Access Africa – Morocco: A Gateway to MENA and Beyond

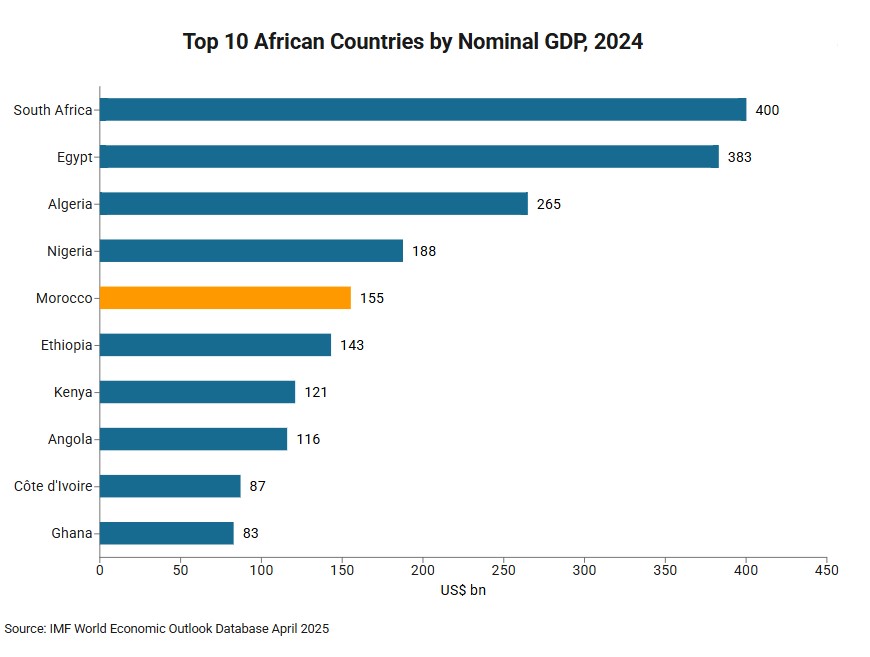

Morocco is the only African country with both an Atlantic and a Mediterranean coast. In 2024, it was the fifth largest economy in Africa, with a nominal GDP of US$155 billion and an annual growth rate of 3.2%, higher than the 2.8% rate posted by the continent as a whole. The IMF predicts that Morocco’s economy will continue to expand for the rest of this decade, with an average annual growth rate of 3.7% between 2025 and 2030.

This article will begin by looking closely at recent developments in the Moroccan economy, including its key trading partners and investment sources. This will be followed by an overview on the policies its government has put in place to support business investment and the country’s investment priorities, and its connectivity with its trading partners in terms of port infrastructure and FTA networks. Finally, it will look at economic relations between Morocco and Hong Kong, with a view to highlighting opportunities in Morocco for Hong Kong businesses.

An economy in transition

Morocco has successfully modernised and diversified its economy since the early 2000s, transitioning into a lower‑middle‑income nation.1 In recent years, measures have been implemented to stimulate investment from the private sector and develop higher valued added industrial activities. The percentage of Morocco’s GDP accounted for by primary sector activities such as agriculture and fishing has fallen over the last quarter‑century or so, from 18.1% in 1998 to 12.6% in 2018 and 12.3% in 2023. Together, the industrial and services sectors now constitute almost 90% of the country’s national income. In recent years, Morocco – because of its relatively low production costs and proximity to European markets – has become an increasingly popular destination for manufacturers, (especially in the automotive and aerospace industries) and has become markedly more relevant to global supply chains.

A key player along Belt and Road in Africa

Partly due to its history as a French colony and its proximity to the Iberian Peninsula, Morocco’s economic ties with south‑western Europe are strong. Spain is its top export market and import source. In 2024, Morocco’s exports to Spain were worth US$10.2 billion (21.0% of the country’s total exports), while the value of its imports from Spain was US$12.5 billion (19.6% of the total). France is the country’s top source of FDI, investing US$1.4 billion in 2024 – almost one‑third of Morocco’s total FDI inflow that year.

Recent years have seen Mainland China’s involvement in the Moroccan economy grow. This followed the signing in 2017 of a Memorandum of Understanding on the Belt and Road Initiative between the two countries. Morocco became the first Maghreb country to join the initiative.2 Since then, Sino‑Moroccan trade has increased from US$4.4 billion in 2017 to US$9.5 billion in 2024. This represents a compound annual growth rate (CAGR) of 11.6%, outpacing the corresponding rate of 8.2% for Morocco’s total merchandise trade over the period. Electronics products such as consumer electronics and related parts and components, including semiconductors and integrated circuits, are some of the major commodities in this bilateral trade.

