative.

- Trade connectivity

- The Chinese government signed economic and trade cooperation agreements with the governments of 30 countries.

- The Ministry of Commerce of China and the relevant agencies of more than 60 countries and international organizations jointly issued the Initiative on Promoting Unimpeded Trade Cooperation along the Belt and Road.

- The China-Georgia Free Trade Agreement was endorsed.

- Bilateral cooperation agreements in the fields of promoting SME development, agriculture trade, e-commerce, inspection and quarantine, cross-border economic cooperation zone, etc. were signed between China and government departments of relevant countries.

- The China International Import Expo will be held from 2018.

- Finance connectivity

- In addition to the funding pledges made by President Xi in his speech, China will set up the China-Russia Regional Cooperation Development Investment Fund, with a total scale of 100 billion yuan and the initial scale of 10 billion yuan.

- The Ministry of Finance of China signed memoranda of understanding on collaboration under the Initiative with six international development organizations.

- The China-Kazakhstan Production Capacity Cooperation Fund came into operation.

- The China Development Bank, the Export-Import Bank of China, and China Export and Credit Insurance Corporation signed cooperation agreements with relevant parties of countries participating in the Initiative.

- People-to-people exchange

- On top of the 60 billion-yuan financial assistance announced in President Xi’s speech, China will provide 2 billion-yuan emergency food aid to the Belt and Road countries, US$1 billion to the South-South Cooperation Assistance Fund, and US$1 billion to relevant international organizations to implement projects benefiting countries along the Belt and Road.

- Bilateral cooperation agreements on various fields such as cultural exchange, tourism, education, science and technology, health, media exchange and think tank exchange were signed between Chinese government departments and relevant parties of other countries along the Belt and Road.

- The Chinese government endorsed assistance agreements with multiple international organizations.

III. Shaping inclusive globalization with worldwide participation

Over the past four years, the Belt and Road Initiative has won warm response and made practical achievements, while challenges and misgivings such as financing gap, transparency, and economic viability of projects largely remain. The launch of the BRF has provided a great occasion for all participating parties to review progress, gather consensus, develop mechanisms, and cultivate deeper and broader cooperation. The concrete and extensive deliverables produced, especially China’s promise of more funding, have boosted the optimism about the Initiative’s prospects.

Amid mounting concerns over rising protectionism and isolationism, the BRF is an important political event for promoting the Belt and Road Initiative as a new platform for mutually beneficial collaboration and inclusive globalization. The joint communique, which was signed by 30 heads of government led by China, signals that developing countries have become a driving force of free trade and open economy.

Notably, the presence of delegations from the US and Japan, who were previously indifferent to the forum, turned out to be a last-minute surprise. In fact, many developed economies, including Germany, France, Canada and the post-Brexit vote UK, sent delegations to the forum, even as diplomats confessed they knew little about the massive integration strategy. The unprecedented attendance by both developing and developed countries has not only transformed the China-led Initiative into a truly open platform with global recognition, but also marked a significant milestone in China’s rise as a diplomatic superpower at the world stage.

Please click to read the full report.

[1] For the full text of the speech, please see http://news.xinhuanet.com/english/2017-05/14/c_136282982.htm

[2] Joint Communique of Leaders Roundtable of Belt and Road Forum, https://eng.yidaiyilu.gov.cn/zchj/qwfb/13694.htm

[3] For the full list of deliverables, please see https://eng.yidaiyilu.gov.cn/qwyw/rdxw/13698.htm

Editor's picks

Trending articles

The interview was prepared within the scope of joint project of KIMEP University and Kapital “Let’s talk”.

Could you please tell us about your first impressions of Kazakhstan when you first came here?

- I first came to Kazakhstan in 2007 as part of a Hong Kong Government delegation to promote Hong Kong as a destination for listing Kazakhstan companies on the stock exchange. I am the owner of a Hong Kong based securities dealer on the Hong Kong stock market, and at that time, I was also the Chairman of the Hong Kong Securities Association. The HKSA represents securities industry in dealing with the government, the securities regulator, and the stock exchange.

- When they first approached me, they said: “Tony, we want you to go to Kazakhstan with us.” I was very surprised. It was nothing like what I had expected after watching the movie “Borat”.

- Kazakh people are very hospitable and they welcomed I continued coming back to Kazakhstan, virtually once a month to meet my friends. Part of the reason enjoy this country is that it reminds me so much of Australia. I lived and studied in Australia for about eight years, and when I looked at open fields, the green, the friendly people, even the buildings – all of these reminded me of the other continent. I have made a lot of friends and now I am living here.

How did your family react to your move to Kazakhstan?

- Well, I am here on my own. My family has been already been living in America for more than 30 years.

What did you think when you started learning about Kazakh traditions and way of life?

- I will tell you a little bit of my family story. I was born in Hong Kong, my father is Filipino, my mother is Indonesian and my nanny was Chinese, so I was born in a multicultural and multilingual environment. At home we spoke a number of languages – mother spoke to me in Bahasa Indonesia and Dutch, my father - in Spanish and Filipino, and my nanny - in Chinese. The common language at home was English. I also speak three dialects of Chinese and some Thai after working in Thailand for a year. So for me coming to a multicultural and multiethnic society was not a big cultural shock.

- I studied in Hong Kong, then I went to Australia to complete my secondary and tertiary studies. I had worked in Australia and America. And when I was based in Hong Kong I travelled to Korea, Japan, Taiwan, Indonesia so it is very easy for me to adapt to different societies. But the most difficult thing for me in Kazakhstan is the Russian language. It is the most difficult language I have come across. Most of my friends and colleagues here speak very fluent English and so I don’t have much opportunity to practice Russian. In Kazakh I only know “Rakhmet”.

Since you have lived in Kazakhstan for a few years now, what differences can you point to between the Kazakh and Hong Kong banking systems?

- Well, banking is banking and the basics are always the same. The main difference is in demographics. This applies across the board to the corporate, small medium enterprises and retail individuals sectors.

- In the US and Hong Kong we have a much larger middle class than in Kazakhstan and because of that the products provided to customers by banks are different. When you have a large middle class, you provide a lot of credit products. Here, for example, in the retail sector, we issue more debit cards than credit cards.

- The second difference is the fact that Kazakhstan has gone through some very difficult times as a result of financial crises. Because of this, the National Bank is controlling the banking sector at a very detailed level.

In the Kazakh banking sector there are a lot of foreign specialists. What is the reason?

- Hong Kong has one of the highest concentration of banking institutions in the world. Seventy of the largest 100 banks in the world have an operation in Hong Kong.

- In the Hong Kong banking sector, at the end of April 2015, there were 157 licensed banks, 23 restricted licence banks and 21 deposit-taking companies, together with 64 local representative offices of overseas banking institutions. These institutions come from 36 countries and include 71 out of the world’s largest 100 banks. Together they operated a comprehensive network of about 1 376 local branches, excluding their principal place of business in Hong Kong.

- Compared to Hong Kong, I do not think there are a lot of foreigners working in the Kazakhstan banking sector. Here at ATF, we have two other foreigners, apart from me, but they are from CIS countries.

Managers come and go. How do you pass on your experience?

- Letting people go is one of the hardest things to do whether you are head of a bank or line manager. You`ve worked with your colleagues for a while, you have built up relationships with them. On top of that if you were the one who was responsible for hiring these people, you have to admit that you might have made a mistake.

- The most important thing you have to do is to discuss this very openly with the person in question and say “I think we both made a mistake”. This is the hardest thing in management. It is easy to hire people, it is much more difficult to let people go.

What was the most difficult decision in your working experience?

- Every decision we make is difficult. The most difficult part of decision making is knowing when to say we have enough information. One of the biggest traps in decision making is what I call “analysis paralysis”. Make a decision based on what we know and know monitor changes.

- By the way, coming to Kazakhstan was not a difficult decision. I saw the opportunities, I liked the business environment and people so it was very easy for me to make the move.

What do you think of the Kazakhstan banking sector in general?

- We have 180 licensed banks and 81 authorized financial institutions in Hong Kong, but it is a much bigger economy. Hong Kong’s GDP in 2015 was over USD300 billion and Kazakhstan was over USD180 billion.

- However, in terms of geography and space and the size of population – Hong Kong is much smaller than Kazakhstan. In Kazakhstan, the top 10 account for most of the loans and deposits.

What areas do you think are promising in Kazakhstan for development?

- Kazakhstan is a developing economy. To a great extent, I compare Kazakhstan to Australia and Canada – large geographic area, small population and rich in minerals and energy. I think Kazakhstan can emulate these two countries’ economies. They are very successful in agriculture exports, Kazakhstan also has agriculture but its share in GDP is not so big as energy and mining or related sectors.

- Next to our country we have two large economies. On the one side is China with a 1.3 billion people, on the other is India with the same size of population. There are a lot of mouths to feed. If you look at dietary habits of Chinese, a typical Chinese consumes less calories and proteins than a Westerner. As the Chinese economy improves, food consumption increases. China now imports wheat and rice, and most proteins come from Canada and Australia. Kazakhstan can and should supply China and India with food.

The interview was first published by Kapial, view full interview content at https://kapital.kz/business/60836/let-s-talk-with-anthony-espina.html

Editor's picks

Trending articles

Background

China is currently promoting the development of the Belt and Road, namely the outward development strategy of the Silk Road Economic Belt and the 21st Century Maritime Silk Road. In March 2015, China published a document entitled Vision and Actions on Jointly Building the Silk Road Economic Belt and 21st Century Maritime Silk Road (Vision and Actions), which put forward the initiative to speed up the development of the Belt and Road with the intention of promoting economic co-operation among countries along its routes. The initiative has been designed to enhance the orderly free-flow of economic factors and the efficient allocation of resources, while furthering market integration and creating a regional economic co-operation framework of benefit to all.

Vision and Actions specifically states that investment and trade co-operation are the major components of the Belt and Road Initiative. In co-operation with the Asian, European and African countries along the routes, the initiative strives to improve investment and trade facilitation, and remove investment and trade barriers for the creation of a sound business environment within the region and in all related countries. This can be done by pushing forward the negotiations on bilateral investment protection agreements and double taxation avoidance agreements with a view to protecting the lawful rights and interests of investors and expanding the scope of mutual investment.

Actions should also be taken to improve the division of labour and distribution of industrial chains by encouraging the entire chain and related industries to develop in concert so as to enhance the industrial supporting capacity and general competitiveness of the region. Co-operation is encouraged in order to build all forms of industrial parks, such as overseas economic and trade co-operation zones and cross-border economic co-operation zones. It is hoped that all countries along the Belt and Road routes can work together to promote the cluster development of various industries.

Development of Overseas Economic and Trade Co-operation Zones

China has embarked on the development of overseas economic and trade co-operation zones since 2006, mainly spearheaded by the Ministry of Commerce. Prior consensuses are reached with the governments of countries that are politically stable and on good terms with China, for approved Chinese enterprises to serve as the principal executors in entering into agreements with these governments for investing in and undertaking development projects in their countries.

Alternatively, these Chinese enterprises may co-operate with enterprises of the host countries in jointly investing in, and undertaking the development of, local industrial parks with comprehensive infrastructural facilities, distinct leading industries and sound public service functions. They will then invite other related enterprises from China, the host countries and other countries to invest and develop in the parks in order to form industrial clusters and build up relatively comprehensive industrial chains. Such a development model is equivalent to direct investment with economic and trade co-operation in the form of group projects.

To further innovate and promote the development of overseas economic and trade co-operation zones and optimise their service provision, the Ministry of Commerce and Ministry of Finance jointly drew up the Administrative Measures on the Accreditation Assessment and Annual Assessment of Overseas Economic and Trade Co-operation Zones (Administrative Measures) in 2013. Under the Administrative Measures, a co-operation zone refers to an industrial park set up with comprehensive infrastructural facilities, distinct leading industries as well as clustering and outreaching effects by a Chinese-funded holding enterprise registered in the People’s Republic of China (excluding Hong Kong, Macau and Taiwan regions) as a separate legal entity (hereinafter referred to as the “executing enterprise”) through an independent corporate body (hereinafter referred to as the “founding enterprise”) established overseas and held by a Chinese-funded enterprise.

Co-operation zones applying for accreditation assessment should play a pivotal role in leading the priority industries of China to “go out” while optimising the country’s industrial structures. They should facilitate the utilisation of resources and the enhancement of resource allocation capacity. They should also contribute in setting up commercial and trade logistics networks and opening up further room for trade development; in securing technological co-operation and raising technological innovation standards; and in promoting the economic and social development of the host countries with a view to achieving mutual benefits with foreign partners.

Co-operation zones passing the accreditation assessment or annual assessment under the Administrative Measures may apply for financial support from a specific central fund. For example, related financial institutions may actively provide the necessary credit support and complementary financial services to the founding enterprises and the enterprises operating in the zones (operating enterprises) that meet China’s policy requirements and related loan financing terms.

According to the Notice of Ministry of Commerce and China Development Bank on Issues Concerning the Support for the Construction and Development of Overseas Economic and Trade Co-operation Zones published in 2013, the Ministry of Commerce and China Development Bank work together to set up a joint mechanism on the co-ordination and information sharing for co-operation zone projects, and provide investment and financing policy support to eligible executing enterprises and operating enterprises of these co-operation zones.

Specifically, China Development Bank supports the industrial clusters that meet the needs of the country’s outward development strategies to “go out” by providing investment and financing services for the development of co-operation zones. It also provides financing support to the executing enterprises of the co-operation zones by actively exploring the financing options of relying on the credits offered by overseas financial institutions, or taking the projects, other assets or the account receivables from land sales as pledges. It provides financing services in the form of sub-loans, syndicate loans and others to operating enterprises in collaboration with well-established financial institutions of the hosting countries.

