ASEAN Ascends – Indonesia: Manufacturing in Central and East Java

Java Island – Indonesia’s growth engine

Java Island is home to over half the population of Indonesia and is the growth engine of the country’s economy. In the first quarter of 2025, Java Island contributed 57.4% of Indonesia’s GDP and enjoyed a growth rate of 4.99%, the second‑highest growth rate of the major islands. The Island has been Indonesia’s main economic centre for the past decade, accounting for an average 58% of the country’s GDP during that time. Jakarta and Surabaya, the logistics hubs of Western and East Indonesia respectively, are both located on Java Island. The Island as a whole exports US$101 billion of goods, accounting for over 38% of Indonesia’s total exports.

In view of the growing interest in Indonesia as an investment and manufacturing destination, HKTDC Research conducted on‑site research in Central and East Java to better understand the manufacturing environment and trends in both areas.

Java investment

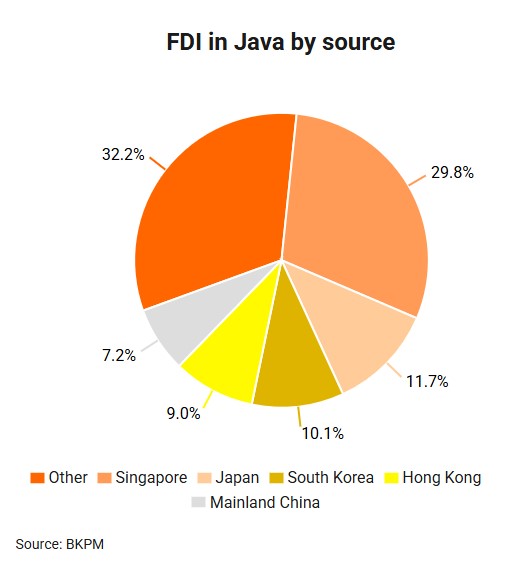

In 2024, about half of foreign investments (45.8%) in Indonesia were invested in Java Island, valued at US$27.5 billion. Outside Java Island, Central Sulawesi and North Maluku also attracted notable FDI, as the two provinces are well known for having abundant minerals resources.

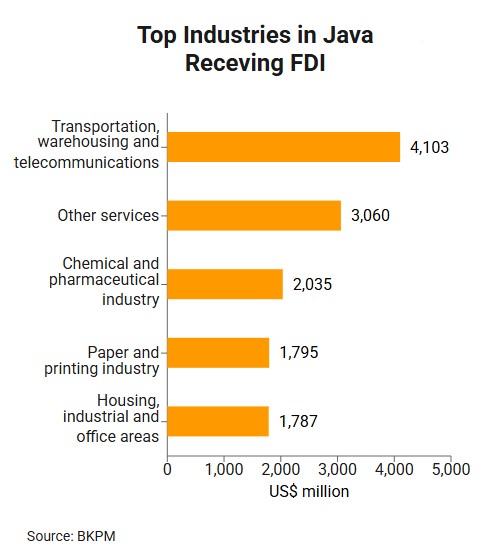

Foreign investments into Java are mainly directed towards transportation, warehousing and telecommunications (14.9% of total foreign investments into Java), chemical and pharmaceutical industry (7.41%), paper and printing industry (6.5%), and housing, industrial and office areas (6.5%).

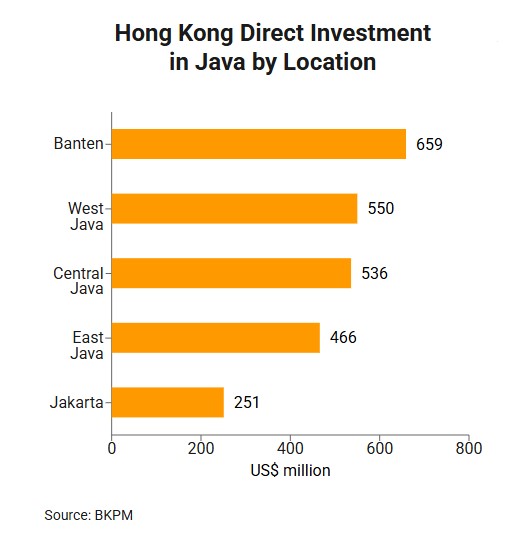

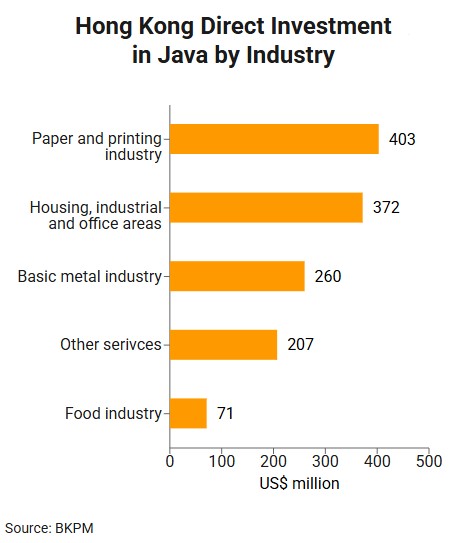

Specifically, investments from Hong Kong (US$2,464 million) are mainly in the paper and printing industry (16.4% of Hong Kong investments into Java), housing, industrial and office areas (15.1%), basic metal industry (10.5%), other services (8.4%), and the food industry (2.9%).

