Insights on E-Commerce Opportunities in Singapore: Positioning of Hong Kong Products

To better understand the online shopping patterns of ASEAN consumers and help Hong Kong companies make the most of opportunities in the ASEAN e-commerce retail market, during the second and third quarters of 2024 HKTDC Research commissioned an agency to conduct a questionnaire survey of ASEAN online shoppers to gain insights into their consumption behaviours. The survey interviewed 1,846 online shoppers in June and July 2024, in six ASEAN markets ‑ Indonesia, Thailand, Malaysia, the Philippines, Vietnam and Singapore. There were roughly 300 respondents from each country. Typically, respondents were aged 18 to 60, lived in major metropolitan areas, made online purchases at least once a month and were mid‑ to high‑annual income earners. |

In March 2025, HKTDC Research published a consumer survey in six ASEAN markets, entitled ASEAN E-Commerce Opportunities: Insights on Consumer Behaviours and Positioning of Hong Kong Products. It evaluated the consumption behaviour of e‑shoppers in these markets, and their perception of Hong Kong brands and products. Using the results of the survey, this article analyses the e‑commerce landscape in Singapore and aims to help Hong Kong companies position their retail e‑commerce business in the Singapore market.

Key highlights

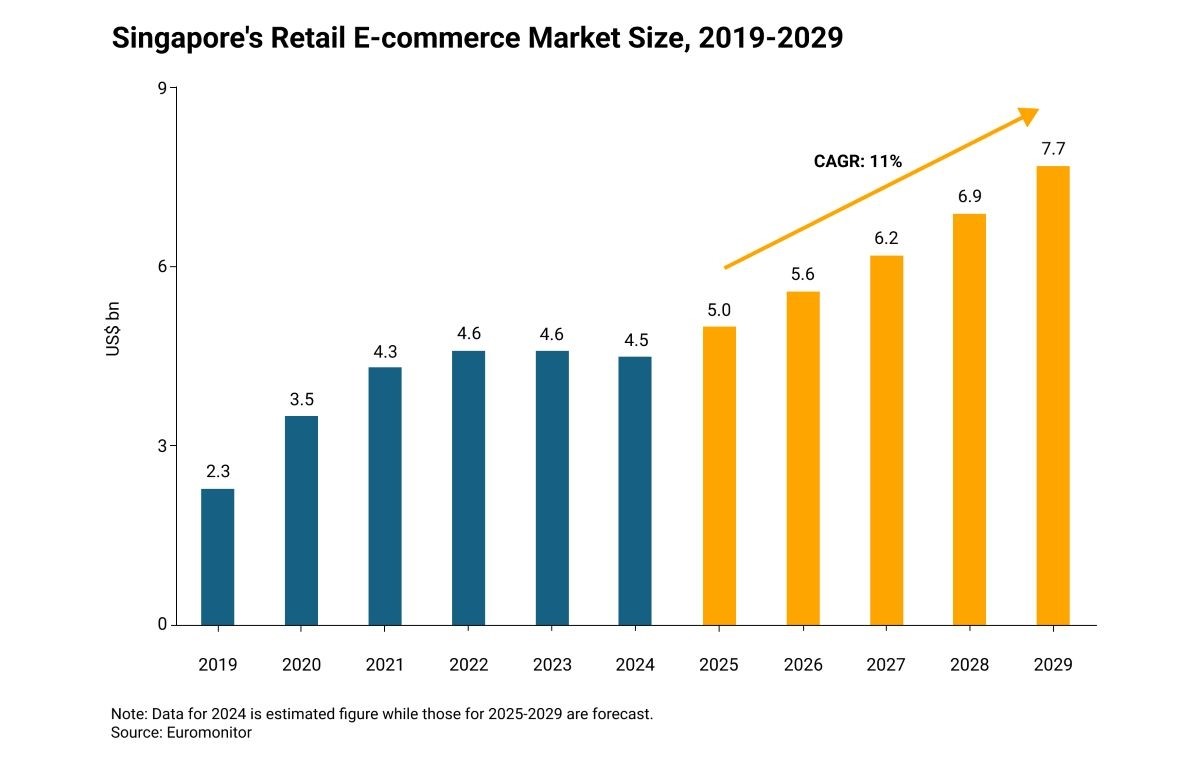

- The Singapore retail e-commerce market is expected to have double digits growth of 11% between 2025 and 2029.