Overseas economic and trade co-operation zones have become a major format for Chinese enterprises to “go out”, and serve as their important carrier and platform for foreign investment and co-operation. According to the Ministry of Commerce, by the end of 2016, Chinese enterprises had set up 77 co-operation zones in 36 countries with a cumulative investment of US$24.19 billion, drawing in 1,522 operating enterprises with a total output value of US$70.28 billion.

The achievement of overseas economic and trade co-operation zones is particularly impressive in the countries along the Belt and Road routes. These countries are mostly at the initial stage of industrialisation, with good potential for market development and aspirations for drawing foreign investment. At present, China is developing 56 co-operation zones in 20 countries along the Belt and Road routes, accounting for 72.7% of the total number of overseas co-operation zones under construction, involving a cumulative investment of US$18.55 billion and drawing in 1,082 operating enterprises with a total output value of US$50.69 billion. These zones have created about 180,000 jobs for the local communities, helping to promote the industrialisation of the host countries and the development of their related industries – particularly the development and upgrade of key industries such as light textiles, home appliances, steel, building materials, chemicals, automobiles, machinery, and mineral products. [1]

Economic and Trade Co-operation Zones in Asia

China has set up co-operation zones across the continents of Europe, Asia and Africa along the Belt and Road routes. Co-operation zones in different localities show various advantages in respect of resources, markets, traffic and transport, as well as infrastructure. In particular, Asia is the key region for China to launch economic and trade co-operation under the Belt and Road Initiative. Most Asian countries, particularly those in Southeast Asia, have been actively drawing investment through the establishment of special economic zones such as industrial parks, and promoting economic development and creating job opportunities in recent years. China can capitalise on this trend and use economic and trade collaborative development as a major tactic to step up co-operation with the Southeast Asia region and hence establish the China-Indochina Peninsula Economic Corridor.

It seems that the small- and medium-sized enterprises on the Chinese mainland and Hong Kong are more inclined to focus on the development opportunities unfolding in Southeast Asia. Whether it calls for direct investment to set up manufacturing plants for processing trade, for co-operation in production capacity with local partners of host countries, or for exploration of the local industrial materials and consumer markets, these small- and medium-sized enterprises are keen to seize the opportunities offered by Southeast Asia. With their rapid expansion in the industrial production sector alongside investment growth in their infrastructural development in recent years, Southeast Asian countries have gradually formed a close-knit supply chain with China.

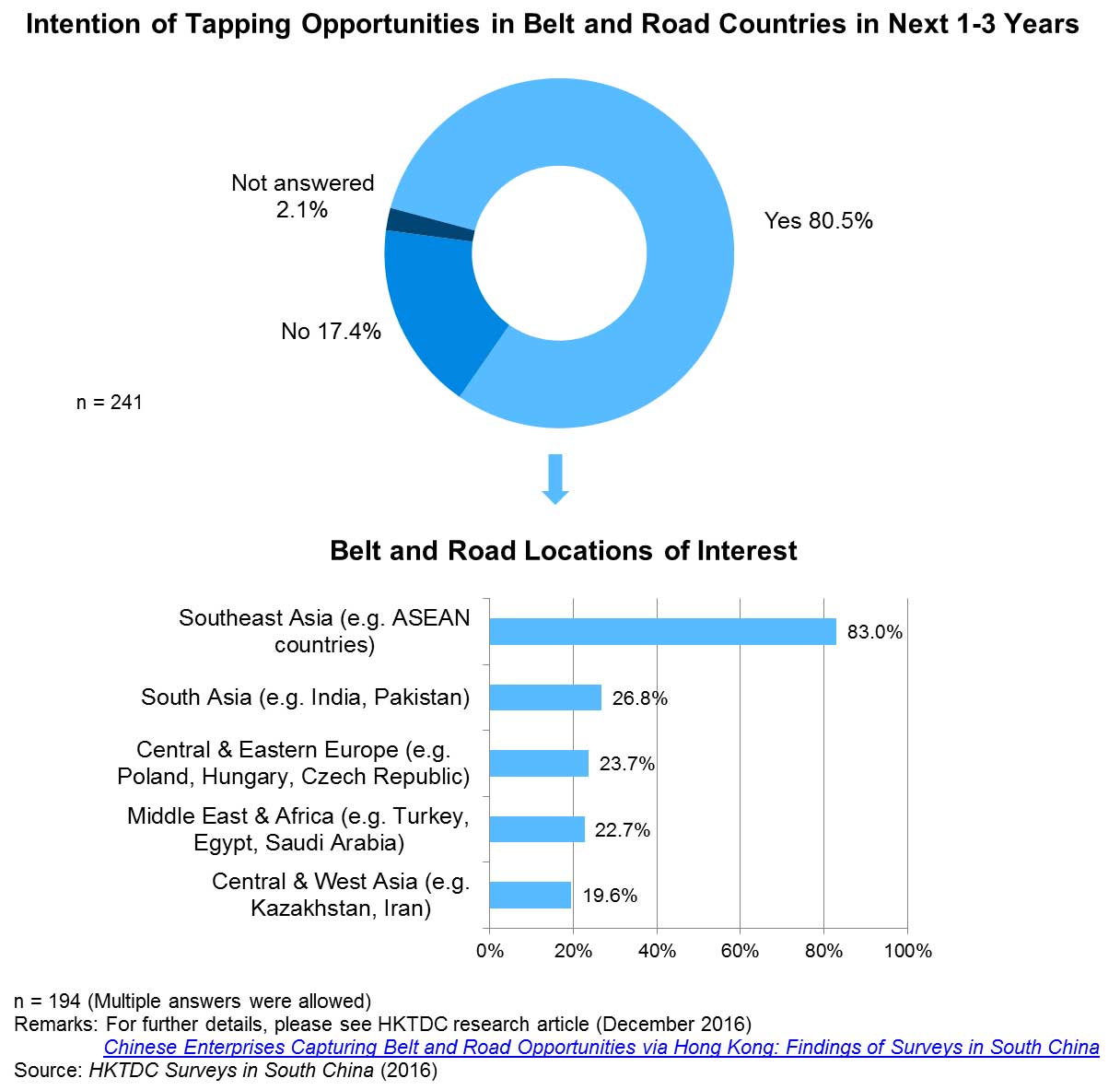

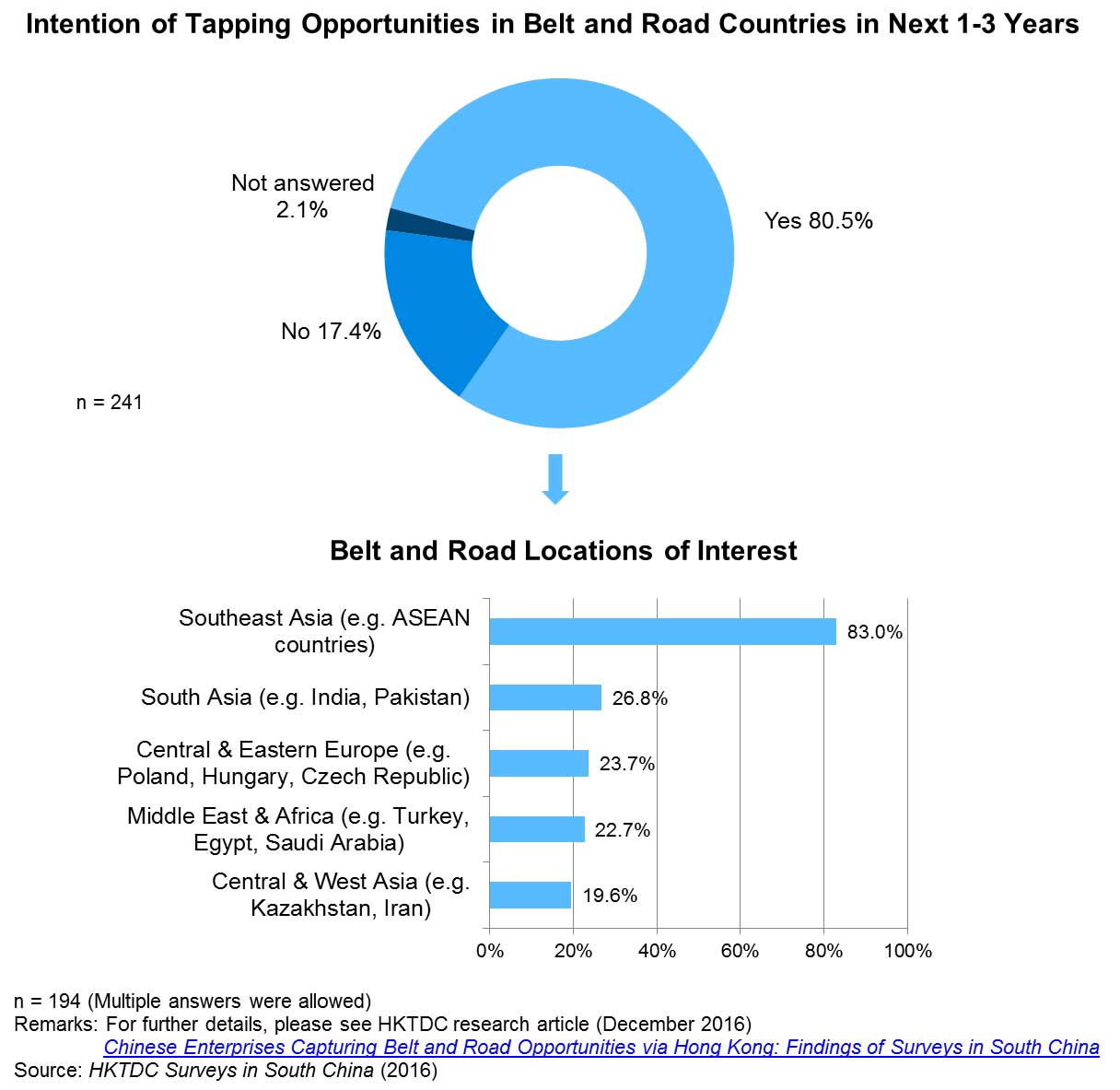

Findings of a questionnaire survey conducted by the HKTDC Research in South China in mid-2016 shows that the majority (83%) of the responding enterprises on the Chinese mainland choose the Southeast Asia region, including ASEAN countries, as their desirable destinations for tapping Belt and Road opportunities, followed by South Asia (27%), and Central and Eastern Europe (24%). While many enterprises want to increase their sales of various products to the Belt and Road markets (88%), some would like to set up manufacturing plants in these regions (36%), or purchase various kinds of consumer goods/food items or raw materials from the local markets (35%).

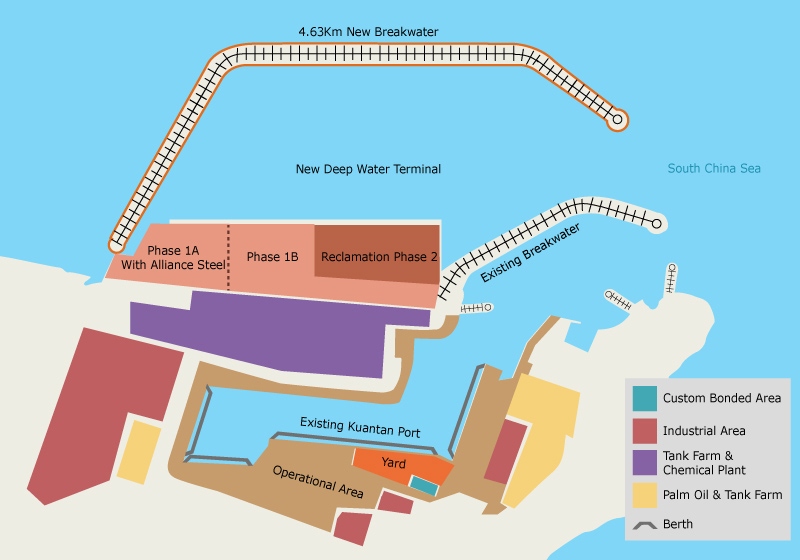

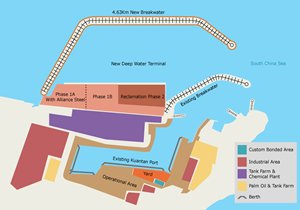

Approved co-operation zones set up by Chinese investors in ASEAN countries include: (1) China-Indonesia Julong Agricultural Industry Co-operation Zone; (2) Laos Saysettha Development Zone; (3) Cambodia Special Economic Zone; (4) Thai-China Rayong Industrial Park; and (5) Vietnam Longjiang Industrial Park. In addition, the governments of China and Malaysia have jointly devised the international production capacity co-operation format of “two countries, twin parks”, whereby two industrial parks have been set up in Kuantan of Malaysia and Qinzhou in Guangxi of China. These parks are expected to serve as the pioneer economic co-operation projects explored and implemented by the Chinese government under the Belt and Road development strategy.

Please click here to purchase the full research report.

[1] Source: Ministry of Commerce

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (2)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (3)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (4)

Belt and Road: Development of China’s Overseas Economic and Trade Co-operation Zones (5)

Editor's picks

Trending articles

China has become a major trading country and important source of foreign investment around the world as its economic activities with other countries continue to grow. Under the Belt and Road development strategy, Chinese enterprises have stepped up their efforts in “going out” to engage in trade and investment activities in countries along the Belt and Road routes. This has spurred demand for professional services to support these enterprises' growing international business.