Both Central Java and East Java are home to a wide range of manufacturing industries. According to local business sources, Central Java tends to be more focused on light industry (such as fashion, furniture, textiles and garments, electronics and food), while East Java tends to have a greater concentration of heavy industries (such as chemicals, electronics, energy, feed mill and automotive).

| Notable Industries | |

| Central Java | East Java |

|

|

Source: HKTDC Research | |

Industrial parks

Industrial parks are an important part of Indonesia’s manufacturing environment, with over 140 such parks currently operating in the country.

Some industrial parks have been designated Special Economic Zones (SEZs), though not all SEZs are industrial parks. Since the first SEZ establishment in 2012, 24 SEZs have been set up across Indonesia, with each focused specifically on key sectors, such as manufacturing, energy, education, healthcare, financial services, tourism and R&D.

Industrial parks and SEZs provide several advantages for the foreign and local companies operating in them.

Industrial clusters

Industry clusters – where upstream and downstream companies in a supply chain are physically located close to each other – are emerging in Indonesia’s industrial parks. Among other benefits, these can help reduce logistics costs, shorten production time, and generally improve the ease of doing business for companies located in these clusters.

Large companies, known as anchor investors (or “Queen bees”), have been seen to bring along upstream and downstream business partners to the same industrial park in order to build up a comprehensive supply chain.

Clusters in these industrial parks can serve a variety of markets – some are domestic‑focussed, some are entirely export focused, while others serve both.

Sustainability features

Sustainability is a growing focus in industrial parks, which might be attractive for investors or companies that have sustainability targets or require sustainability certification.

One feature is sustainability‑related infrastructure. Some industrial parks use rooftop solar panels to generate electricity. Others feature solid and liquid waste management systems, including wastewater facilities that adopt ultrafiltration and reverse osmosis recycling technologies to ensure no liquid waste is discharged into the environment, rainwater reservoirs to make better use of natural water resources, and processing facilities that turn waste into refuse‑derived fuel and organic fertiliser. Industrial parks are also installing EV charging stations to power vehicles, such as battery‑powered forklifts.

Software development plays a vital role. Some industrial parks implement IoT‑based solutions to monitor and share real time data on water and electricity usage, as well as emission and waste reduction. This can then be provided to tenants for certification purposes.

Benefits of SEZs

Industrial parks in Central and East Java mainly offer the option for renting industrial land and building factory facilities, though renting of ready‑built factories is also possible. The right to use of a land in Indonesia’s industrial parks can last up to 80 years, subject to two extensions after 30 and 50 years since acquisition.1

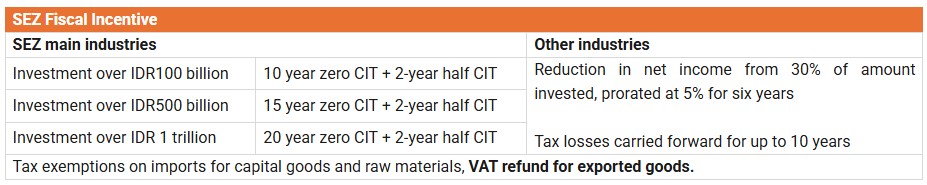

In order to attract investment, the Indonesian government has prioritised over 200 business sectors such as textiles and garments, pharmaceutical, cosmetics and the energy sector. Fiscal incentives are offered to investors in these sectors such as 30% reduction in taxable income on total investment for six years, and 50% corporate income tax (CIT) reduction.

Investments made into SEZs, however, can enjoy special tax incentives of up to 20 years tax holiday if the investment is made in the SEZ’s focus industry. Other fiscal incentives include import tax exemptions on capital goods and raw materials and VAT refunds on exported goods.

Doing business in Indonesia can be complicated. For example, imported goods for local use have to be imported by licensed importers, and requirements are being phased in requiring a wide range of consumer goods to be Halal certified. Additionally, obtaining environmental licenses is one of the most complicated challenges for foreign investors when they plan to set up factories. Before the Omnibus Law (Indonesian Job Creation Law) was enacted, environmental impact assessment (AMDAL) was mandatory for many projects. This was replaced by a risk‑based system where companies could instead submit a UKL‑UPL, which stands for Efforts for Environmental Management and Monitoring, if their business activities were relatively small and have no significant impact on the environment. An Online Single Submission platform has also been created to simplify administrative costs for companies. Despite these improvements, companies often face difficulties and bureaucratic hurdles when it comes to dealing with regulations.

Licensing services offered by SEZs to help investors deal with regulatory and business registration issues are therefore valuable. Thanks to the special status of SEZs, significant licensing and supervisory authority is delegated to SEZs’ respective administrators which enables them to provide a single point of contact for licensing and regulatory oversight, and hence streamline business registration. Taking environmental licensing as example, this reduces the time required to just about a month for industries deemed not to pose a significant impact on the environment.