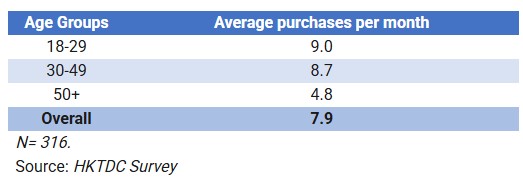

- Consumers in Singapore are frequent online shoppers, making an average of 7.9 purchases per month.

- Consumer electronics (83%), fashion (60%), cosmetics and personal care products (59%) as well as household groceries (59%) were the products most often bought online in Singapore in the past 12 months.

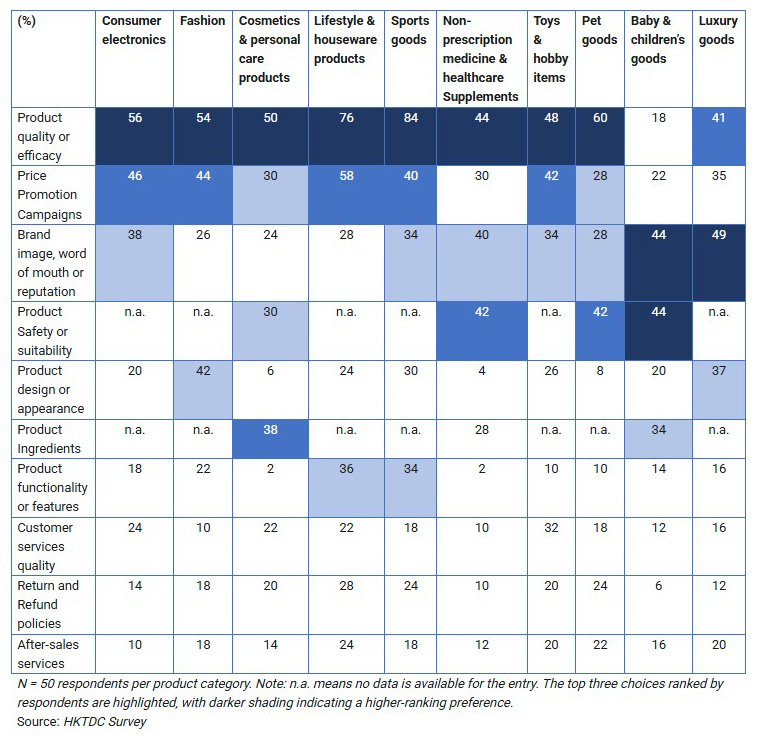

- Quality is the most important consideration for Singapore’s online shoppers. Price promotion campaigns, brand image and product safety are also key influencing factors.

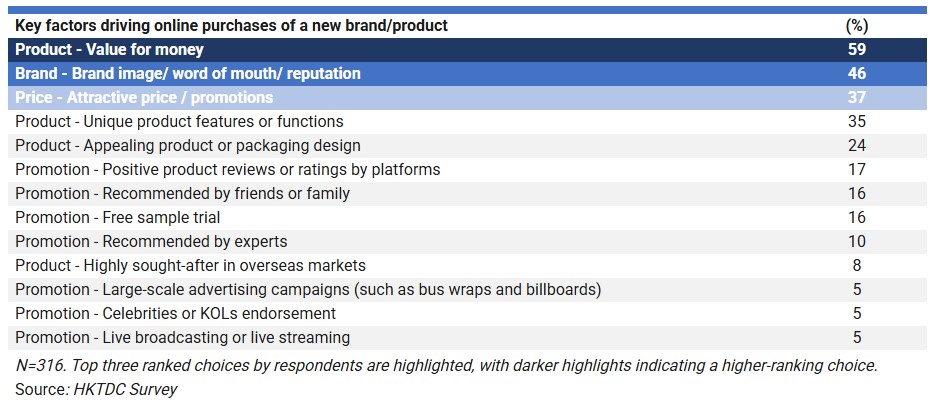

- In the case of new products or brands, e-consumers in Singapore care most about value for money (59%), followed by brand image, word of mouth or reputation (46%) and price attractiveness (37%).