China’s coastal areas, including the Pearl River Delta adjoining Hong Kong and the Yangtze River Delta (YRD), have always been major areas for economic co-operation with foreign countries. More and more enterprises in Shanghai and the adjacent areas have been heading for the Belt and Road regions in search of opportunities to boost the development of their businesses.

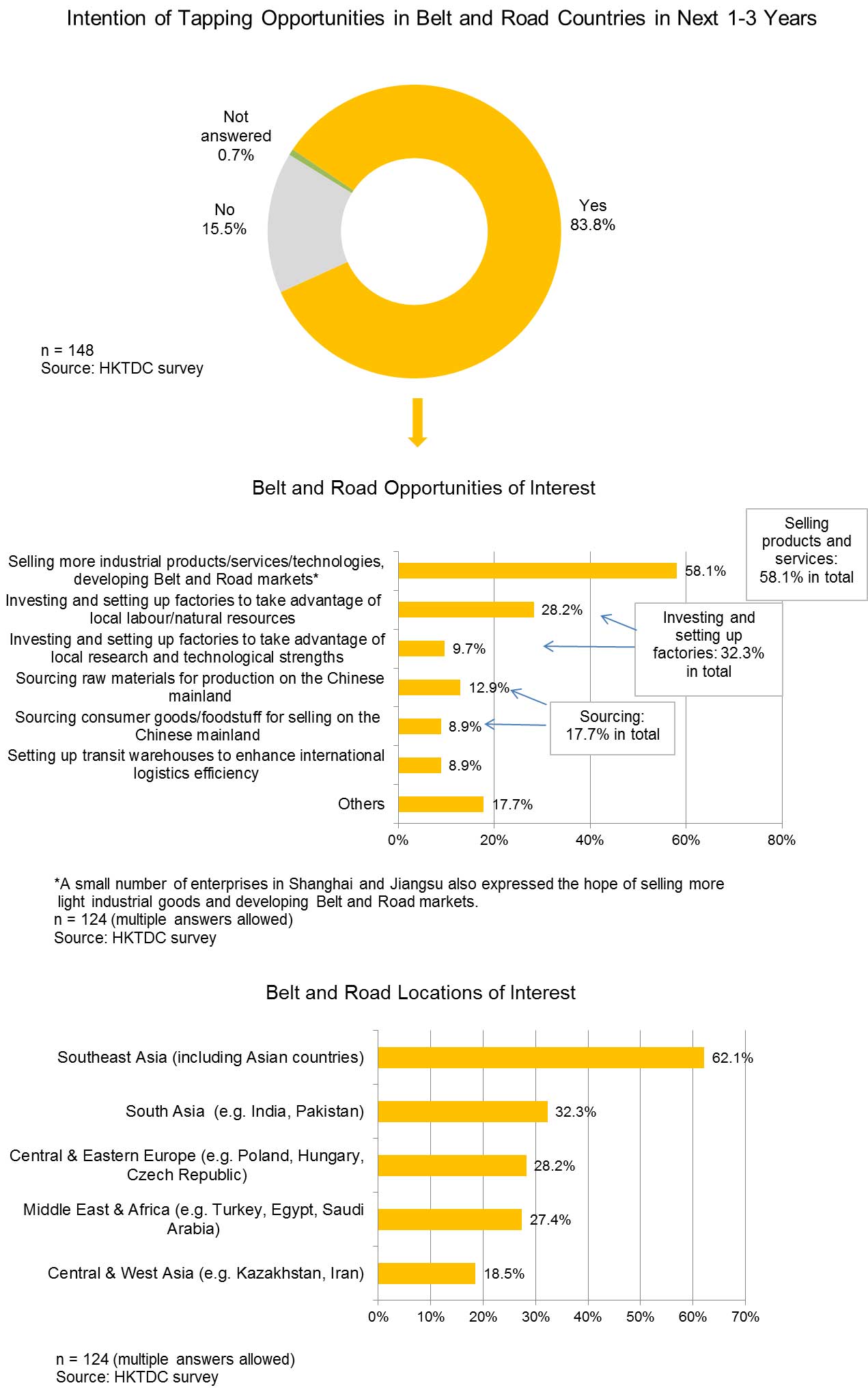

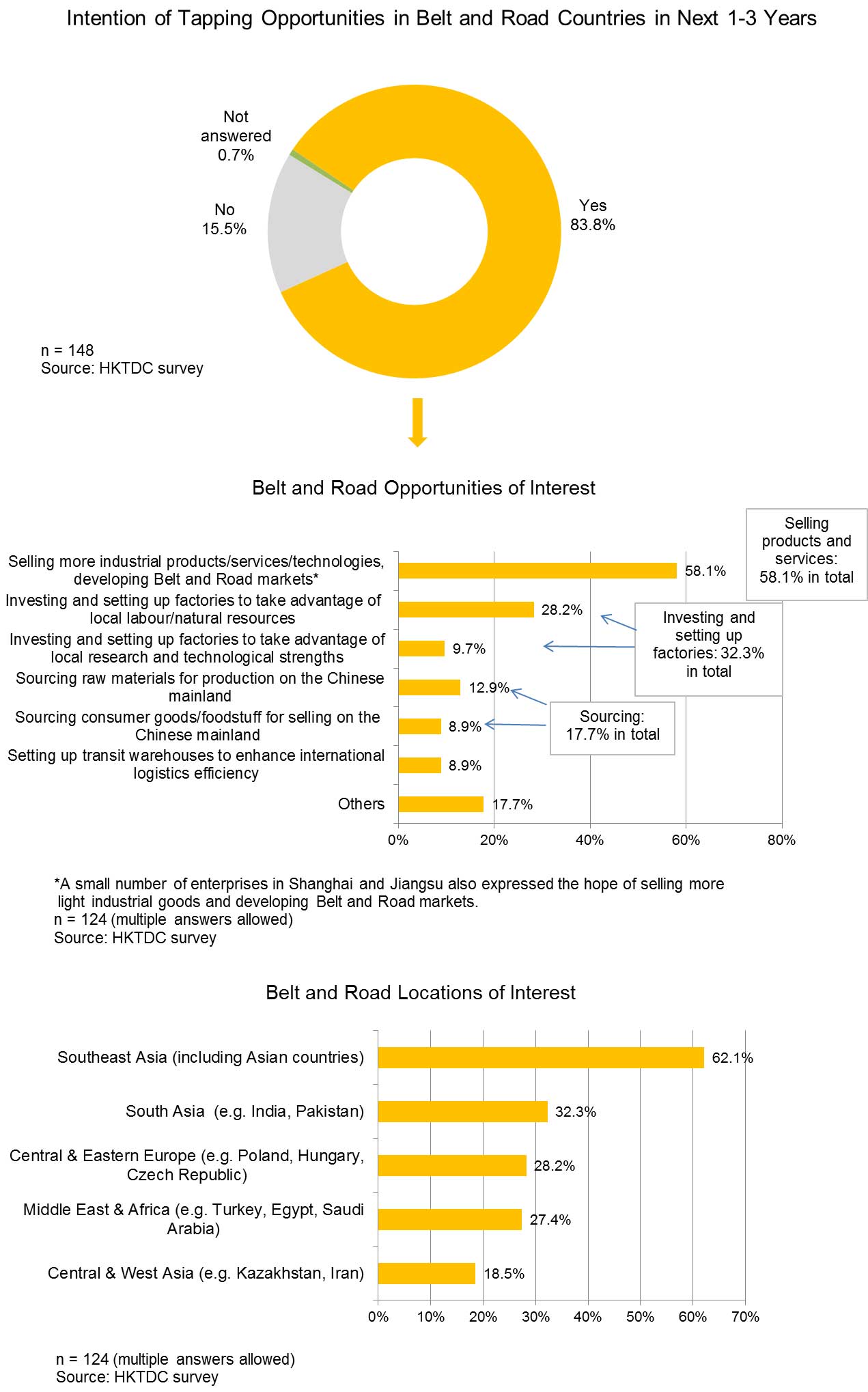

HKTDC conducted a questionnaire survey in Shanghai, Jiangsu and other places in the YRD in the first quarter of 2017 to gauge the situation. The survey results indicate that the great majority of domestic respondents (84%) would consider tapping business opportunities in Belt and Road countries in the next one to three years. Among these, many enterprises (46%) said that Hong Kong was their preferred destination for seeking professional services outside the mainland for capturing business opportunities. This matches with the findings of a similar HKTDC survey in South China last year. [1]

The Belt and Road destinations that respondents showed the greatest interest in were Southeast Asia (62%), South Asia (32%), and Central/Eastern Europe (28%). Most enterprises (58%) expressed the hope of selling more industrial products, relevant services and technologies to Belt and Road markets, while one in three (32%) would consider investing and setting up factories in Belt and Road countries.

There is no doubt that Hong Kong is the preferred platform for mainland enterprises “going out” to invest overseas. Hong Kong service providers have been helping mainland enterprises handle their trade and investment businesses in Hong Kong and overseas markets for many years. Further efforts by mainland enterprises, including those in the YRD, to tap Belt and Road opportunities are bound to generate more business for Hong Kong. (For more details on China’s foreign investment and Hong Kong as the preferred platform for mainland enterprises “going out” to invest overseas, see: China Takes Global Number Two Outward FDI Slot: Hong Kong Remains the Preferred Service Platform)

Belt and Road: Hotspot for China’s Foreign Trade and Investment

China has become a major world economy and the economic activities of Chinese enterprises abroad have gradually extended from trade to other fields of investment. China’s foreign trade volume stood at US$3.69 trillion in 2016, second only to the US with US$3.71 trillion. [2] During the same period, China’s foreign direct investment (FDI) flows (excluding financial sector investment) reached US$170 billion [3], which was among the highest in the world and exceeded foreign capital inflow. It is now a country with net capital outflow.

China’s trade and investment in Belt and Road countries will see sustained growth particularly under the Belt and Road initiative and development strategy. Figures released by the Ministry of Commerce showed China’s total trade with Belt and Road countries rose by 0.6% to RMB6.3 trillion (equivalent to US$1 trillion) in 2016, accounting for just over a quarter (26%) of China’s total foreign trade during the period. Direct investment made by Chinese enterprises in non-financial sectors in 53 Belt and Road countries totalled US$14.53 billion, accounting for 8.5% of China’s total non-financial FDI during this period. Most of the investment went to Singapore, Indonesia, India, Thailand and Malaysia.

As China gears up for the Belt and Road development strategy and encourages businesses to develop trade and investment with the countries and regions concerned, the Belt and Road initiative has become an important factor in driving the “going out” of Chinese enterprises for all kinds of economic activities. As Hong Kong has consistently been the preferred service platform for these enterprises [4], the development of the Belt and Road initiative is expected to spur demand for various Hong Kong support services from mainland enterprises.

HKTDC joined hands with the Shanghai Municipal Commission of Commerce in conducting a questionnaire survey among related enterprises in Shanghai and Jiangsu of the YRD in the first quarter of 2017 to find out about the challenges facing mainland enterprises in the region, their transformation, upgrading and investment strategies, their intention of “going out” to capture Belt and Road opportunities, and their demand for related professional services.

