Insights on E-Commerce Opportunities in Malaysia: Positioning of Hong Kong Products

To better understand the online shopping patterns of ASEAN consumers and help Hong Kong companies make the most of opportunities in the ASEAN e-commerce retail market, during the second and third quarters of 2024 HKTDC Research commissioned an agency to conduct a questionnaire survey of ASEAN online shoppers to gain insights into their consumption behaviours. The survey interviewed 1,846 online shoppers in June and July 2024, in six ASEAN markets ‑ Indonesia, Thailand, Malaysia, the Philippines, Vietnam and Singapore. There were roughly 300 respondents from each country. Typically, respondents were aged 18 to 60, lived in major metropolitan areas, made online purchases at least once a month and were mid‑ to high‑annual income earners. |

In March 2025, HKTDC Research published a consumer survey in six ASEAN markets, entitled ASEAN E-Commerce Opportunities: Insights on Consumer Behaviours and Positioning of Hong Kong Products. It evaluated the consumption behaviour of e‑shoppers in these markets, and their perception of Hong Kong brands and products. Using the results of the survey, this article analyses the e‑commerce landscape in Malaysia and aims to help Hong Kong companies position their retail e‑commerce business in this Malaysia market.

Key highlights

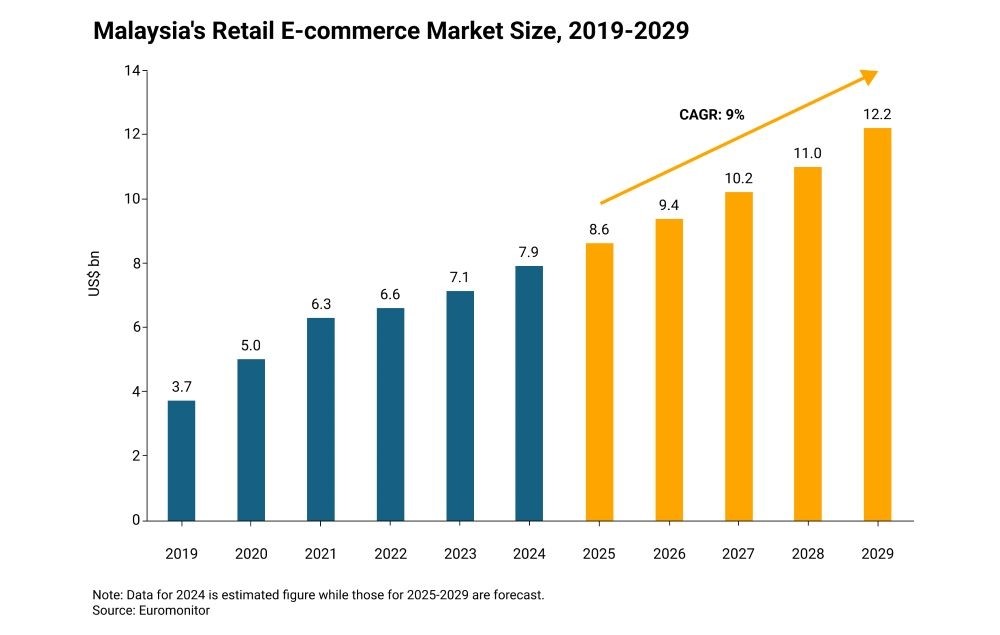

- Malaysia’s retail e-commerce market is expected to grow by an average annual rate of 9% between 2025 and 2029.

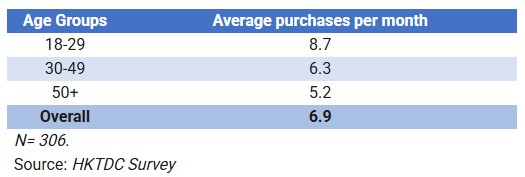

- Consumers in Malaysia are frequent online shoppers, making an average of 6.9 purchases per month.

- Consumer electronics (84%), fashion (69%), and cosmetics and personal care products (61%) were the three most popular products among online shoppers in Malaysia during the period of the survey.