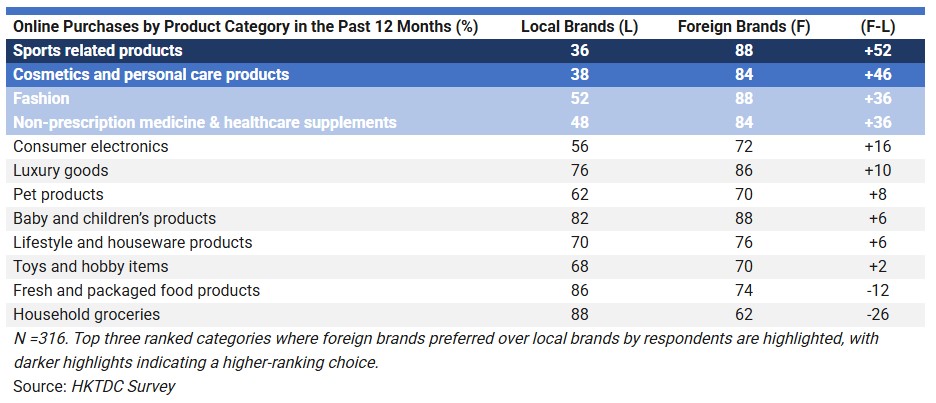

- Respondents in Singapore preferred foreign brands in ten of the 12 product categories in the survey – particularly sports products, cosmetics and personal care, fashion, and non-prescription medicine & healthcare supplements.

- 85% of respondents spend more during online shopping festivals, with an average increase in spending of 19%.

- Shopee (82% respondents made purchase) and Lazada (60%) remain the two leading e-commerce platforms in Singapore.

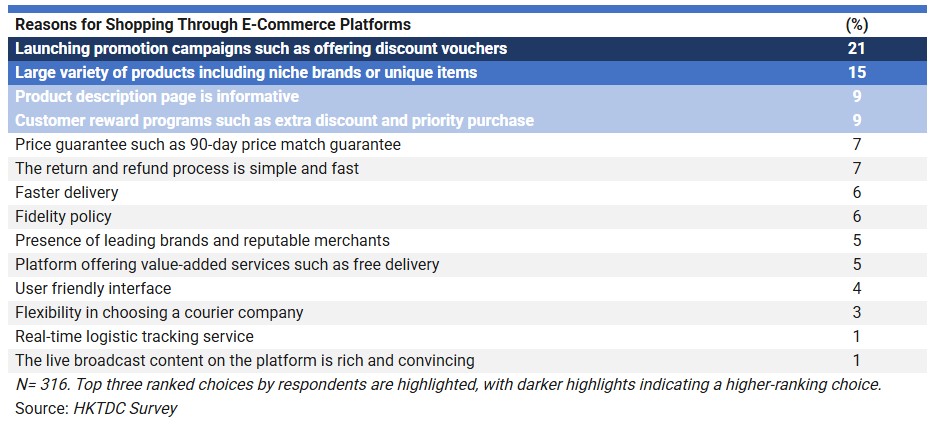

- The main reasons for consumers in Singapore favour e-commerce platforms include promotion campaigns (21%), large variety of products (15%), informative product descriptions (9%) and customer reward programs (9%).

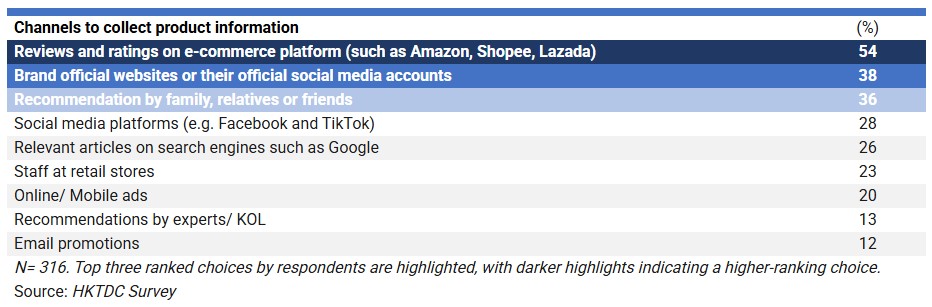

- Reviews and ratings on e-commerce platforms were deemed the most important information source for online shoppers in Singapore looking for product information (54%), followed by brands’ official websites or social media accounts (38%), and recommendations from family, relatives or friends (36%).