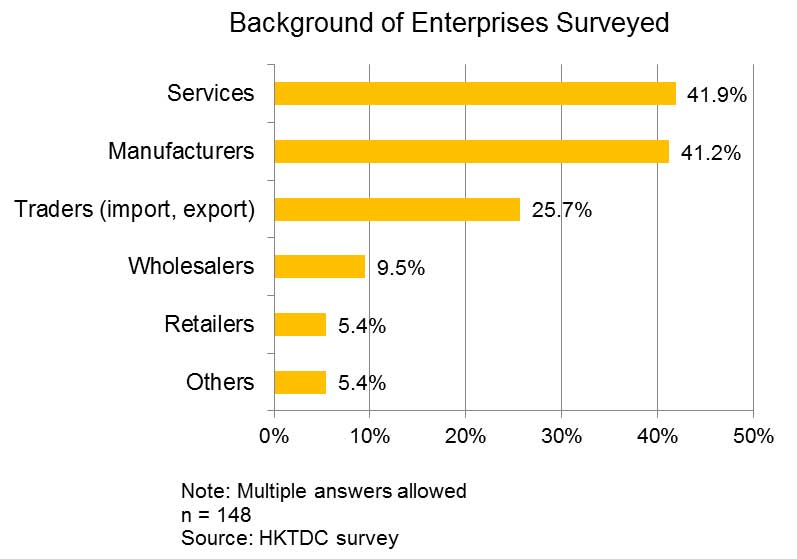

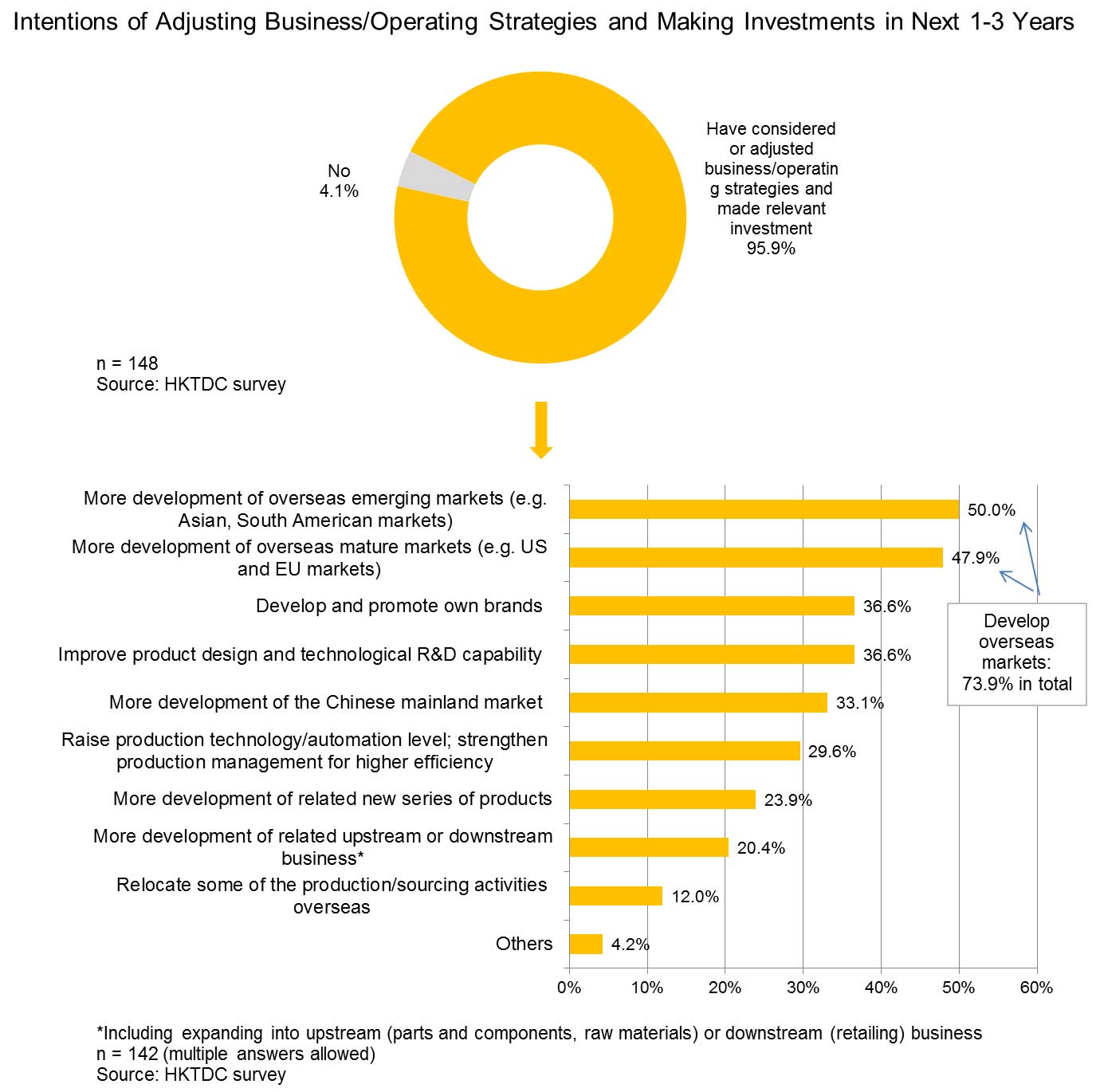

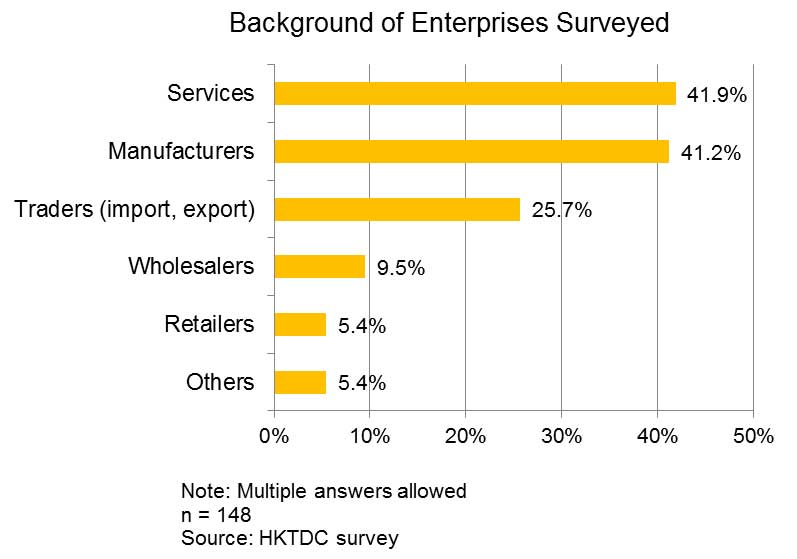

This survey was similar to the one conducted by HKTDC in South China in 2016. [5] A total of 163 completed questionnaires were collected. Of these, 148 were completed by mainland enterprises, including service suppliers, manufacturers and traders. What follows is a summary of the views expressed by these 148 mainland enterprises on “going out” to capture Belt and Road opportunities.

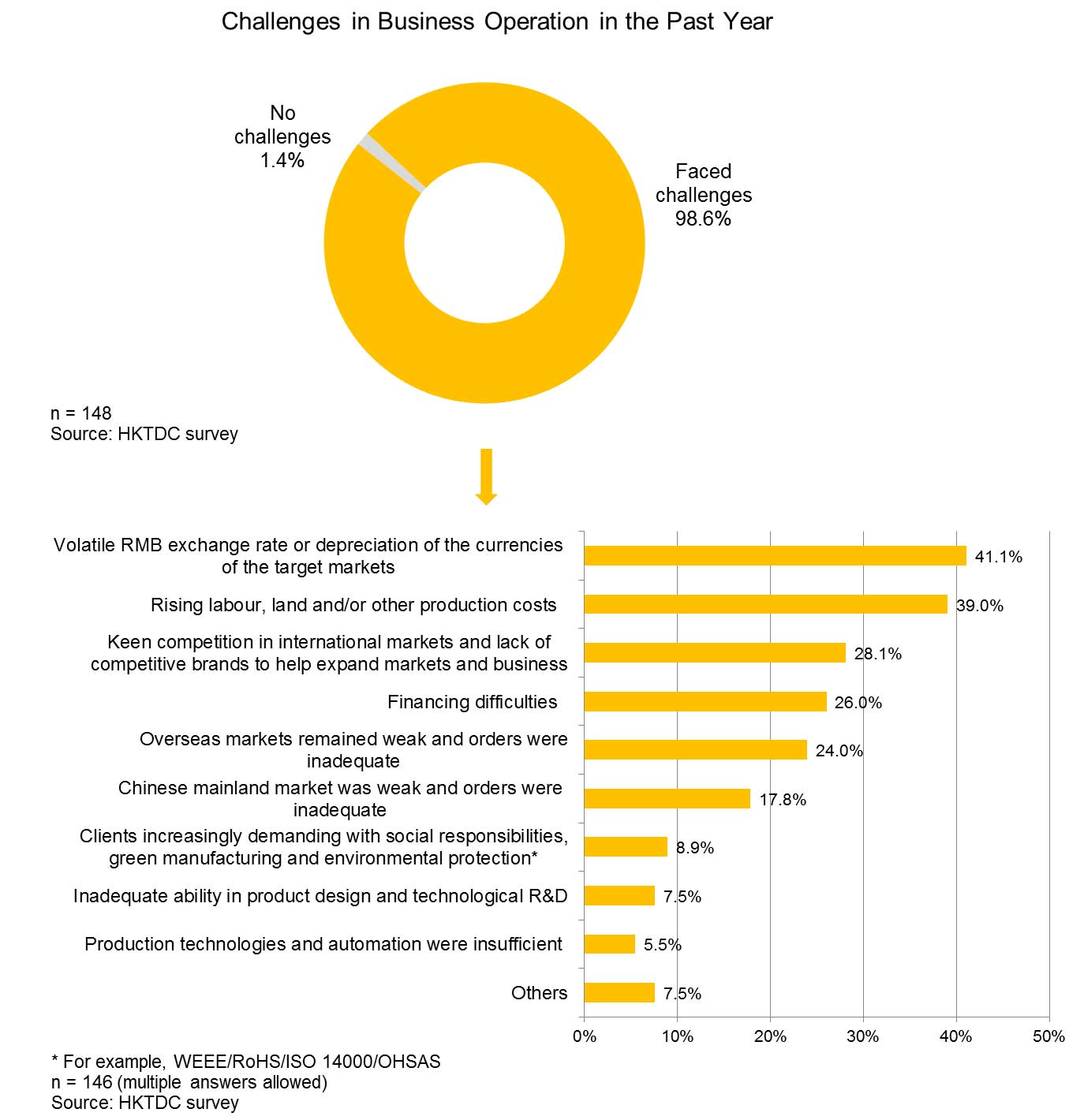

Challenges in Business Operation

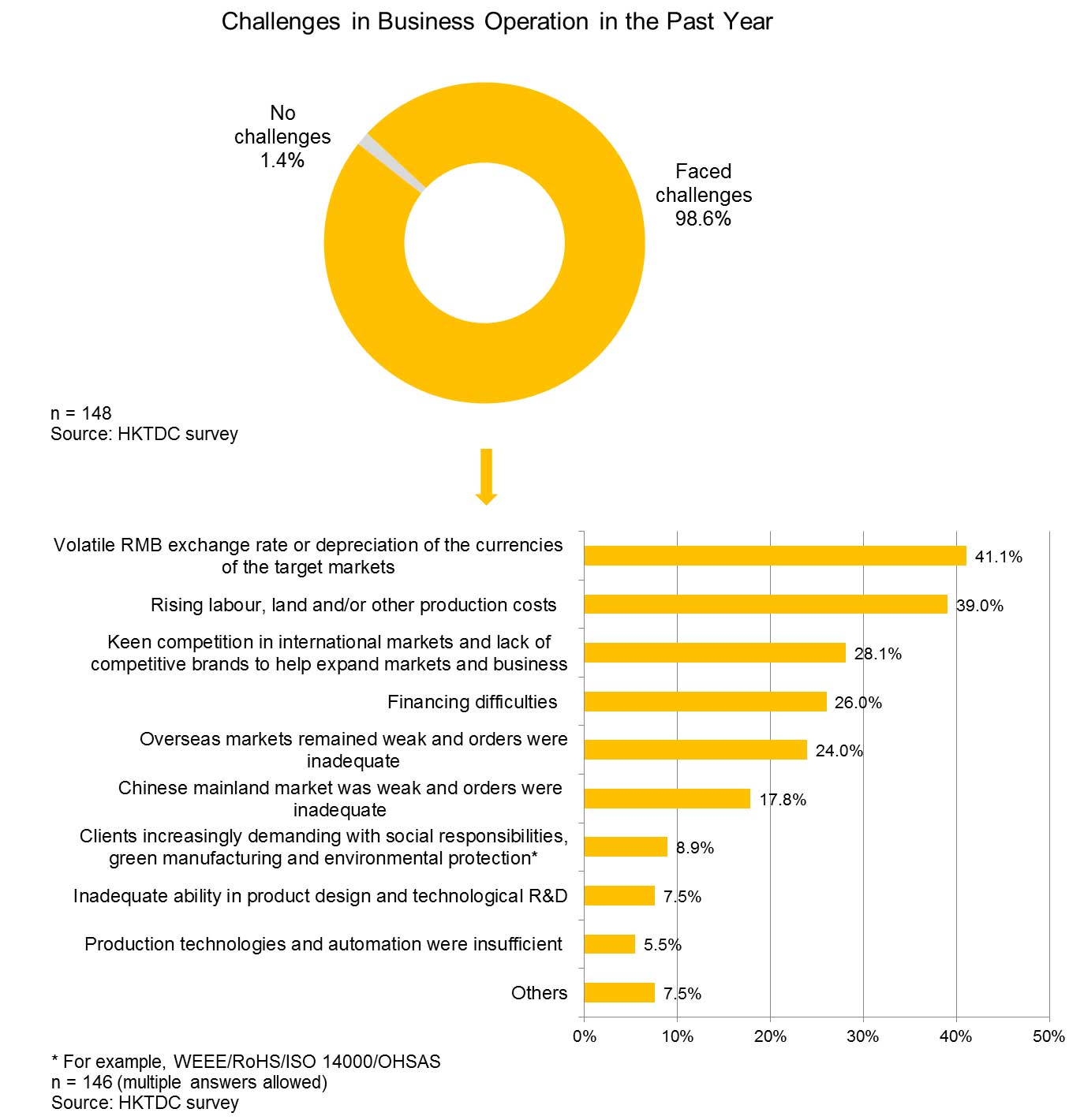

Virtually all respondents (99%) said that their business operations faced a variety of challenges over the past year. Their foremost concerns were the volatile RMB exchange rate (41%) and rising labour, land and/or other production costs (39%). Other challenges included keen competition in international markets (28%), financing difficulties (26%) and weak overseas markets and inadequate orders (24%).