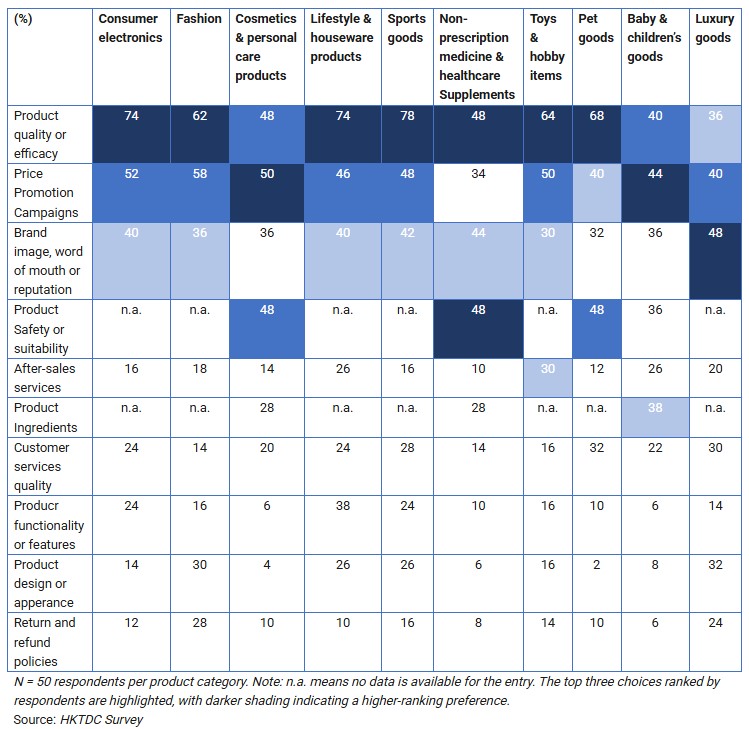

- Quality is the most important consideration across most product categories for Malaysia’s online shoppers. Other key factors influencing purchasing decisions are price promotion campaigns, brand image and product safety.

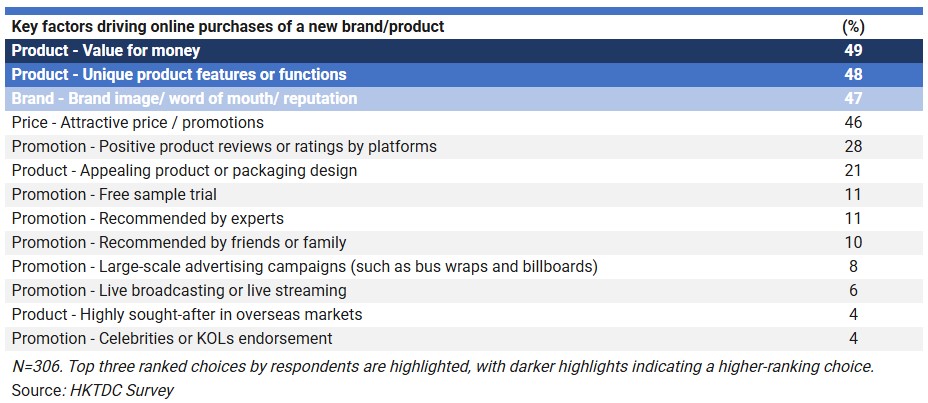

- When considering purchasing new products or brands, online shoppers in Malaysia care most about value for money (49%), followed by the product’s unique features or functions (48%) and then its brand image, word of mouth or reputation (47%).