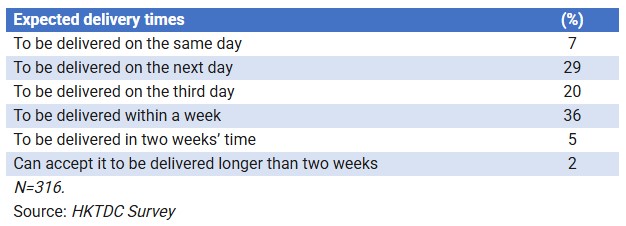

- Among e-shoppers in Singapore, the majority (56%) expect products to be delivered within three days, with 7% of respondents expecting same-day delivery.

E-shoppers in Singapore hold Hong Kong brands and products in high regard

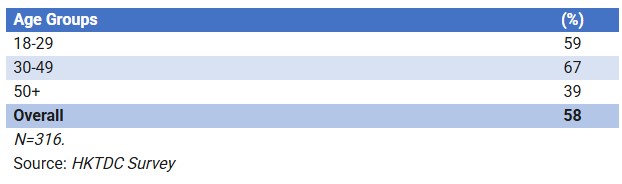

- Hong Kong brands are popular among e-consumers in Singapore, with 58% of online shoppers having purchased a Hong Kong-sourced product in the past 12 months. People aged 30 – 49 had a higher tendency to buy Hong Kong products than those in other age cohorts.

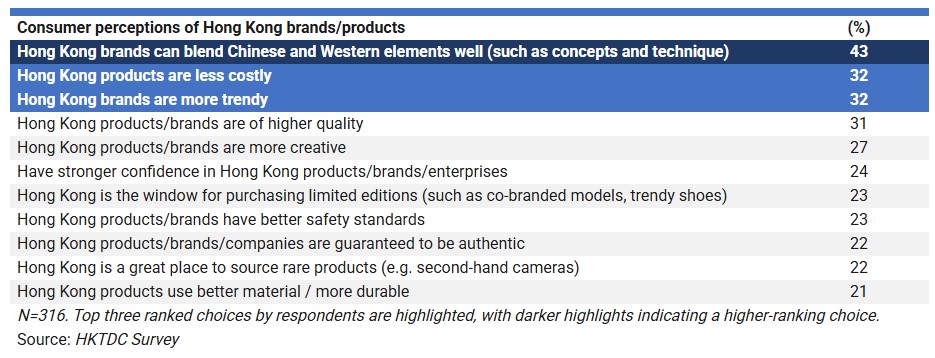

- E-consumers in Singapore see Hong Kong products as being able to blend Chinese and Western elements well (43%), more trendy (32%) and less costly (32%).

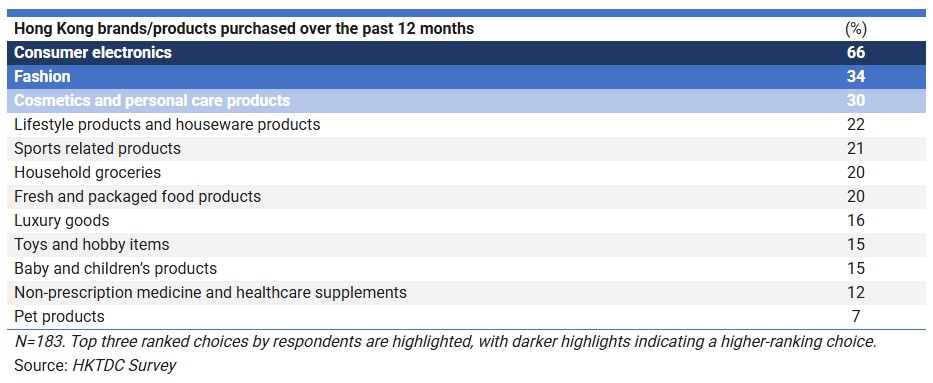

- The Hong Kong brands and products that e-consumers in Singapore reported purchasing most often were consumer electronics (66%), followed by fashion (34%) and cosmetics and personal care products (30%).