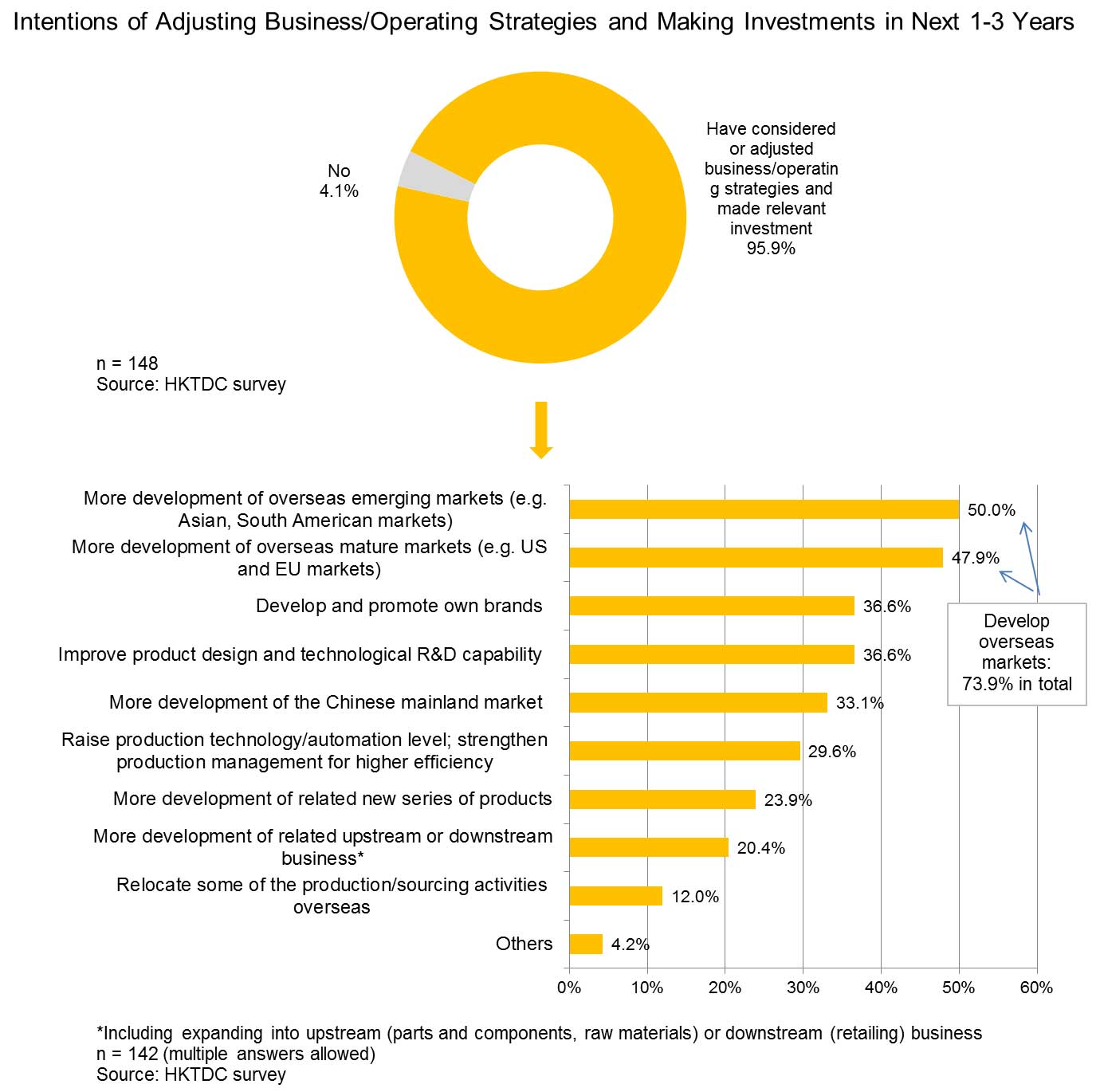

Most Important Countermeasure: Develop Overseas Markets

In order to tackle these challenges, over 95% of the respondents said either they would consider adjusting their business/operating strategies and making relevant investment in the next one to three years or they had already done so. Almost three out of every four (74%) of the respondents said they would first exert themselves to develop overseas markets. Of these, half (50%) said they would develop further overseas emerging markets and 48% said they would focus on overseas mature markets. More than one in three (37%) said they would develop/promote their own brands, while the same number said they would work on the improvement of product design and technological R&D capability.

Belt and Road Opportunities: Focusing on Southeast Asian Markets

As China continues to promote the Belt and Road development strategy, 84% of the respondents said they would consider tapping business opportunities in Belt and Road countries in the next one to three years.

Among those enterprises that would consider tapping Belt and Road opportunities, most said they wanted to sell more industrial products and related services and technologies to the Belt and Road markets. Just under a third (32%) said they wanted to go to Belt and Road countries to invest and set up factories for production, while 18% said they would like to go to source consumer goods/foodstuff for selling on the Chinese mainland and source raw materials for production on the Chinese mainland. Another 9% said they hoped to set up transit warehouses in Belt and Road countries to improve their international logistics efficiency.

Among those enterprises interested in tapping opportunities in Belt and Road markets, almost two thirds (62%) said they would focus on Southeast Asia, including ASEAN countries. Fewer respondents chose other regions, with a third (32%) picking South Asia (32%), just over one in four going for Central and Eastern Europe (28%) and the Middle East and Africa (27%), and one in five choosing Central and West Asia (19%).

Although there is a slight difference between the preferences of the respondents in this survey and the one conducted in South China last year, the preferences for Belt and Road opportunities and locations of interest are similar, suggesting that most mainland enterprises have the same intentions of tapping Belt and Road opportunities, regardless of where they are based.

Comparison of Survey Findings in South China and YRD

| Opportunities of Interest | Survey in South China | Survey in YRD |

| Selling products | 88% | 58% |

| Investing and setting up factories | 36% | 32% |

| Sourcing | 35% | 18% |

| Setting up transit warehouses | 22% | 9% |

| Locations of Interest | Survey in South China | Survey in YRD |

| Southeast Asia | 83% | 62% |

| South Asia | 27% | 32% |

| Central & Eastern Europe | 24% | 28% |

| Middle East & Africa | 23% | 27% |

| Central & West Asia | 20% | 19% |

Source: HKTDC survey

Need to Seek Services Support

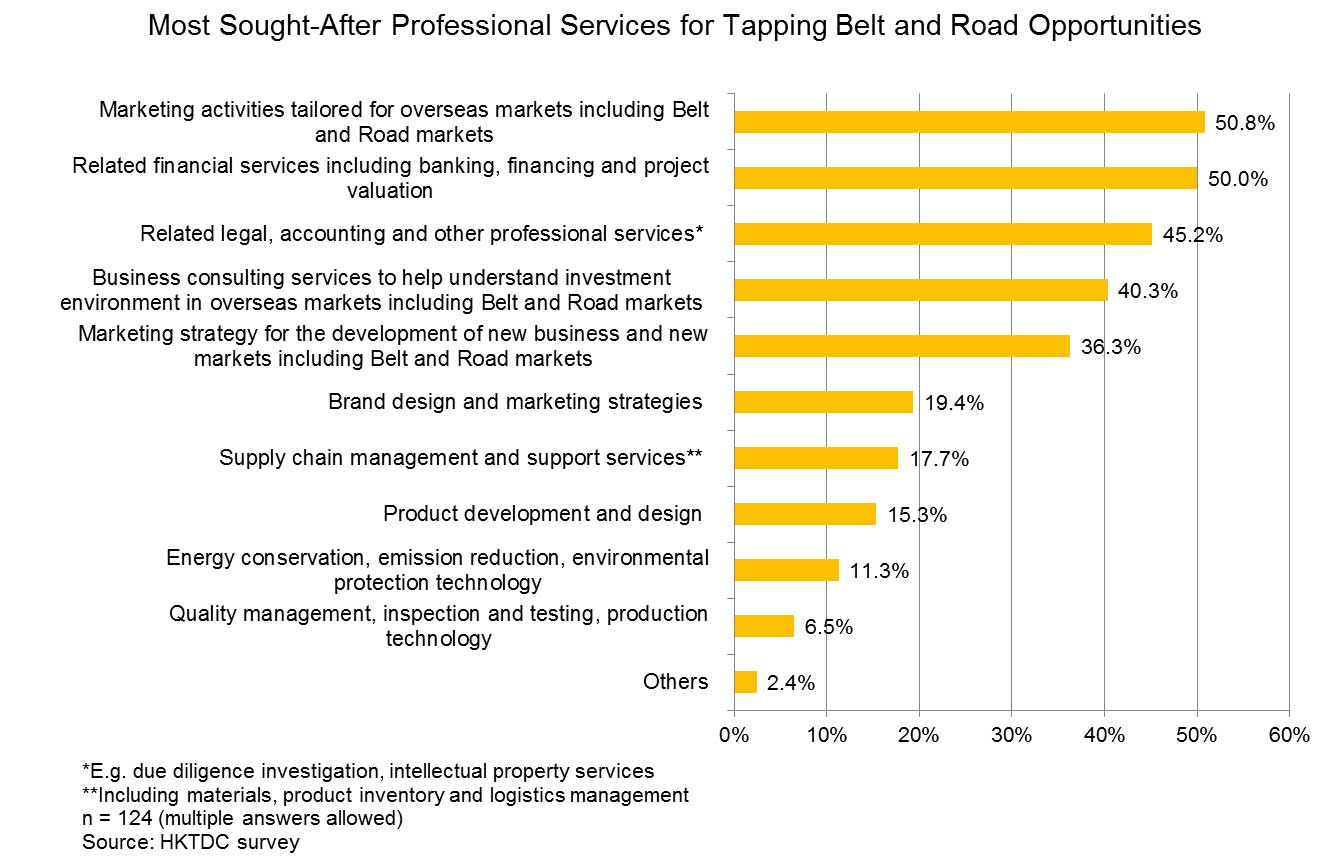

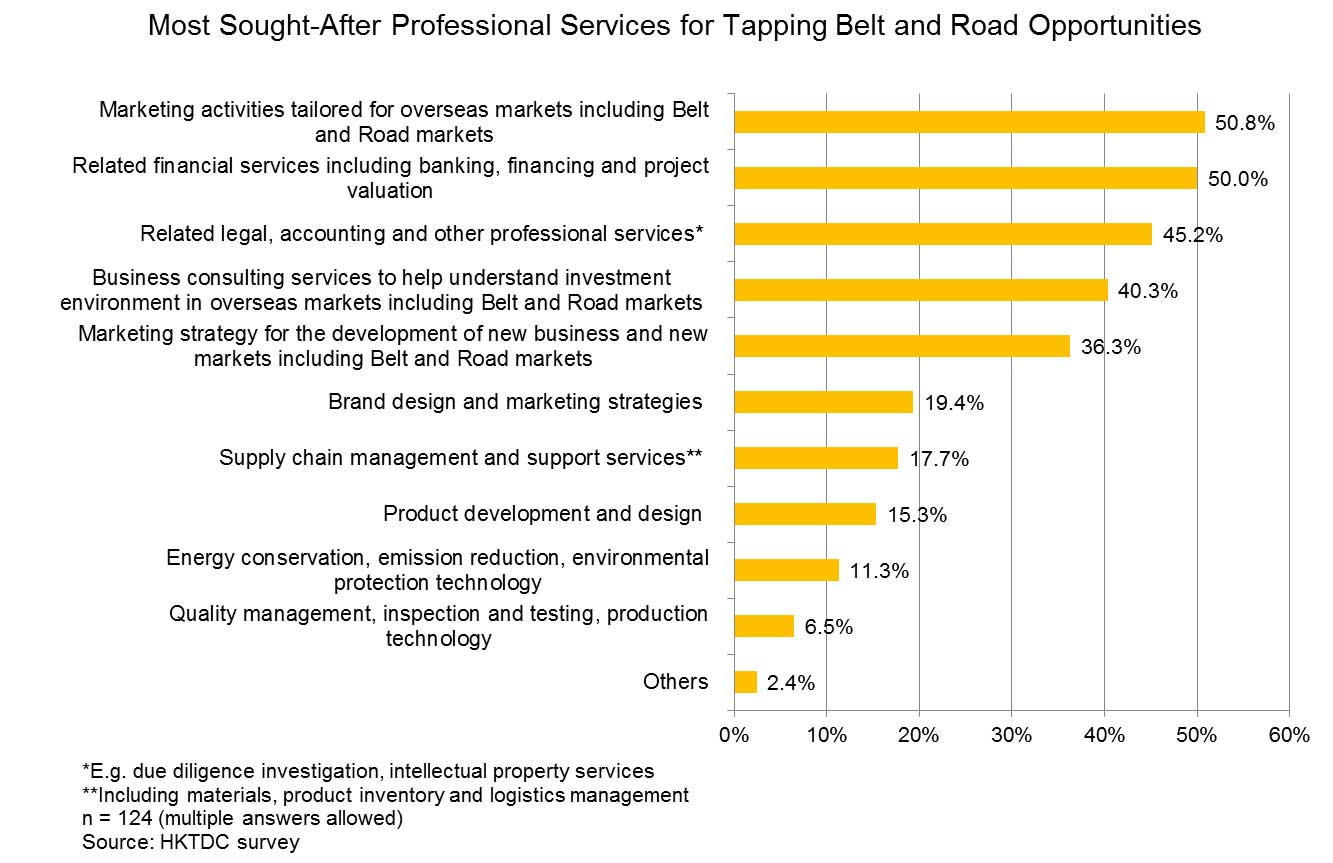

Of those enterprises looking to tap into Belt and Road opportunities, half (51%) said they would like to become involved in marketing activities tailored for Belt and Road and other overseas markets. Half (50%) said they would require related financial services, including banking, financing and project valuation. Just under half (45%) said they would like to seek related legal, accounting and other professional services. 40% said they would require business consulting services to help understand the investment environment in overseas markets, including Belt and Road markets.

Seeking Services Support in the Chinese Mainland and Hong Kong

In order to locate these aforementioned professional services, more than half (55%) of the respondents looking to tap Belt and Road opportunities said they would first source these support services locally. However, a significant number said they would also seek various professional services outside the mainland. Hong Kong was the most preferred destination for most enterprises, accounting for almost half (46%) of all respondents who would like to tap into Belt and Road markets. This again matched the findings of the survey conducted by HKTDC in South China last year. Other destinations highlighted as of interest included the US (34%), Germany (27%) and Singapore (23%).

HKTDC Research would like to acknowledge the help extended by the Shanghai Municipal Commission of Commerce in conducting the survey.