Mainland China has also become an increasingly important source of FDI for Morocco, particularly in the development of infrastructure and emerging sectors such as technology and electric vehicles. For example, in 2022, Morocco signed an accord with the Mainland, under which Chinese companies took a 35% stake in a US$10 billion technology hub near the port of Tanger Med called Tangier Tech City. Meanwhile, Chinese car manufacturers and producers of related components such as EV batteries have established production bases in Morocco, in order to take advantage of the country’s proximity to European markets and its extensive free trade agreements network (outlined below) and create an alternative route into key markets such as the EU and the US.3 In 2024, Mainland China was Morocco’s fifth largest FDI source behind France, the UAE, Germany and Spain, contributing investment of US$209 million (about 5% of the total FDI inflow).

The new investment charter is boosting private investment

Moroccan firms tend to be small (about 90% have ten or fewer employees) with a high level of informality. Because of the financial and technical constraints this imposes on them, their ability to upgrade and expand their operations is limited. Indeed, while investment in Morocco has been strong compared to that of its neighbouring countries, it has largely been public‑led investment and efficiency has been low.4

In 2022, the Moroccan government promulgated its new investment charter, the Charte de l’Investissement, which is designed to encourage private investment and support the country’s SMEs. Its aim is to raise private investment (including both domestic and foreign) by US$55 billion, so that it accounts for around two‑third of the country’s total investment, and to create 500,000 jobs by the end of 2026.

The Charte de l’Investissement has improved the country’s business climate by streamlining administrative procedures, creating a one‑stop shop to support investors, introducing a multi‑layer investment support mechanism, and offering a total subsidy of up to 30% of the eligible investment amount. The maximum subsidy available for renewable energy projects, is US$3 million.5

Investment Support Mechanism under the Charte de l’Investissement

| Common Incentives |

|

| Territorial Incentives |

|

| Sectoral Incentives |

|

Sources: Moroccan Investment and Export Development Agency, OECD |

The Charte de l’Investissement also provides training and guidance for Moroccan SMEs and micro‑businesses and helps the country’s companies expand their operations abroad.

Between May 2023, when the Charte de l’Investissement came into force, and June 2024, Moroccan authorities approved over 100 projects with an estimated value of (US$17 billion) and commitments to create over 96,000 jobs. Domestic businesses accounted for the majority of approved investment projects. In June 2024, the total value of approved investments had reached about one‑third of the charter’s target for 2022‑2026, and about 20% of the job creation target had been met.6

Port of Tanger Med – largest port in Africa by TEU handling

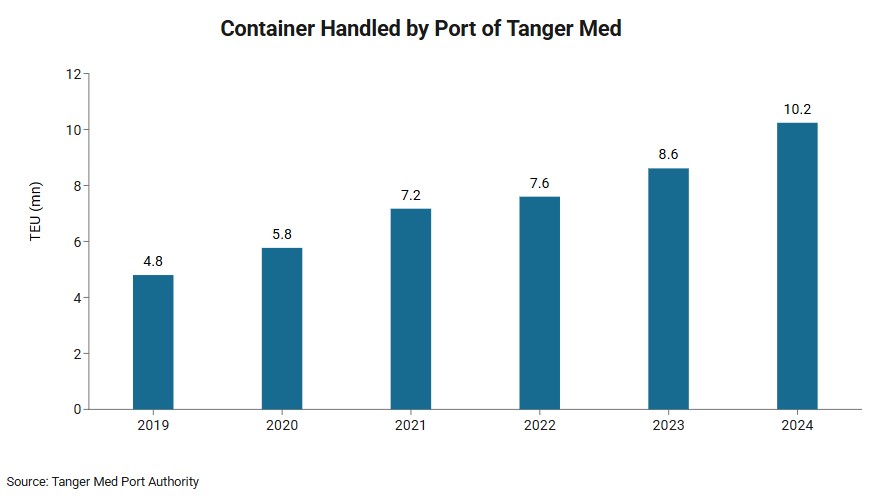

Logistics is one of the priority sectors for investment under the Charte de l’Investissement. The industrial port complex of Tanger Med, situated on the Strait of Gibraltar and directly opposite Tarifa in Spain, is Africa’s largest port and connects the continent with Europe and the US. In 2024, it handled 10.2 million TEUs (up 18.9% on the previous year), making it the 17th busiest container port in the world and the only African port in the top 30.7

Tanger Med has connections to more than 180 ports in 70 economies. Ships from there can reach most Western European ports in five days or under, the US in ten days and Asia Pacific (including Hong Kong) in 20 days.8