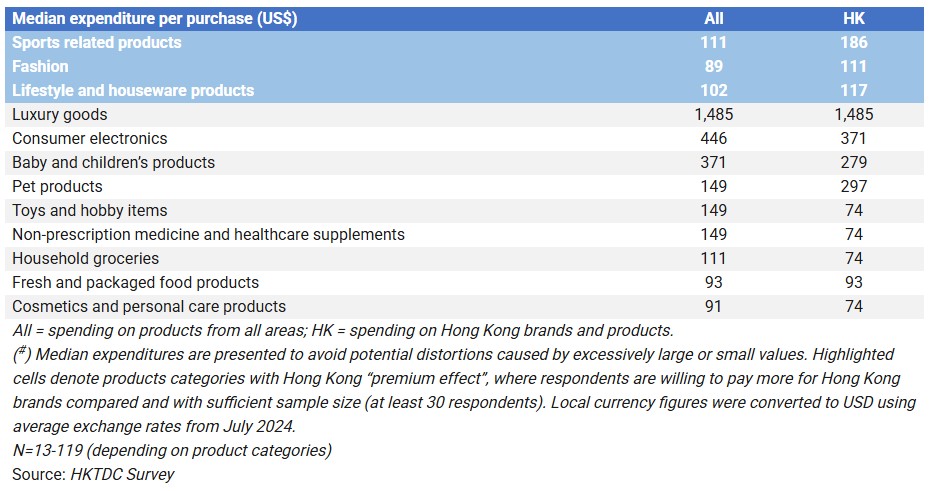

- E-consumers in Singapore tend to spend more on Hong Kong brands than brands from elsewhere on sports related products (68% more per purchase), fashion (25% more) and lifestyle and houseware products (15% more).

Hong Kong companies are selling online in Singapore

- As a supplement to the above survey, HKTDC Research conducted a series of interviews with Hong Kong businesses that are currently selling their products to ASEAN consumers through online channels.1

- The key reasons why some of these companies choose Singapore as the starting point when trying to penetrate the ASEAN e-commerce market are that it has a higher income (and hence stronger spending power) and well-developed logistics networks.

- One of these businesses, a luxury handbag designer, underlined three key issues that Hong Kong companies need to take on board when selling in Singapore: (a) develop localised products (e.g. designing water-resistant bags in Singapore where rain is common); (b) sell through brand websites (to ensure product authenticity); and (c) adopt omnichannel sale strategies by setting pop-up stalls (to enhance their customers’ shopping experience while keeping costs manageable).2

The findings from the survey highlight clear preferences among e‑shoppers in Singapore that businesses can leverage. They also suggest that Hong Kong’s businesses and brands are well placed to tap into the growing retail e‑commerce opportunities in Singapore and the ASEAN bloc.

I. Singapore Retail E-commerce Market Overview

The Singapore retail e-commerce market is expected to enjoy double-digits growth

The size of Singapore retail e‑commerce market is estimated to be US$4.5 billion in 2024. It is expected to grow from US$5.0 billion in 2025 to US$7.7 billion in 2029 (or at an average annual growth rate of 11%), according to projections by Euromonitor.

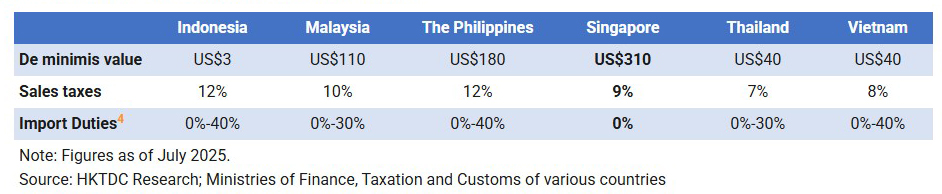

Selling directly to Singapore consumers is subject to 9% GST

By and large, Singapore is a free port. Most imports enter the nation duty‑free, with the exception of selected items such as alcohol beverages and tobacco products.3 In January 2023, Singapore imposed a goods and services tax (GST) on low‑value goods valued at S$400 (US$310) or less that are imported via air or post. The current GST rate stands at 9%. Overseas suppliers selling directly to Singapore consumers must register for GST.