[1] For details about the survey in South China, please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

[2] Source: Customs Administration of China; World Trade Organisation

[3] Source: Ministry of Commerce of China

[4] On Hong Kong as the preferred service platform for mainland enterprises “going out”, please see: Guangdong: Hong Kong Service Opportunities Amid China’s “Going Out” Strategy, Jiangsu/YRD: Hong Kong Service Opportunities Amid China's "Going Out" Initiative, China’s “Going Out” Initiatives: Professional Services Demand in Bohai and China's “Going Out” Initiative: Service Demand of Western China to Tap Belt and Road Opportunities.

[5] Please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

Editor's picks

Trending articles

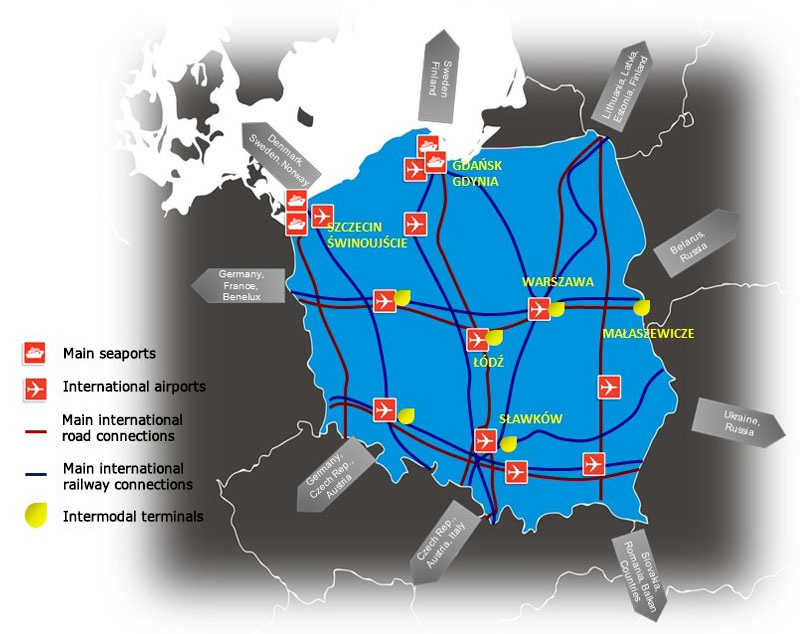

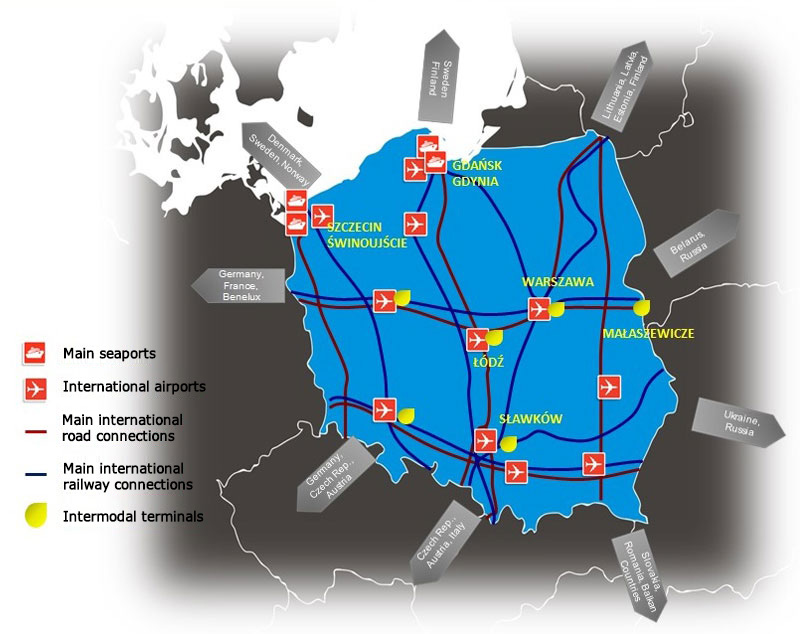

Since the launch of direct rail freight services linking Łódź (Poland’s third largest city) and Chengdu (the capital of China’s southwest Sichuan Province) in April 2013, Poland has become an increasingly popular destination among traders looking for competitive logistics alternatives to the existing Eurasian ocean lanes and air routes. This popularity has been enhanced by the ongoing Russian-Ukrainian conflict, which has compromised the rail traffic routes passing through Ukraine to such destinations as Hungary and Slovakia.

The initial profits from the increasing level of Asia-Europe rail traffic have been seen as a crucial contributor to the success of Poland’s new national economic roadmap. Dubbed the Morawiecki Plan (after Mateusz Morawiecki, the Deputy Prime Minister and Minister of Economic Development and Finance), the roadmap shares many common elements with the Belt and Road Initiative (BRI), envisaging not only an increase in investment, but an improvement in per-capita income and the greater prominence of international trade.

From a Mere Middle-ground Solution to a Market-opening Solution

Following the arrival of the first direct container train from Chengdu to Łódź in December 2012, regular rail freight services linking China and Poland increased significantly. Among these new routes are the Suzhou-Warsaw railway link, which opened in September 2013 and the first to originate from a free trade zone – the Xiamen Haicang Free Trade Port – which has now been operating between Xiamen and Łódź route since August 2015.

This rapid growth has made rail transport, usually considered a middle-ground solution between ocean and air transport, a more attractive logistics option for traders who cannot afford the long shipping time of seaborne freight or the high price of air freight. It has also strengthened Poland’s role as a regional trans-shipment hub in Central and Eastern Europe (CEE) for high-value-added, China-bound/Europe-bound products. With most Asia-Europe rail services currently avoiding travelling through the Russian-Ukrainian border, due to the ongoing conflict between those two countries, Poland, as a ready alternative, has enjoyed great success in challenging for the region’s logistics crown.

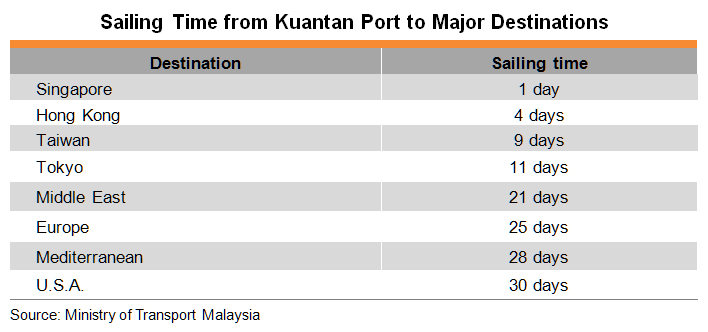

In order to transport a 40-foot high cube (HC) container from Hong Kong to Poland, cargo owners usually opt for one of the maritime routes, which costs port-to-port around US$1,800 and takes 33 days to reach the port of Gdańsk in northern Poland. In the case of cargo destined not only for the Polish market, traders can also consider other European ports, such as Hamburg in Germany (US$1,800; 32 days), Slovenia’s port of Koper (US$1,700; 25 days) and, more frequently, the Greek port of Piraeus (US$1,600; 22 days) in which China’s Cosco Shipping has lately acquired a majority stake and made the overland connection – road and rail – to major European hubs more practical and convenient.

Source: CEEC-CHINA Secretariat on Logistic Cooperation

Goods arriving from the port of Piraeus, for example, can be distributed across Poland (or to warehouses and distribution centres in other European destinations) via the Trans-European Transport Network (TEN-T). At the crossroads of the two core TEN-T corridors – the Baltic-Adriatic Corridor (the North-South axis connecting CEE countries with the ports of the Baltic and Adriatic seas) and North Sea-Baltic Corridor (the West-East axis connecting the Baltic States and Poland with Germany and the Benelux countries) – most of the capital cities in Europe are within 2-3 days trucking from Poland. However, the price tag of overland connections between the port of Piraeus and such major CEE cities as Warsaw, Budapest in Hungary, the Slovakian capital Bratislava, Pardubice in the Czech Republic and Belgrade in Serbia can often start at around €1,100.

A direct container train, on the other hand, will take no more than two weeks to arrive in Warsaw, the capital of Poland, thanks to key improvements in route options, performance and customs protocols. For instance, the movement of containers between the broad-gauge (1,520mm) trains used in former Soviet countries, such as Russia, Kazakhstan and Belarus, and the standard-gauge (1,435mm) trains used in China and the EU, can nowadays be carried out within 50 minutes at Khorgas – one of the busiest junctions on the Silk Road Economic Belt near the Chinese-Kazak border.

This speed is one of the major reasons why the rail option has increasingly gained in popularity among traders in dire need of quick (usually same-day) delivery to fulfill their growing e-commerce business requirements, although the cost can easily rise to a level more than double that of ocean freight – the cost of sending a 40-foot HC container by rail from Shenzhen to Warsaw, for instance, is about US$4,000 station-to-station.

At first sight, such a middle-ground alternative is not very tempting for traders who want to ship Hong Kong-origin products to Europe, due to the extra cost and time needed for trucking the products by bonded trucks to mainland train stations. It is, however, becoming more routinely undertaken by Hong Kong manufacturers who produce and export to Europe direct from factories across the border.

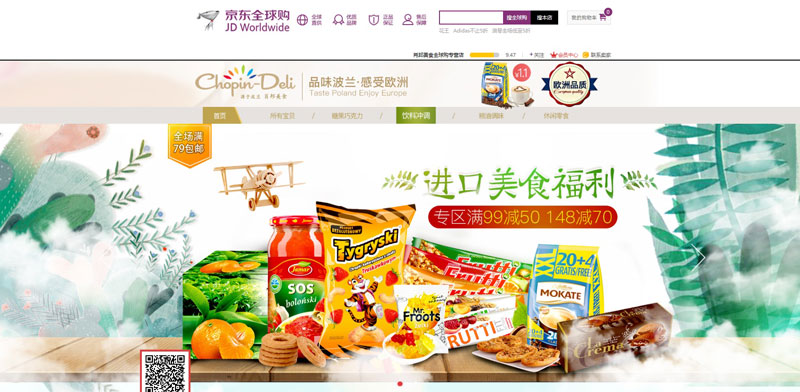

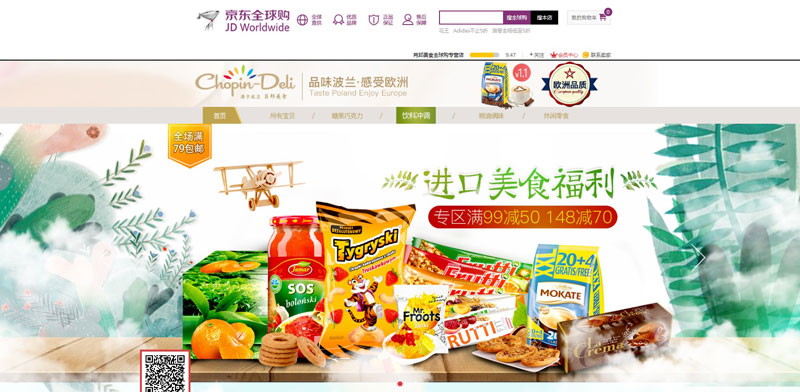

Given the higher price tag and limited capacity (around 60-65 containers per train) compared to ocean transport (11,000-plus containers per vessel), rail is not suitable for all products. According to Hatrans Logistics, the Łódź-based logistics company that operated the first direct rail freight train between China and Poland, the items being transported by Europe-bound trains are mainly electronics, auto parts, electrical appliances and medical devices, while advanced machinery and equipment, automobiles and building materials are most typical of the products being sent on China-bound trains. More intriguingly, food and beverages (F&Bs) have become a frequent cargo on such Eurasian trains.

To better utilise the idle loading capacity on trains returning to China, Polish exporters have started to work with logistics players to develop new possibilities, while some visionary Chinese companies have even set up their own sourcing teams to seek out attractive European products to fill containers on their return journey.

Source: www.chopin-deli.com

Hatrans Logistics, for example, has launched Chopin-Deli, a web shop, on JD Worldwide, China’s cross-border e-commerce platform, in order to promote a number of F&B items, such as coffee, tea, juices, spirits, jam and confectionery. It also runs a showroom in Chengdu showcasing other niche products, including cleaning materials for damaged soil, building materials (wooden flooring panels), lifestyle products (health/diet supplements and sport drinks) and personal care products (cosmetics and hair care) that are seen as having considerable potential in the mainland market.

According to the Association of Polish Butchers and Meat Producers, Chinese and Asian restaurants are present in almost every Polish town, with 95% of the ingredients used in food preparation actually locally grown. This highlights not only how capable the Polish food industry is when it comes to meeting the needs of Chinese and Asian chefs, but also demonstrates the huge potential for Polish fresh produce and processed F&Bs in the Chinese and Asian market. To further bolster customer confidence, Poland has positioned itself as the only EU country to put in place three national food quality schemes – the QMP (Quality Meat Program), the PQS (Pork Quality System) and the multi-product QAFP system (Quality Assurance for Food Products) – in order to guarantee both the safety and quality of its meat products.

Although the outbreaks of H5N8 avian influenza in the Ostrowski and Moniecki Districts of Poland have caused a suspension of the imports of Polish poultry meat and associated products (including eggs), the fact that Hong Kong imported about 20,500 tonnes of frozen poultry meat and 4.8 million poultry eggs from Poland in 2016 shows how well-received Polish food products are by consumers in Hong Kong. This, in turn, opens wide a new window for Polish-Hong Kong co-operation – the pairing of Polish F&Bs with the complementary Asian culinary skills and flavours for the enjoyment of Asian foodies.