The Tanger Med Port Complex covers 1,000 hectares and consists of Tanger Med 1 Port and Tanger Med 2 Port (each of which has two container terminals, terminals which specialise in wheeled cargos such as cars and trucks, and a logistics zone which provides warehousing, packaging and quality inspection services). It is a regional logistics hub with its own Port Community System, making the automation of administrative procedures possible along logistics chains and increasing the port’s overall efficiency.9

China Merchants Port Holding (a Mainland‑based enterprise listed on the Hong Kong Stock Exchange) owns a 40% share in Tanger Med 2 Port, through one of its subsidiaries. It has also invested in Casablanca’s Somaport, reflecting the rising presence of Chinese companies in Morocco.10

In order to meet the rising demand for logistics, the Moroccan government introduced its 2030 National Port Strategy, a plan to invest US$7.5 billion in upgrading and expanding 27 of the country’s ports. One key project is the development of Dakhla Atlantic Port, at an estimated cost of US$1.7 billion. This aims to boost trade and investment in the southern part of the country and facilitate logistics flows from western Africa to European and American markets. The first phase of this project is expected to be completed by 2030.11

Extensive FTA network

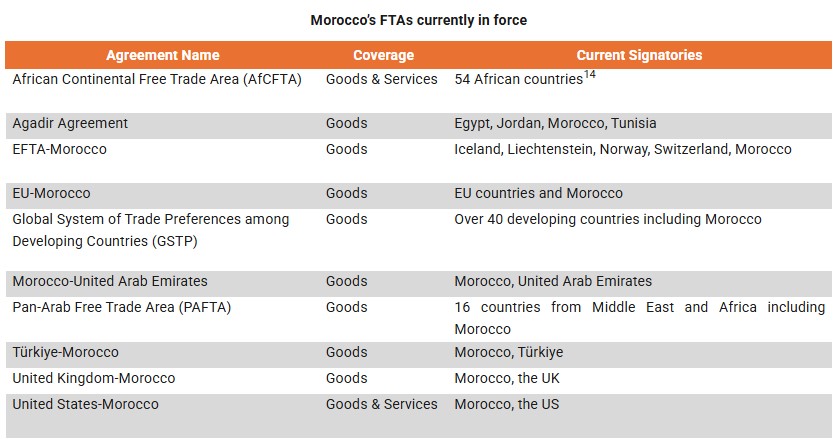

Morocco has an extensive network of free trade agreements (FTAs), including preferential trade agreements with 62 countries.12 It is a signatory to the African Continental Free Trade Area (AfCFTA), which aims to create a single market for goods and services across Africa with tariffs and non‑tariff barriers being gradually eliminated. On 12 June 2025, it was announced that Mainland China will remove import tariffs on goods from 53 African countries, including Morocco.13 Although Morocco has not escaped the so‑called “reciprocal” Trump tariff currently being implemented by the US, the 10% figure that the White House announced in April 2025 that is to be imposed on Morocco is the lowest faced by any African country.

Source: WTO Regional Trade Agreements Database

Hong Kong-Morocco businesses ties

Hong Kong businesses have a presence in Moroccan retail markets. For example, AS Watson Group, a Hong Kong‑based company, is the parent company of Marionnaud, a French‑based luxury perfumery and cosmetics retailer with outlets in cities like Casablanca.