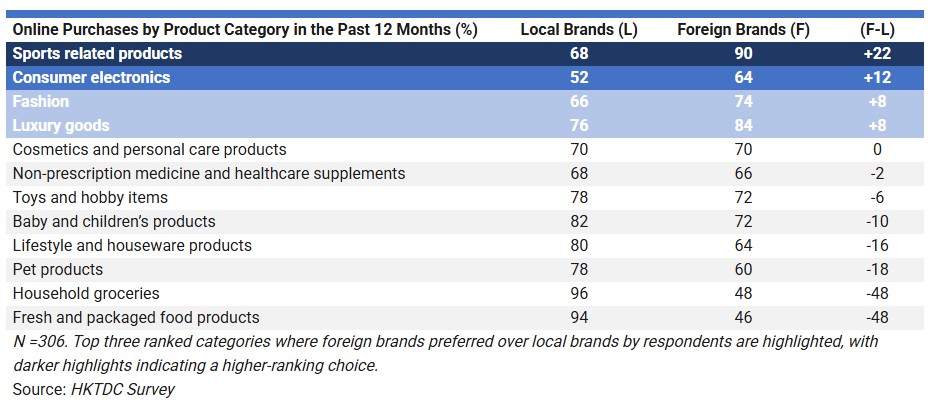

- Malaysia’s online shoppers are interested in foreign products, particularly in categories such as sports-related items, consumer electronics, fashion and luxury goods.

- Around 85% of respondents in the survey said that they spend more during major online shopping festivals, with an average increase in spending of 22%.

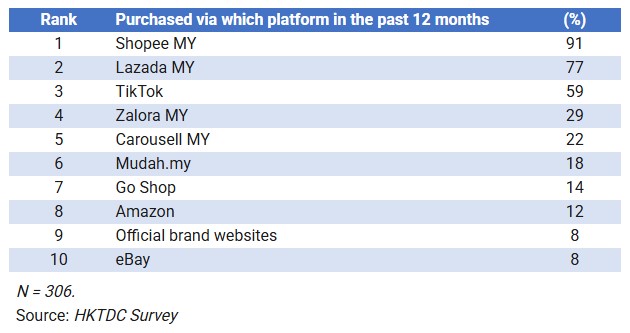

- Shopee (where 91% respondents shopped with) and Lazada (77%) are the two leading e-commerce platforms in Malaysia.

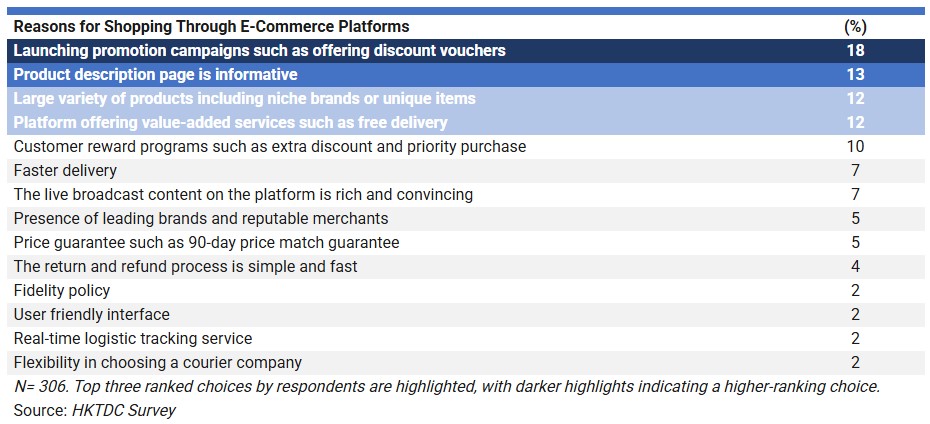

- The main reasons online shoppers in Malaysia give for buying from e-commerce platforms are promotional campaigns (18%), informative product descriptions (13%), the large variety of products available (12%) and value-added services (12%).

- Reviews and ratings on e-commerce platforms were considered the most important source of product information for online shoppers in Malaysia (61%), followed by social media platforms (44%) and brands’ official websites or social media accounts (38%).

- More than 70% of online shoppers in Malaysia expect products to be delivered within three days, with 8% expecting a same-day delivery service.

E-shoppers in Malaysia hold Hong Kong brands and products in high regard

- Hong Kong brands are popular among e-consumers in Malaysia, with 63% of online shoppers having purchased a Hong Kong-sourced product in the past 12 months. People aged 18-29 had a higher tendency to buy Hong Kong products than those in other age cohorts.