De minimis values, sales taxes and import duties in the ASEAN-6

II. Preferences of Online Shoppers in Singapore

Younger cohorts are more frequent online shoppers

Singapore’s consumers shopped online an average of 7.9 times per month. The younger cohorts are more frequent online shoppers than those in older age groups. The 18‑29 age group made online purchases more frequently (9.0 times per month) than other age groups. The aged 30‑49 segment also made frequent online purchases of 8.7 times per month. The 50+ group made substantially less online purchases (just 4.8 times a month).

Consumer electronics are the most popular online purchases

Consumer electronics5 (bought by 83% of those surveyed), fashion (60%), cosmetics and personal care products (59%) as well as household groceries (also 59%) are the most popular products among online shoppers in Singapore.

Product quality is the key when making online purchases

Product quality, price promotion campaigns, brand image and product safety are the key factors influencing online purchase decisions for e‑shoppers in Singapore. Product design, ingredients, and product functionality and features are also important for several products.

Product quality or efficacy was the most important factor in eight out of the ten product categories, including sports (cited by 84% of respondents), lifestyle and houseware (76%), pet products (60%), consumer electronics (56%), fashion (54%), cosmetics and personal care (50%), toys and hobby items (48%) as well as non‑prescription medicines and healthcare supplements (44%).

By and large, price promotion campaigns ranked as the second most important factor for e‑shoppers in Singapore in five of the ten product categories, including consumer electronics (46%), fashion (44%), lifestyle and houseware (58%), sports (40%) and toys and hobby items (42%) and as the third most important factor in cosmetics and personal care (30%) and pet products (28%).

Meanwhile, “brand image, word of mouth, or reputation” was also an important consideration when Singapore online shoppers make purchasing decisions. This is particularly the case for luxury goods (where it was cited by 49% of respondents) and baby and children’s products (44%). Brand image was also rated as the third most important factor when purchasing non‑prescription medicine and healthcare supplements (40%), consumer electronics (38%), sports goods (34%), toys and hobby items (34%) and pet products (28%).

Product safety was an important factor in the purchase of baby and children’s products (where it was cited by 44% of respondents), non‑prescription medicine and healthcare supplements (42%), pet products (42%) and cosmetics and personal care products (30%). Product design is deemed important for fashion (42%) and luxury items (37%), while product ingredients stand out as a factor in the purchasing decisions regarding cosmetics and personal care products (38%) and baby and children’s products (34%). Product functionality or features are important when purchasing lifestyle and houseware items (36%) and sports goods (34%).

Major factors considered when purchasing online

Value for money is the key when buying a new brand online

When looking to purchase a new product or brand, e‑consumers in Singapore care most about value for money (59%), brand image, word of mouth or reputation (46%) and price attractiveness (37%).

E-shoppers in Singapore have a strong preference for foreign brands

In the survey, respondents said they preferred foreign brands to local ones in ten of the 12 product categories ‑ in particular sports, cosmetics and personal care, fashion, and non‑prescription medicine and healthcare supplements.

Extra 19% spending during major festivals

85% of respondents reported spending more during online shopping festivals, with an average increase in spending of 19%.

Shopee, Lazada and FairPrice Online are the top platforms for online purchases

Regional platforms Shopee and Lazada are the two leading e‑commerce platforms in Singapore. While both offer a variety of products, ranging from consumer electronics to fashion and from cosmetics to lifestyle items, Shopee is better known for its mobile‑first approach (capitalising on the high smartphone penetration in Singapore) whereas Lazada has developed LazMall, where only brand owners and authorised brand distributors are allowed to sell their products in order to ensure product authenticity. FairPrice Online, a Singapore‑based platform mainly selling household groceries, is the third most popular among Singapore’s e‑shoppers. Meanwhile, foreign platforms such as Amazon, TikTok and eBay rank fourth, eighth and tenth respectively.