Meat products aside, Poland – an EU leader in the export of apples, berries, mushroom, cucumber, onion and garlic – has been more active in promoting its fruit and vegetables to the Asian market. Following President Xi Jinping’s visit to Poland in June last year and the co-operation agreements signed between the two governments, Polish apples were given the green light to enter the Chinese mainland market in September. As Asian manufacturers have become more knowledgeable about the quality and value for money of Polish crops, Polish apples, apple juices, cereals and frozen vegetables have become more widely available as part of the global food supply chain.

Following the success of Polish apples, it’s hoped that other Polish fruit such as strawberries, raspberries, currants and blueberries (Poland is the biggest producer of blueberries in Europe) may also do well in the Chinese market, especially given the complementary nature of the Polish harvesting season to those in other fruit-producing regions, notably Latin America and New Zealand. Polish berries are already selling in Hong Kong, which is widely considered by Polish fruit growers to be a good test bed for the other Asian markets, especially the Chinese mainland.

Many Polish F&B companies see Hong Kong as a trendsetter for wider Asian food consumption. The case of LEI Food & Drinks, a Polish manufacturer and exporter of premium F&B products, is a good example of how Polish F&Bs are entering the Asian market through a direct Hong Kong presence. From its warehouses in Hong Kong, LEI is supplying a number of the city’s high-end hotels with high-quality apples and fresh juices, produced using the traditional method of cold pressing with no preservatives or sugar added, while the company is also introducing the Asian market to its organic apple chips and sausages, isotonic drinks and alcohol beverages through a number of different Hong Kong channels, such as trade fairs and events.

As revealed by the National Association of Fruit and Vegetables Producer Groups, Polish soil, with little history of artificial fertiliser use, is so green and clean that it can be easily converted to organic farming use in just two to three years, compared with the six to seven years required in other EU countries. Thanks to EU financial support since the country’s accession to the union in 2004, Poland has developed state-of-the-art infrastructure with regard to agriculture, crop storage and food processing.

As the second biggest poultry producer in the EU – behind only France – Poland, has been sharing its best practices with other European farmers with regard to hen house automation and management. In addition to natural, nutritious and safe foodstuffs, the commercialisation of agricultural experience and technology is another promising field for Hong Kong-Polish partnerships, by dint of the city’s established technology marketplace and proven record of international collaboration in the fields of test-bed set-up, proof of concept (PoC) trials and solution customisation.

More Vibrant Trade Calls for More Vibrant Investment

With Sino-EU trade expected to top the US$1 trillion mark by 2020 (rising from around US$570 billion in 2016 – largely on account of the growing demand from mainland consumers and manufacturers for better, safer and tastier European products and for supplies of raw materials and parts and components from their European counterparts –rail transport is poised to play an even more important role in the Eurasian supply chain. This warrants improvements in infrastructure and more investment from both domestic Polish sources and overseas private investors and institutions, including the EU.

The early profits from the increasing level of Asia-Europe rail traffic have been considered by the Polish government as a crucial contributor to the success of the Morawiecki Plan, which foresees an investment of more than PLN2tn (US$490bn) through to 2020. The Morawiecki Plan shares many things in common with the China-proposed BRI, envisaging not only more robust investment in and out of Poland, but an improvement in per-capita income and greater role for international trade.

According to the targets set under the terms of the Morawiecki Plan, Poland is expecting its per-capita GDP to rise from 69% of the EU average to 79% by 2020, which, if achieved, will mean fresh demand for higher-quality, greater-variety imports. The plan also aims to boost the level of investment from its current level of 20% of GDP to 25% by 2020, as well as anticipating a 70% increase in outward foreign direct investment (FDI), giving rise to growing opportunities for services providers worldwide to facilitate not just foreign investment in Poland, but outbound investment by Polish institutions and enterprises.

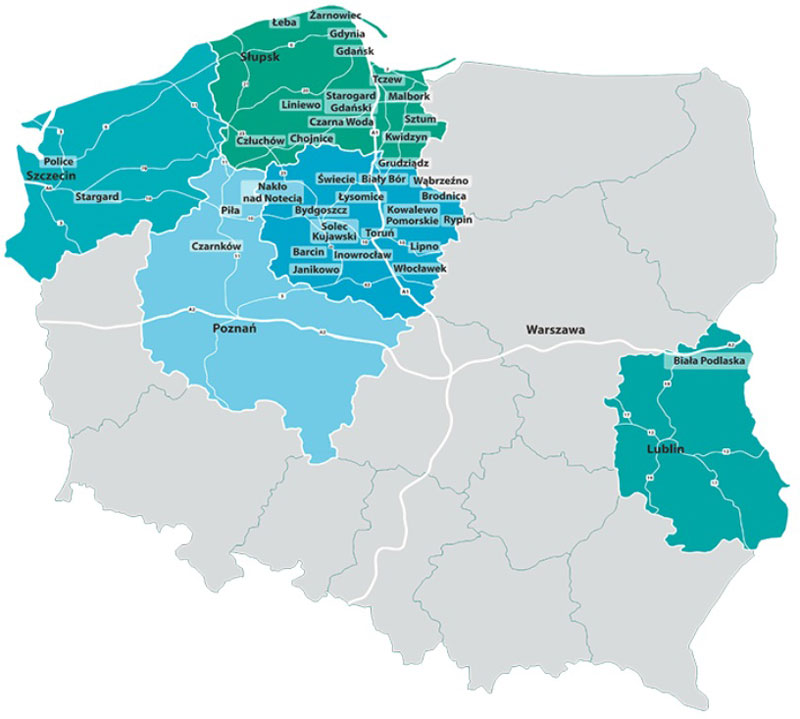

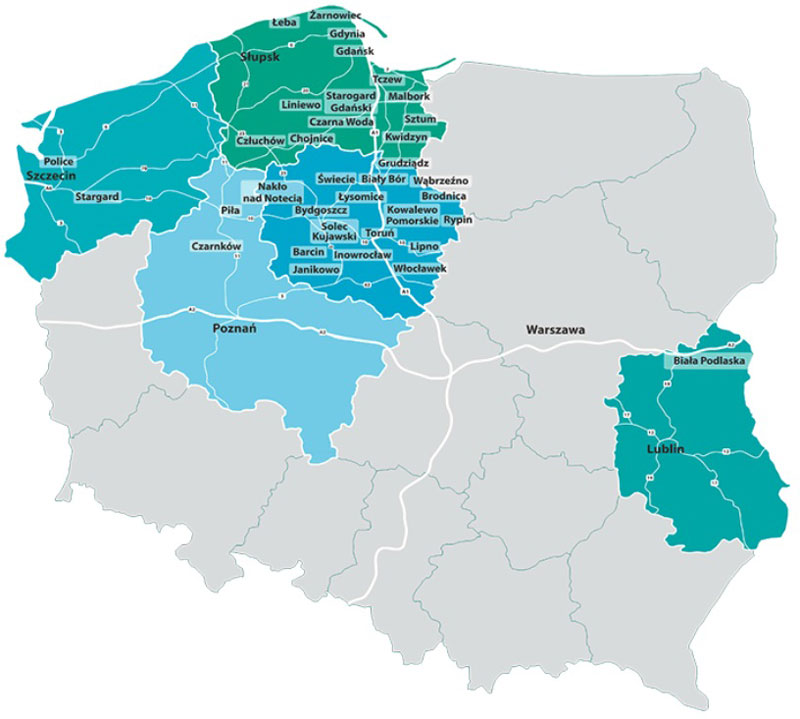

At the regional level, local governments have been very active in devising new projects and competitive incentives to attract both domestic and foreign investors to build and/or upgrade existing infrastructure so as to better tap the increasing demand for loading/unloading services and manufacturing/processing facilities expected with the growing proliferation of Eurasian rail operations. The recent enlargement of the Pomeranian Special Economic Zone (PSEZ) in the Lublin region (or Lubelskie voivodeship in Poland) at the Biała Podlaska county near the Polish-Belarusian border, is a case in point.

Source: Polish Investment and Trade Agency (PAIH)

As one of the 14 SEZs in Poland, PSEZ has been active in implementing a range of supplementary ventures and expansion activities, including the Gdańsk Science and Technology Park, which supports the development of start-ups, ICT and new technologies, and the Baltic Port of New Technologies in Gdynia, which has focused on the construction of a modern environment supporting the shipbuilding and related industries.

Under the Regulation of the Council of Ministers of 30.12.2016, the reach of PSEZ, thanks to its proven track record, has been further extended to eastern Poland. In the Biała Podlaska county of the Lublin region, the PSEZ is planning to build a logistics centre or trans-shipment hub by utilising the infrastructure of a defunct military airport and the existing inland trans-shipment facility with an aim of integrating with the New Silk Road Route connecting China and West Europe.

According to Pomeranian Special Economic Zone Ltd, the management company behind the PSEZ, the enhanced rail connection has made it more viable for manufacturers to relocate their production (or at least some of the manufacturing processes of their products destined for the European market) to Poland or the CEE region in general. The new Biała Podlaska Subzone, which is located close to the Polish-Belarusian border, is seen as serving as not only a logistics hub for trans-shipment from rolling broad-gauge onto a fleet of standard-gauge (1,435 mm) carriages or deconsolidation before sorting and sending directly to customers or warehouses in Europe, but also as a means of enabling manufacturing relocation across the country or even the whole CEE region.

Putting the new subzone under the management of PSEZ is seen as the best way of guaranteeing synergy across the country’s multimodal transport capacity. This will enable better connections with the inland cargo port in Biała Podlaska with the tide and ice-free seaports at Gdańsk/Gdynia in the Pomerania region and Szczecin/Świnoujście in the West Pomerania region, so as to best increase the overall freight turnover. The logistics advantages aside, companies that invest in the new subzone can also count on a higher level of tax relief – from 50% (for large companies with 250+ employees) to 60% (for medium-sized companies) and 70% (for micro and small companies), based on the cost of their investment or the two-year cost of their newly-hired employees.

Another bustling Polish region actively enticing Chinese investment is Łódź in Central Poland. Chinese investors operating a plastics manufacturing plant producing parts for TVs, computer panels and other entertainment equipment and an upcoming glass factory have already begun to reap the benefits of the region’s strategic location, which allows for rapid delivery not only between China and Poland, but across the whole European continent.

In order to attract Chinese investors, the local government and the Łódź Special Economic Zone have prepared far reaching plans for the development of new infrastructure and industrial zones near the main cargo terminals to facilitate co-operation between Chinese enterprises and the region’s strong local business community, especially in the fields of electrical engineering, food processing, alcoholic beverages, cosmetics and pharmaceuticals.

Going from Strength to Strength following Successful Investment Footprints

Hong Kong, with its FDI stock of US$418.7 million as of the end of 2015, is ranked 24th on the list of Poland’s inbound foreign investors. Among Asian investors, however, the city trailed only South Korea and Japan. A number of the city’s most well-known companies, including Hutchison Ports (formerly known as Hutchison Port Holdings (HPH)), Orient Overseas Container Line (OOCL), Kerry Logistics and Cathay Pacific are the examples of successful Hong Kong investment in Poland.

Since 2005, Hutchison Ports, a subsidiary of CK Hutchison Holdings, has carried out a number of investment programs at the port of Gdynia, transforming the Gdynia Container Terminal (GCT) into a modern container handling facility and strengthening the Port’s role as a feeder port connecting Poland with other European hubs in Germany (Bremerhaven and Hamburg) and the Netherlands (Rotterdam). In 2015, GCT completed its deep-water port development program, including the addition of a deep-water berth for vessels of up to 19,000 TEUs and an expansion of its rail terminal.

Hong Kong-based container carrier OOCL, a member of the former G6 Alliance, has recently added a direct port call to Gdańsk in its Asia-Europe (AET) service loop. Fuelling optimism for the floundering Asia-Europe trade lane, the direct port call makes it more convenient for Chinese and Asian companies to ship parts and components directly to Gdańsk for processing in close vicinity to the seaport, at places such as the Pomeranian Logistics Centre, in order to enjoy both lower operational cost and the tariff-free status of being Made in the EU.

Ensuring customers have smooth access into and out of CEE, Hong Kong-based Kerry Logistics inaugurated a shared service center (SSC) in Poznań in western Poland in November 2016 and a new office in Warsaw in March 2017 as part of its efforts to increase its European coverage in line with its customers’ developments in the region. While the new SSC is aimed at improving the overall cost efficiency and service competitiveness in the region, the new Warsaw office will support customers with regard to international freight forwarding via ocean, air and road freight services, as well as in customs brokerage.

Hong Kong’s flagship carrier, Cathay Pacific Airways (CX), with no direct flight connection with Polish airports, remains in the “uncharted brand territory” for Polish passengers. It did, however, choose Kraków, the second largest city in Poland, as the site of its fourth Global Contact Centre in April 2016. The capital of southern Poland’s Małopolska region, for the last three years Kraków has been ranked number one in Europe for outsourcing services [1]. Among the first Asian companies to have a direct business presence in the city, CX’s new Kraków centre handles inbound calls from Africa, Europe and the Middle East seeking with regard to bookings, baggage, online check-in, website technical issues and more and boasts a team of 120-plus young, multilingual professionals.

The unique combination of its diversified investment footprint and its ready professional and financial advisory services cluster, complete with extensive global networks and affiliations, has made Hong Kong a ready partner for Polish enterprises, intermediaries and project owners hoping to grow alongside Chinese investors under the framework of either China’s BRI or Poland’s own economic roadmap.

As these development strategies and frameworks progress and become more specific and concrete, more ambitious proposals involving increasingly technical and complex projects are expected to roll out. In turn, these will require more intricate and sophisticated project finance facilities and more comprehensive professional services of the sort that Hong Kong excels in providing, given its status as a super-connector for international collaboration.