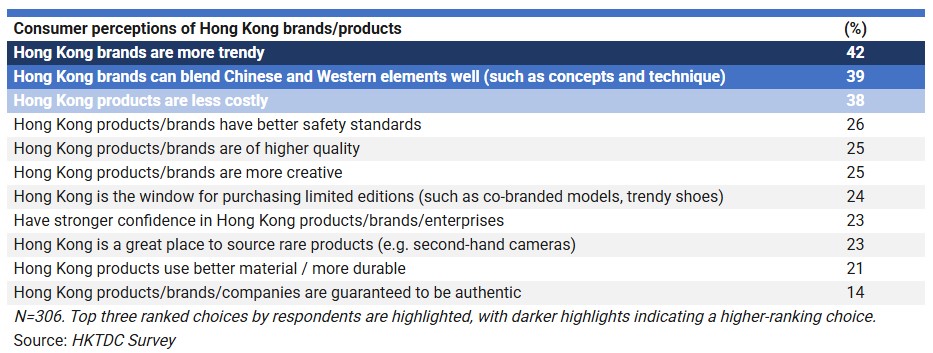

- Online shoppers in Malaysia see Hong Kong products as more trendy (42%), being able to blend Chinese and Western elements well (39%) and less costly (38%).

- The Hong Kong brands and products that e-consumers in Malaysia reported purchasing most often were consumer electronics (68%), fashion (32%) and cosmetics and personal care products (32%).

- E-consumers in Malaysia tend to spend 16% more on cosmetics and personal care products from Hong Kong brands than on those from elsewhere.

Hong Kong companies are selling online in Malaysia

- As a supplement to the above survey, HKTDC Research conducted a series of interviews with Hong Kong businesses that are currently selling their products to ASEAN consumers through online channels.1

- The key reasons why some of these companies choose Malaysia as the starting point when trying to penetrate the ASEAN e-commerce market are the country’s rising income and purchasing power, and the popularity of Hong Kong culture in Malaysia.

- One particularly relevant case is a Hong Kong SME selling retro‑style photography equipment and camera accessories. The company’s co-founder highlighted the importance of promoting products through Key Opinion Leaders (KOLs) in the photography community, as the followers or subscribers of these KOLs tend to have similar preferences and tastes, and are therefore more likely to become interested in the company’s products. He said that after a promotional campaign with a Malaysian KOL, digital traffic to the company’s online store rose 15% and sales to Malaysia received a significant boost.2

The findings from the survey highlight clear preferences among online shoppers in Malaysia that businesses can take advantage of. They indicate that Hong Kong‑based companies and brands are well positioned to benefit from the expanding e‑commerce landscape in Malaysia and across the ASEAN region.

I. Malaysia’s Retail E-commerce Market Overview

Malaysia’s retail e-commerce market is expected to expand by 9% annually

The value of Malaysia’s retail e‑commerce market in 2024 was estimated to be US$7.9 billion. It is expected to grow from US$8.6 billion in 2025 to US$12.2 billion in 2029 (at an average annual growth rate of 9%), according to projections by Euromonitor.

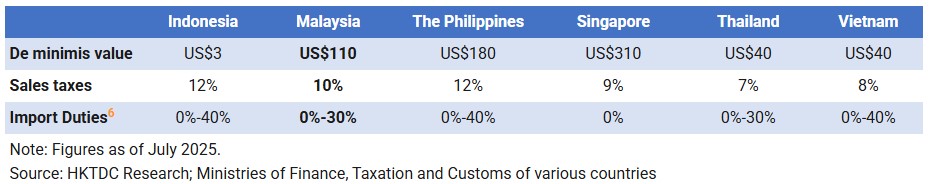

Selling directly to Malaysia’s consumers may be subject to sales tax and duties

In general, goods entering Malaysia from overseas are subject to import duties. Import duty is charged in two ways, depending on the type of goods: (a) ad valorem ‑ a fixed percentage of the value of the goods ranging from 0% to 60%3, and (b) a fixed sum per unit or quantity of goods regardless of their value.4 The country has a de minimis value of MYR500 (US$110), meaning shipments below this value are generally exempted from import duties when entering the country. From January 2024, a fixed 10% rate of Sales and Service Tax (SST) has been applied to imported products ordered online with a value below the de minimis level.5