Top 10 Platforms Used for Online Purchases in the Past 12 Months

Promotion campaigns and product variety are key reasons for shopping through e-commerce platforms

All respondents reported that they made purchase through e‑commerce platforms during the survey period because of promotion campaigns (21%), large variety of products (15%), informative product descriptions (9%) and customer reward programs (9%).

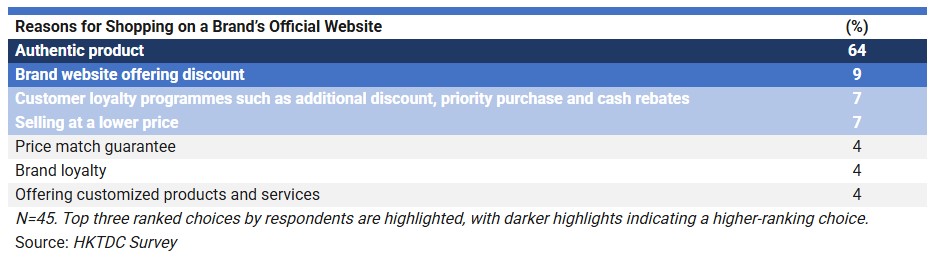

Authenticity is the key reason for shopping on a brand’s official website

About 15% of the respondents in the survey bought items on brands’ official websites during the survey period. These were likely to be products with a higher value or luxury goods, which may explain why respondents considered the guarantee of getting an authentic product the primary reason to shop on official websites (cited by 64%).

Reviews and ratings on e-commerce platforms is the most influential channel

For e‑consumers in Singapore, the most important channel for collecting product information was reviews and ratings on e‑commerce platforms (cited by 54% of respondents), followed by brand official websites or social media accounts (38%) and recommendations by families, relatives or friends (36%).

The majority expected delivery within 3 days

Among e‑shoppers in Singapore, more than half (56%) expect products to be delivered within three days. Another 36% expect products to be delivered within one week.

III. Hong Kong Brands in Singapore

A majority of survey respondents (58%) had purchased a Hong Kong brand or product over the past 12 months. Among them, those aged 30–49 showed a higher tendency to buy Hong Kong products than other age cohorts did.

Purchasing Hong Kong Brands or Products in the Last 12 Months

Hong Kong consumer electronics is the most popular items purchased online

The Hong Kong brands and products that the respondents reported purchasing most often were consumer electronics (cited by 66%), fashion (34%) and cosmetics and personal care products (30%).

E-shoppers see Hong Kong brands and products blend Chinese and Western elements well, more trendy and less costly

When asked about their views on Hong Kong brands or products, 43% of respondents said that they blend Chinese and Western elements well, 32% of them saw these products more trendy and less costly.

E-shoppers in Singapore tend to spend more on Hong Kong sports, fashion as well as lifestyle & houseware products

The difference in the amount that e‑consumers in Singapore spend on Hong Kong brands rather than on brands from elsewhere is particularly marked in certain product categories. Specifically, they spend 68% more on sports related goods from Hong Kong, 25% more on fashion and 15% more on lifestyle and houseware products.

1 See HKTDC Research (2025) ‑ The ASEAN E-Commerce Marketing Strategies and Tactics: The Experts’ Opinion

2 See HKTDC Research (2025) ‑ Start In Singapore: Advice for Selling Luxury Products in ASEAN

3 In Singapore, duties on alcohol and tobacco products are charged based on import quantity. For example, duties on alcohol products can be as high as S$88 (US$70) per litre while the maximum duty on tobacco products is S$491 (US$380) per kilogram.

4 Depending on the types of imported goods, import duties can be as high as 150% for products such as spirits and alcohol in some of these countries. Import duties rates listed in the table above typically refer to consumer goods sold via retail e‑commerce.

5 This includes audio & video products, home appliances, computers & related accessories, smartphones, tablets & related accessories, e‑sports products and equipment (such as consoles, accessories and games) and other consumer electronic products and accessories (such as wearable electronic devices, power banks, electronic healthcare devices, etc).

Original article published in https://hkmb.hktdc.com