Additionally, foreign workers in SEZs receive special treatment whereby they can obtain temporary resident status for themselves and their families. This is also important to companies that expand their production lines in Indonesia as they often need to send staff from their home country to oversee the project in Indonesia, either for management purposes or for training local staff.

Improving infrastructure

Both Central and East Java provinces have been developing roads and railroads to improve connectivity between their ports and industrial areas.

East Java has relatively more developed infrastructure. Tanjung Perak, the port of Surabaya, is Indonesia’s second busiest port and the key trade and logistics hub for Eastern Indonesia, facilitating trade domestically and internationally. In view of the busy traffic of the Surabaya port, some industrial parks in East Java have also developed their own ports, including ports specifically for handling bulk cargo and LNG. Some of these ports are also open for use to companies outside the industrial park, helping to reduce pressure on the Surabaya Port.

The supply of electricity and quality of internet connections are also well perceived by manufacturers in Indonesia, particularly in Java. Notably, East Java province is exporting electricity to Central Java and Bali.2 Internet connections are also stable, characterised by the fact that some foreign companies are adopting IoT‑enabled management tools to monitor their production lines and share real‑time information with their headquarters back in home country. It is expected that Indonesia will accelerate their 5G ecosystem development, as announced by the country’s Communication and Digital Affairs Minister in May 2025.3

Access to labour

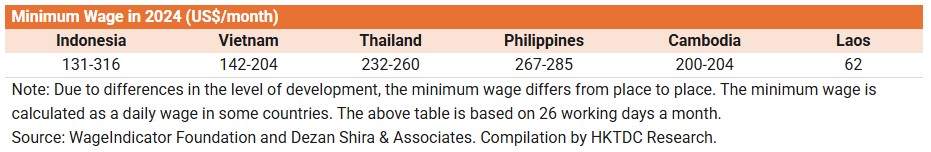

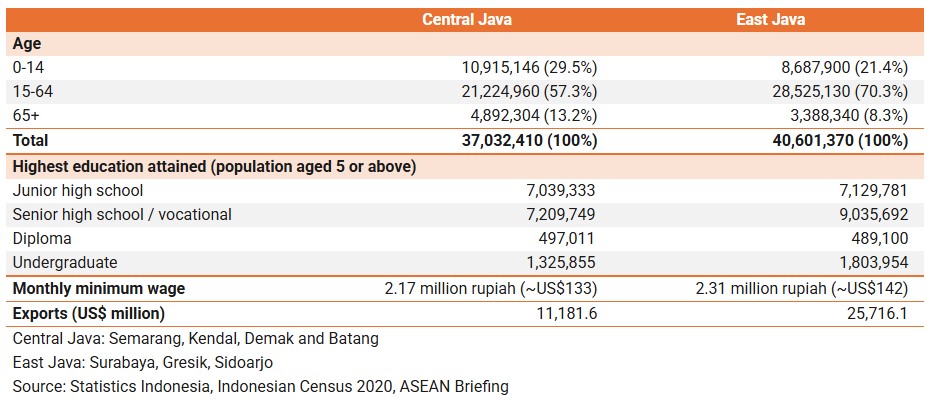

With a monthly minimum wage of 2,169,348 rupiah (~US$133), Central Java has the lowest minimum wage across all provinces in Indonesia. This is also competitive when compared to other countries in the region (see table below). This indicates that the province has an abundant labour supply and is suitable for developing light industry, which is relatively labour intensive.

Similar to Central Java province, East Java province also has a large working age population. With more than 6 million population in Surabaya and the surrounding area, labour supply for industrial parks is not an issue. Notably, a higher proportion of population has attained senior high school / vocational school or undergraduate education in East Java compared to Central Java. This might explain the observation that East Java tends to have more capital‑intensive industries requiring more specialised training.

That being said, specialised labour is not yet abundant. Some heavy industry companies, for instance, note that workers need additional training for up to a whole year in order to fully operate the machines in the factory. It is expected that the supply of skilled labour will increase as clusters in industrial parks become more relevant, more technical or vocational schools emerge to support them, and workers gain the relevant experience and skillsets.

Readiness for manufacturing

In conclusion, the huge investment flows into Indonesia from Hong Kong and Mainland China in recent years are a testament to Indonesia’s potential as a manufacturing base, as well as business confidence in the country’s rich natural resources, abundant labour supply, and rapidly developing infrastructure and industrial areas.

With the advantages of offering special incentives, one stop investor services, and burgeoning industry clusters and sustainability elements, industrial parks and SEZs can offer beneficial platforms for Hong Kong manufacturers looking to develop supply chains in Indonesia.

1 For details about Vietnam industrial parks please refer to the article ASEAN Ascends – Vietnam Evaluated: Industrial Parks Facilitate Foreign Businesses’ Supply Chain Diversification.

2 James Parulian Manurung, M. SidikBoedoyo, SriSundari, Ronald Sianipar, International Journal of Innovative Science and Research Technology: Management of the Energy Sector and Coal Phase‑Out in East Java Province to Support the State Defense.

3 Indonesia committed to building a 5G ecosystem in Asia-Pacific.

Original article published in https://hkmb.hktdc.com