De minimis values, sales taxes and import duties in the ASEAN-6

II. Preferences of Online Shoppers in Malaysia

Younger consumers exhibit higher online shopping frequency

Consumers in Malaysia shopped online an average of 6.9 times per month. Younger cohorts are more frequent online shoppers than older ones. The 18‑29 age group made online purchases more frequently (8.7 times per month) than other age groups. The 30‑49 year‑olds also shopped online frequently (6.3 times per month). The group aged 50 and above made significantly fewer online purchases (5.2 times a month).

Consumer electronics is the product category most commonly purchased online

Consumer electronics7 (bought by 84% of those surveyed), fashion (69%), and cosmetics and personal care products (61%) are the most popular categories of product among online shoppers in Malaysia.

Product quality is the top priority when making online purchase decisions

Product quality, price promotion campaigns, brand image and product safety are the key factors influencing online purchase decisions by e‑shoppers in Malaysia. After‑sales services and product ingredients are also important in the case of several types of products.

In seven out of ten product categories, quality or efficacy emerged as the top priority, including sports‑related goods (cited by 78% of respondents), lifestyle & houseware products (74%), consumer electronics (74%), pet products (68%), toys & hobby items (64%), fashion (62%) and non‑prescription medicines & healthcare supplements (48%).

Price promotion campaigns was the most important factor for cosmetics and personal care (cited by 50% of respondents) and baby and children’s products (44%). It was also the second most important factor across six out of ten product categories, including fashion (58%), consumer electronics (52%), toys and hobby items (50%), sports‑related goods (48%), lifestyle and houseware items (46%), and luxury goods (40%). It was also the third most influential factor for pet products (40%).

“Brand image, word of mouth, or reputation” was also an important consideration for online shoppers in Malaysia when making purchasing decisions. 48% of respondents buying luxury goods considered this to be the most significant factor. Brand image was also rated as the third most important factor when purchasing non‑prescription medicine & healthcare supplements (cited by 44%), sports‑related goods (42%), consumer electronics (40%), lifestyle and houseware products (40%), fashion (36%) and toys and hobby items (30%).

When it comes to the purchase of non‑prescription medicine and healthcare supplements, product safety was considered as important as product efficacy (both factors were picked out by 48% of respondents). It was also the second most important factor in terms of cosmetics and personal care products as well as pet products. After‑sale service was deemed important for toys and hobby items (highlighted by 30%), while the product’s ingredients was chosen as a key factor by 38% of respondents when making purchasing decisions on baby and children’s products.

Major factors considered when purchasing online

Value for money is key for online purchases of a new brand

When looking to purchase a new product or brand, e‑consumers in Malaysia care most about value for money (mentioned by 49% of respondents), the presence of unique product features or functions (48%) and brand image, word of mouth or reputation (47%).

E-shoppers in Malaysia prefer foreign brands over local ones in selected product categories

Respondents said they preferred foreign brands to local ones in four of the 12 product categories ‑ sports‑related products, consumer electronics, fashion and luxury goods.

Spending increases by 22% on average during major festivals

85% of respondents said that they spend more during online shopping festivals, with an average increase in spending of 22%.

Shopee, Lazada and TikTok are the most popular platforms for online shopping

Regional platforms Shopee and Lazada are the two leading e‑commerce platforms in Malaysia. While both offer a variety of products, ranging from consumer electronics to fashion and from cosmetics to lifestyle items, Shopee is better known for its mobile‑first approach (capitalising on the high smartphone penetration in Malaysia) whereas Lazada has developed LazMall, where only brand owners and authorised brand distributors are allowed to sell their products, in order to ensure product authenticity. TikTok, a social media video platform owned by a Chinese internet company, is the third most popular, capitalising on its live‑streaming capability, creator ecosystem and strength in social commerce. Official brand websites were ranked the ninth most popular by survey respondents.