With some 60 members from financial agencies, banks, investors, law firms to insurance companies, the Hong Kong Monetary Authority’s Infrastructure Financing Facilitation Office, for example, is seen as an important enabler for the ongoing development of Hong Kong as an infrastructure financing hub. In particular, its role is to help companies that are eager to invest in infrastructure projects survive the ever-changing challenges of infrastructure investment funding and financing.

Any future expansion in trade and investment will lead to a rise in demand for a number of legal services, including those relating to contractual arrangements, project management and dispute resolution. In this regard, any involvement by Hong Kong service providers offer considerable reassurance to local, Asian and Polish traders and investors as they look to benefit from the Belt and Road, on the back of the city’s trusted common law system and independent judiciary.

[1] Tholons Outsourcing Destinations List

Editor's picks

Trending articles

The Visegrad Four (V4) nations, consisting of the Czech Republic, Hungary, Poland and Slovakia, have had remarkable success in aligning and strengthening their economies to compete and play a dominant role in the regional economy of Central and Eastern Europe (CEE). They are poised to benefit most from the multifaceted alignment of the “16+1” format co-operation between Central and Eastern European countries and China) and Belt and Road Initiative (BRI).

The V4 countries, located in the heart of Europe, have seen rising trade and investment flows on the back of strengthened Sino-CEE co-operation and connectivity. Meanwhile, more and more V4 businesses have taken on a more global perspective in searching for new markets.

Hong Kong, given its unique combination of a vibrant capital market and a large professional services cluster with extensive global networks and affiliations, can be a crucial link in providing the important capital flows and the highly sought-after assurance to new-to-the-market V4 enterprises and investors.

Enhanced connectivity and increasingly vibrant investment flows have not only made it possible for each of the V4 countries to reinvent and reposition itself in the bigger picture of Sino-CEE co-operation, they have also provided traders and manufacturers with more possibilities in terms of regional distribution and supply chain management.

V4 Countries as Core BRI Partners in CEE

Central and Eastern European Countries (CEECs) have played an increasingly pivotal role in China’s foreign policy, and are key partners in the BRI. The “16+1” format and the BRI have multifaceted alignment as both development initiatives led by China are aiming at intensifying and expanding co-operation with the 16 CEECs, including investment in infrastructure and cooperation in industry and technology development.

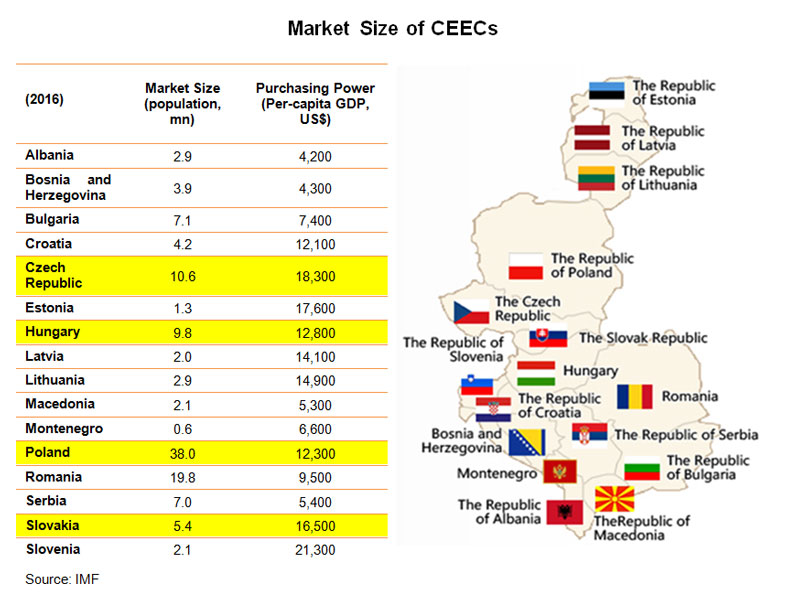

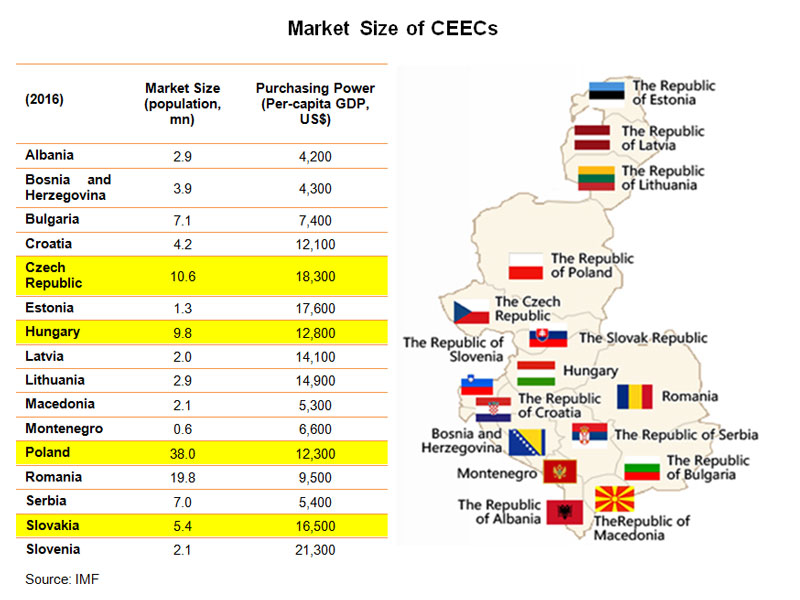

Different CEECs may benefit differently from the strengthening Sino-CEEC co-operation and connectivity subject to their own development plans and national strategies. The V4, which play a leading role in the regional economy and have had remarkable success aligning and strengthening their economies to compete effectively regionally and internationally, are poised to benefit most in drawing trade and investment interest.

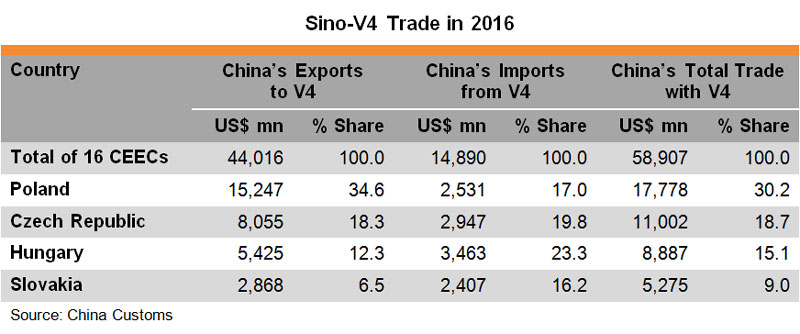

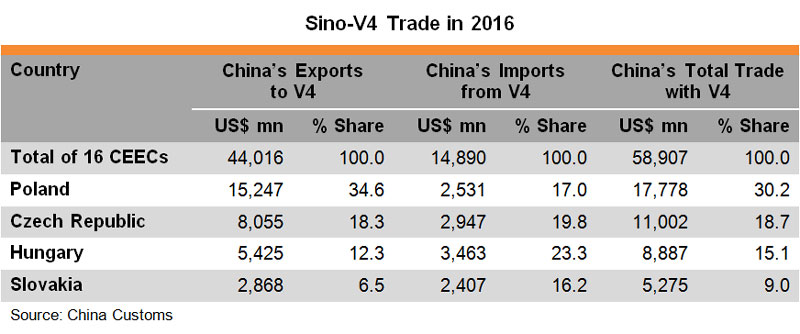

Representing more than half of the population and nearly two-thirds of the economic output of the 16 CEE member countries under the umbrella of the “16+1” format, the V4 are naturally important and active participants in the BRI. They offer a progressively interesting logistic alternative for shippers and their forwarders moving cargo between Asia and Western Europe, which is considered a priority to the success of the BRI as it aims to enhance the connectivity between Asia, Europe and Africa.

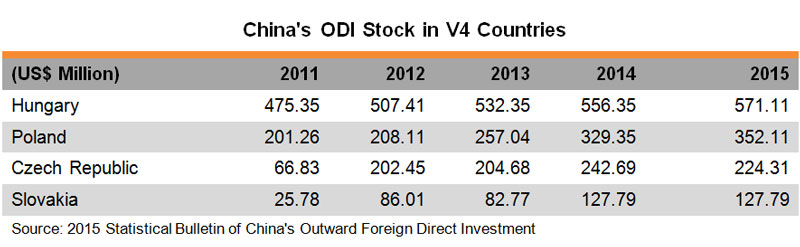

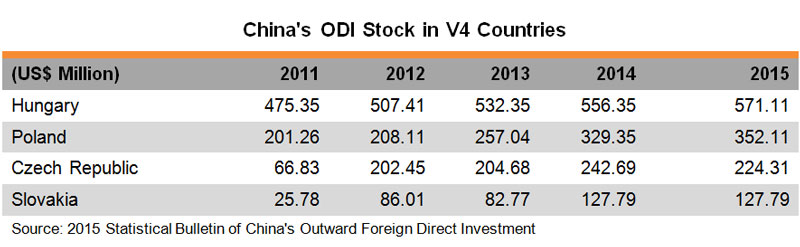

Banking on the good Sino-V4 relations and China’s continuous implementation of its “going out” strategy, China’s outbound direct investment (ODI) in the V4 countries has been flourishing, while bilateral trade blossoms. In the five years ending 2015, China’s ODI to the V4 grew by more than 65% from US$769mn to US$1.28bn, accounting for nearly two-thirds of China’s ODI in the 16 CEECs. Though China’s investment in V4 countries and the other CEECs is far from significant in the light of China’ total ODI, Hong Kong’s professional services providers and Chinese-funded corporate structures have quite often been involved in Sino-V4 investment deals such as M&As and takeovers.

While cash-rich Chinese investors have already made successful inroads into V4 countries by acquiring promising businesses over the past decade, more brownfield and greenfield projects, both private and public, are expected to materialise in the bloc in the coming years. Such a sustained wave of Chinese investment, plus generous funding from European Structural and Investment Funds (ESIF) supporting mega infrastructure projects, research and innovation and small businesses (including start-ups), will certainly give a big shot in the arm for the V4 economy to rejuvenate its industrial and commercial prowess.

Amount budgeted for period 2014-2020 Czech Republic Czech Republic, through 11 national and regional programmes, benefits from ESIF funding of €24 billion representing an average of €2,281 per person over the period 2014-2020 Hungary Hungary, through 9 national and regional programmes, benefits from ESIF funding of €25 billion representing an average of €2,532 per person over the period 2014-2020 Poland Poland, through 24 national and regional programmes, benefits from ESIF funding of €86 billion representing an average of €2,265 per person over the period 2014-2020 Slovakia Slovakia, through 9 national programmes, benefits from ESIF funding of €15.3 billion representing an average of €2,833 per person over the period 2014-2020

Source: European Commission |

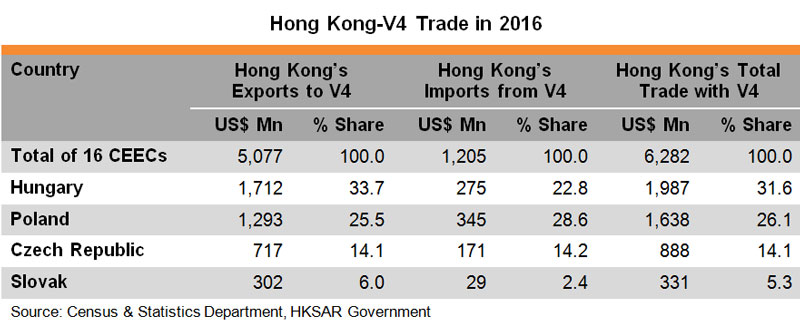

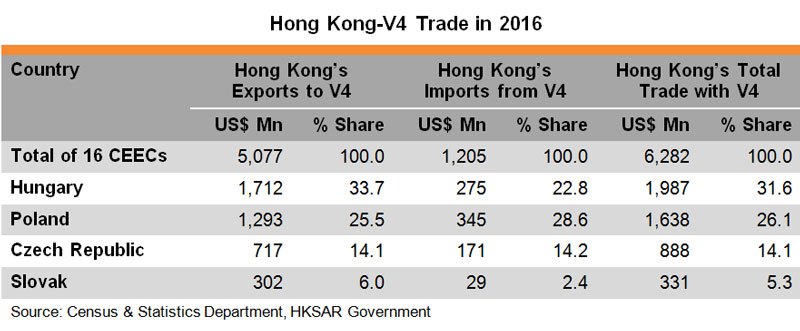

Just as they are the leading recipients of Chinese ODI in CEE, the V4 countries are also the leading trading partners of China among the 16 CEECs, accounting for 73% of the total Sino-CEEC trade in 2016. Trade between China and CEECs has remained unbalanced, however. This unbalanced trade pattern – China exported nearly twice as much as it imported from the V4 countries in 2016 – has become a raison d’etre for deeper and wider Sino-V4 cooperation from mergers and acquisitions (M&As) and takeovers to higher value-added manufacturing, technology exchanges and infrastructure and real estate (IRES) projects.

The pattern of Hong Kong’s trade with V4 countries coincides with that of Sino-V4 trade – with the four countries accounting for more than 75% of Hong Kong’s total trade with the 16 CEECs in 2016. Boasting a year-on-year growth in trade of between 9% and 22%, (compared to the regional average of less than 7%) Hungary, Poland and Slovakia were not only Hong Kong’s key trading partners in the CEE, but the city’s fast-growing export destinations in the region last year.