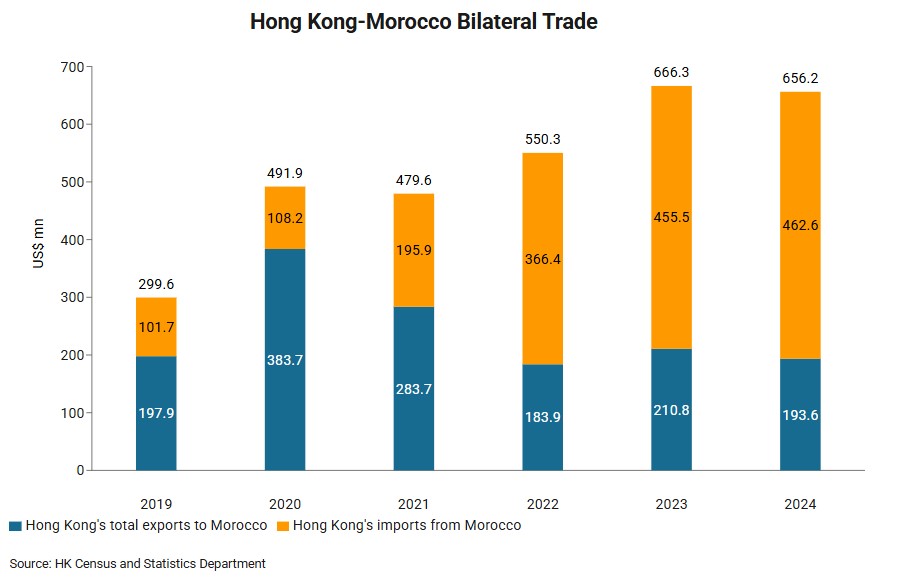

Hong Kong‑Morocco trade has been growing rapidly in recent years. In 2024, bilateral trade amounted to about US$656 million, having increased since 2019 at a CAGR of 17.0%. This is a much faster rate than the 2.6% CAGR of Hong Kong’s total trade with the world over the same period.

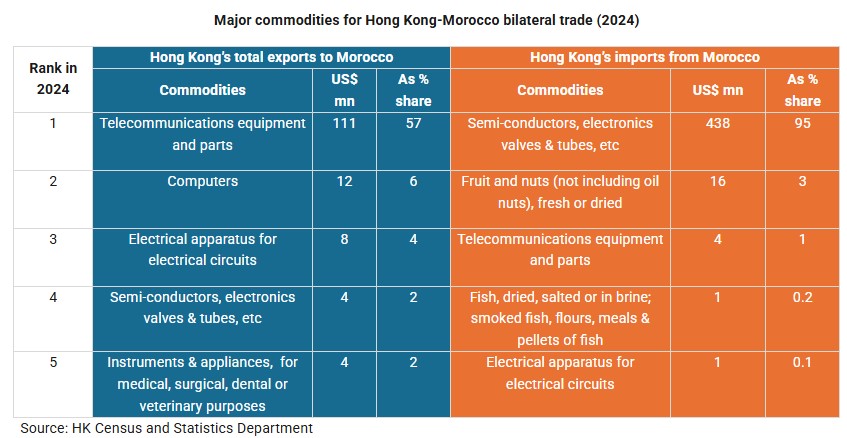

In 2024, Hong Kong’s exports to Morocco were valued at US$194 million, with telecommunication equipment & parts accounting for 57% of the total. Computers, semiconductors and related components, and electrical apparatus for electrical circuits together contributed a further 12%. Meanwhile, Hong Kong’s imports from Morocco in 2024 amounted to US$463 million, with semiconductors, electronics valves & tubes accounting for 94% of the total.

Opportunities for Hong Kong companies

Morocco’s business‑supportive policies, robust infrastructure, proximity to Europe and preferential access to key markets mean that it holds potential for Hong Kong businesses in the following areas:

- accessing European and African markets – given Morocco’s proximity to and logistical connections with Europe, Morocco could be a gateway to both European and African markets;

- exploring local opportunities – sectors such as logistics, manufacturing, renewable energy and the digital economy are considered priority sectors with sector-specific incentives under the Charte de l’Investissement. This may present opportunities for Hong Kong businesses; and

- providing professional services – as Morocco is expanding its logistics capacity by building new ports, this may create opportunities for Hong Kong’s port and maritime services providers.

1 IMF (2023) – Morocco: 20 Years of Reforms

2 Maghreb refers to region of North Africa bordering the Mediterranean Sea, including countries like Morocco, Algeria, Tunisia and Libya. See Assomac (2022) – Belt and Road Initiative in Morocco.

3 See New York Times (2025) ‑ Why China Is Investing So Much Money in Moroccan Factories

4 See OECD (2024) – OECD Economic Surveys: Morocco 2024

5 For details, see Moroccan Investment and Export Development Agency (2023) – The Investment Charter

6 See OECD (2024) – OECD Economic Surveys: Morocco 2024

7 See Lloyd’s List (2025) – One Hundred Ports 2025

8 See Tanger Med (2021) ‑ Livret-des-Connexions-Maritimes-2021-2022

9 See Tanger Med (2025) – Tanger Med Port Community System

10 See HKEX (2013) ‑ 有關收購 TERMINAL LINK SAS 的 49% 股權的須予披露交易

11 See International Trade Administration, the US (2025) ‑ Morocco Country Commercial Guide (infrastructure)

12 See International Trade Administration, the US (2025) ‑ Morocco Country Commercial Guide (Trade Agreements)

13 See HKTDC Research (2025) ‑ Africa: China to Remove Import Tariffs on Goods from African Nations

14 All African countries except Eritrea have signed or ratified AfCFTA. See Africa Trade Foundation (2025) – AfCFTA Ratification Status

Original article published in https://hkmb.hktdc.com