Promotional campaigns and informative product descriptions are the key reasons for shopping via e-commerce platforms

The main reasons that respondents gave for making purchases through e‑commerce platforms were promotional campaigns (cited by 18%), informative product descriptions (13%), the large variety of products (12%) and the provision of value‑added services (12%).

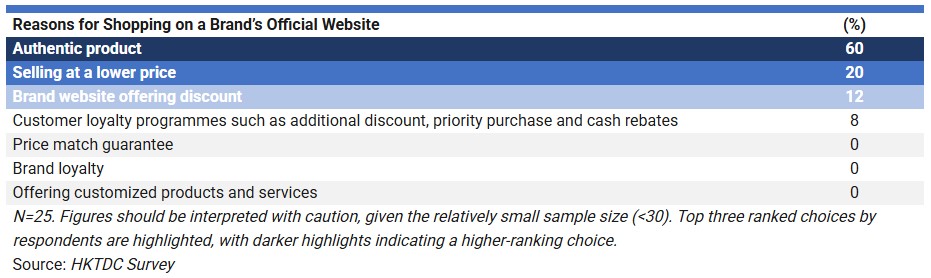

Authenticity is the main reason to buy from a brand’s official website

About 8% of the respondents in the survey bought items on brands’ official websites during the survey period. These were likely to be luxury goods or products with higher value, which may explain why respondents considered the guarantee of getting an authentic product the primary reason to shop on official websites (cited by 60%).

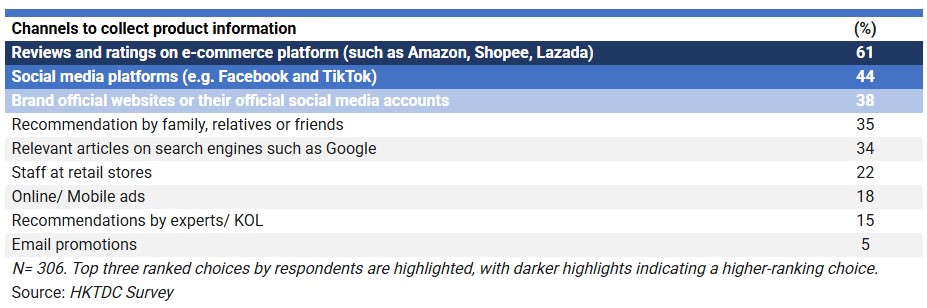

Reviews and ratings on e-commerce platforms the most influential channel for product information

For e‑consumers in Malaysia, the most important way to collect product information is via reviews and ratings on e‑commerce platforms (cited by 61% of respondents), followed by social media platforms (44%) and brand official websites or social media accounts (38%).

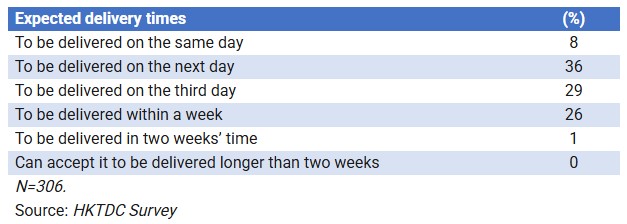

Nearly three-quarters of online shoppers expect delivery within three days

A significant majority of e‑consumers in Malaysia (73%) expect products to be delivered within three days. Another 26% expect products to be delivered within one week.

III. Hong Kong brands in Malaysia

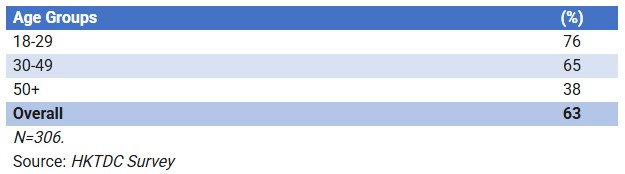

63% of survey respondents said they had purchased Hong Kong brands or products over the past 12 months. Among them, those aged 18–29 showed a higher tendency to buy Hong Kong products than other age cohorts did.

Purchasing Hong Kong Brands or Products in the Last 12 Months

Consumer electronics is the most popular Hong Kong product category purchased online

The Hong Kong brands and products that the respondents reported purchasing most often were consumer electronics (cited by 68%), fashion (32%) and cosmetics and personal care products (32%).

E-shoppers see Hong Kong brands and products as more trendy, able to blend Chinese and Western elements well and less costly

When asked about their views on Hong Kong brands or products, 42% of respondents said that they are more trendy, 39% of them considered that they blend Chinese and Western elements well, and 38% believed them to be less costly.

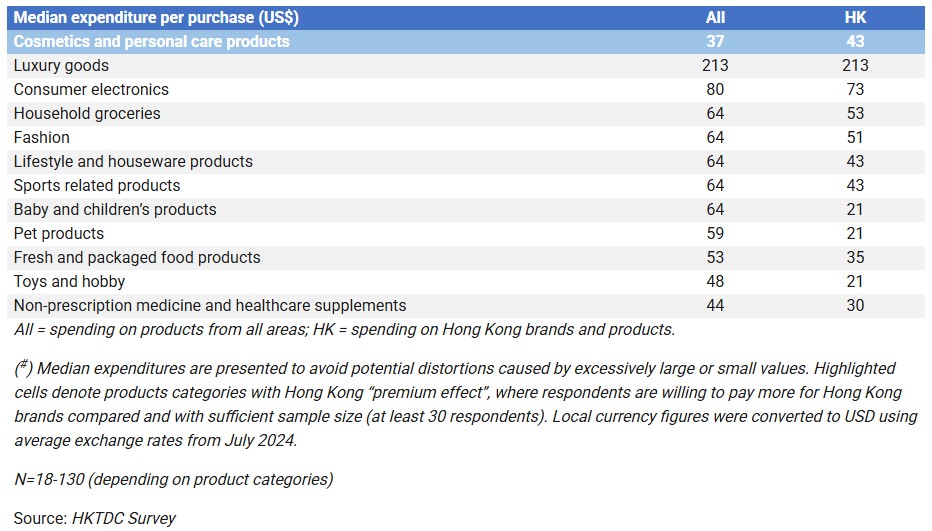

E-consumers in Malaysia spend more on Hong Kong cosmetics and personal care products

The difference in the amount that e‑consumers in Malaysia spend on Hong Kong brands rather than on brands from elsewhere is particularly marked in cosmetics and personal care. Specifically, they spend 16% more on this product category.

1 See HKTDC Research (2025) ‑ The ASEAN E-Commerce Marketing Strategies and Tactics: The Experts’ Opinion

2 See HKTDC Research (2025) ‑ KOLs Help Drive Sales in ASEAN E-commerce Market

3 For consumer goods typically sold via retail e‑commerce, the import duties roughly range from 0% to 30%.

4 For example, importing sparkling wine is subject to a duty of MYR23 (US$5). See DHL (2024) – All about Malaysia’s Import Duty.

5 In addition to import duties and SST, excise duty is also charged when shipping selected products such as All‑Terrain Vehicles into the country.

6 This includes audio & video products, home appliances, computer & related accessories, smartphones, tablets & related accessories, e‑sports products and equipment (such as consoles, accessories and games) and other consumer electronic products and accessories (such as wearable electronic devices, power banks, electronic healthcare devices, etc).

7 This includes audio & video products, home appliances, computer & related accessories, smartphones, tablets & related accessories, e‑sports products and equipment (such as consoles, accessories and games) and other consumer electronic products and accessories (such as wearable electronic devices, power banks, electronic healthcare devices, etc).

Original article published in https://hkmb.hktdc.com